Daily Equity Reports

Keep up-to-date with what's happening in the Equity Index markets with CME Group daily reports.

| Weekly Options Product | CME Globex Ticker | Bloomberg Front Month Ticker | Thomson Reuters Chain |

|---|---|---|---|

| E-mini S&P 500 Monday | E1A, E2A, E3A, E4A, E5A | IWWA Index | 0#1AEW+ |

| E-mini S&P 500 Tuesday | E1B, E2B, E3B, E4B, E5B | IMBA Index | 0#E1BW+ |

| E-mini S&P 500 Wednesday | E1C, E2C, E3C, E4C, E5C | IEWA Index | 0#ECW+ |

| E-mini S&P 500 Thursday | E1D, E2D, E3D, E4D, E5D | IMDA Index | 0#E1DW+ |

| E-mini S&P 500 Friday | EW1, EW2, EW3, EW4 | 1EA Index, 2EA Index, 3EA Index, 4EA Index | 0#ESW+ |

| Micro E-mini S&P 500 Monday | X1A, X2A, X3A, X4A, X5A | HWCA Index OMON | XAA1W-XAA5W |

| Micro E-mini S&P 500 Tuesday | X1B, X2B, X3B, X4B, X5B | HWDA Index OMON | XB1W-XB5W |

| Micro E-mini S&P 500 Wednesday | X1C, X2C, X3C, X4C, X5C | HWEA Index OMON | XXC1W-XXC5W |

| Micro E-mini S&P 500 Thursday | X1D, X2D, X3D, X4D, X5D | HWLA Index OMON | XD1W-XD5W |

| Micro E-mini S&P 500 Friday | EX1, EX2, EX3, EX4 | HXSA Index OMON | 1EX1W-1EX4W |

| Weekly Options Product | CME Globex Ticker | Bloomberg Front Month Ticker | Thomson Reuters Chain |

|---|---|---|---|

| E-mini Nasdaq-100 Monday | Q1A, Q2A, Q3A, Q4A, Q5A | QNBA Index | 0#QNC1W+ |

| E-mini Nasdaq-100 Tuesday | Q1B, Q2B, Q3B, Q4B, Q5B | - | - |

| E-mini Nasdaq-100 Wednesday | Q1C, Q2C, Q3C, Q4C, Q5C | QNCA Index | 0#QNA1W+ |

| E-mini Nasdaq-100 Thursday | Q1D, Q2D, Q3D, Q4D, Q5D | - | - |

| E-mini Nasdaq-100 Friday | QN1, QN2, QN3, QN4 | 1OA Index, 2OA Index, 3OA Index, 4OA Index | 0#1NQW+ |

| Micro E-mini Nasdaq-100 Monday | D1A, D2A, D3A, D4A, D5A | HWSA Index OMON | DA1W-DA5W |

| Micro E-mini Nasdaq-100 Tuesday | D1B, D2B, D3B, D4B, D5B | HWTA Index OMON | XDB1W-XDB5W |

| Micro E-mini Nasdaq-100 Wednesday | D1C, D2C, D3C, D4C, D5C | HWWA Index OMON | DC1W-DC5W |

| Micro E-mini Nasdaq-100 Thursday | D1D, D2D, D3D, D4D, D5D | HVYA Index OMON | DD1W-DD5W |

| Micro E-mini Nasdaq-100 Friday | MQ1, MQ2, MQ3, MQ4 | HWYA Index OMON | 1MQ1W-1MQ4W |

| Weekly Options Product | CME Globex Ticker | Bloomberg Front Month Ticker | Thomson Reuters Chain |

|---|---|---|---|

| E-mini Russell 2000 Monday | R1A, R2A, R3A, R4A, R5A | MRYA Index | 0#1AR1W+ |

| E-mini Russell 2000 Tuesday | R1U, R2U, R3U, R4U, R5U | RFOA Index | 0#1UR1W+ |

| E-mini Russell 2000 Wednesday | R1C, R2C, R3C, R4C, R5C | WRYA Index | 0#1RC1W+ |

| E-mini Russell 2000 Thursday | R1D, R2D, R3D, R4D, R5D | RFSA Index | 0#1RD1W+ |

| E-mini Russell 2000 Friday | R1E, R2E, R3E, R4E | RUWA Index | 0#1RTYW+ |

| Weekly Options Product | CME Globex Ticker | Bloomberg Front Month Ticker | Thomson Reuters Chain |

|---|---|---|---|

| E-mini Dow ($5) Friday | YM1, YM2, YM3, YM4 | 1FA Index, 2FA Index, 3FA Index, 4FA Index | 0#1YMW+ |

Weekly options provide a deep pool of liquidity for you to express views on market-moving events and economic announcements – from national elections to monthly employment and inflation reports – nearly around the clock.

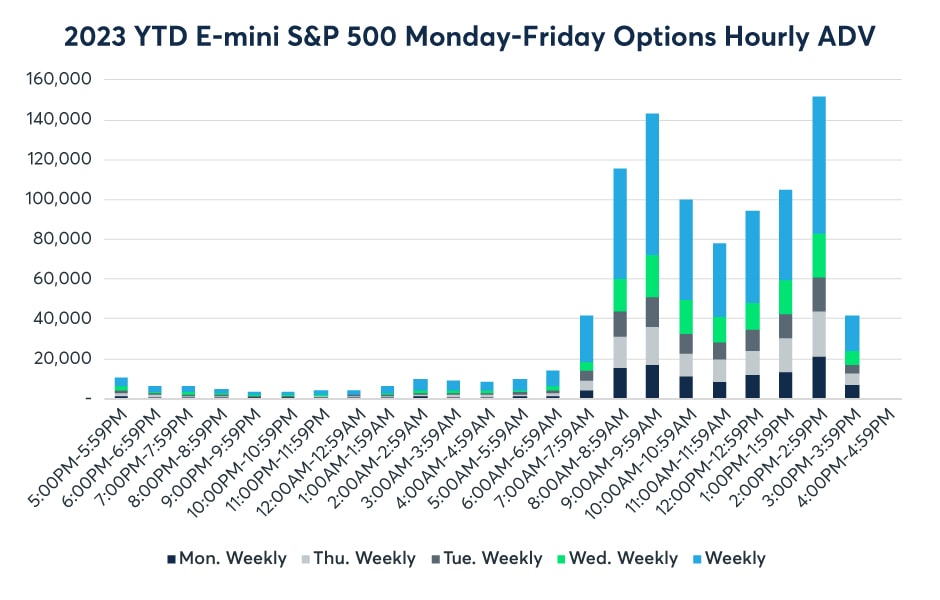

CME Group continues to see strong liquidity during Extended Trading Hours (ETH). In 2022, 16% of E-mini S&P 500 options volume traded during ETH.

Five reasons to trade E-mini S&P 500 options

Find out why market participants continue to turn to the deep, around-the-clock liquidity of E-mini S&P 500 (ES) options.

Explore the benefits of Short-Dated options

Learn more about CME Group’s Equity Index options that provide participants with variety and flexibility in strategies over varying time horizons.

There’s an option for that – flexibly trade using Equity weekly options

Examine different ways to trade E-mini Nasdaq-100 and S&P 500 weekly options to manage risk ahead of major market events.

Gain small-cap exposure with options on the Russell 2000 Index

Learn why small-cap indexes, such as the Russell 2000 Index, historically outperform large-cap indexes and how you can express your view on the index using options.

Open Interest Heatmap

Gain insight into market sentiment through the lens of put/call open interest.

Options Expiration Calendar

View or download a year’s worth of expiration dates, including yet-to-be-listed weekly options.