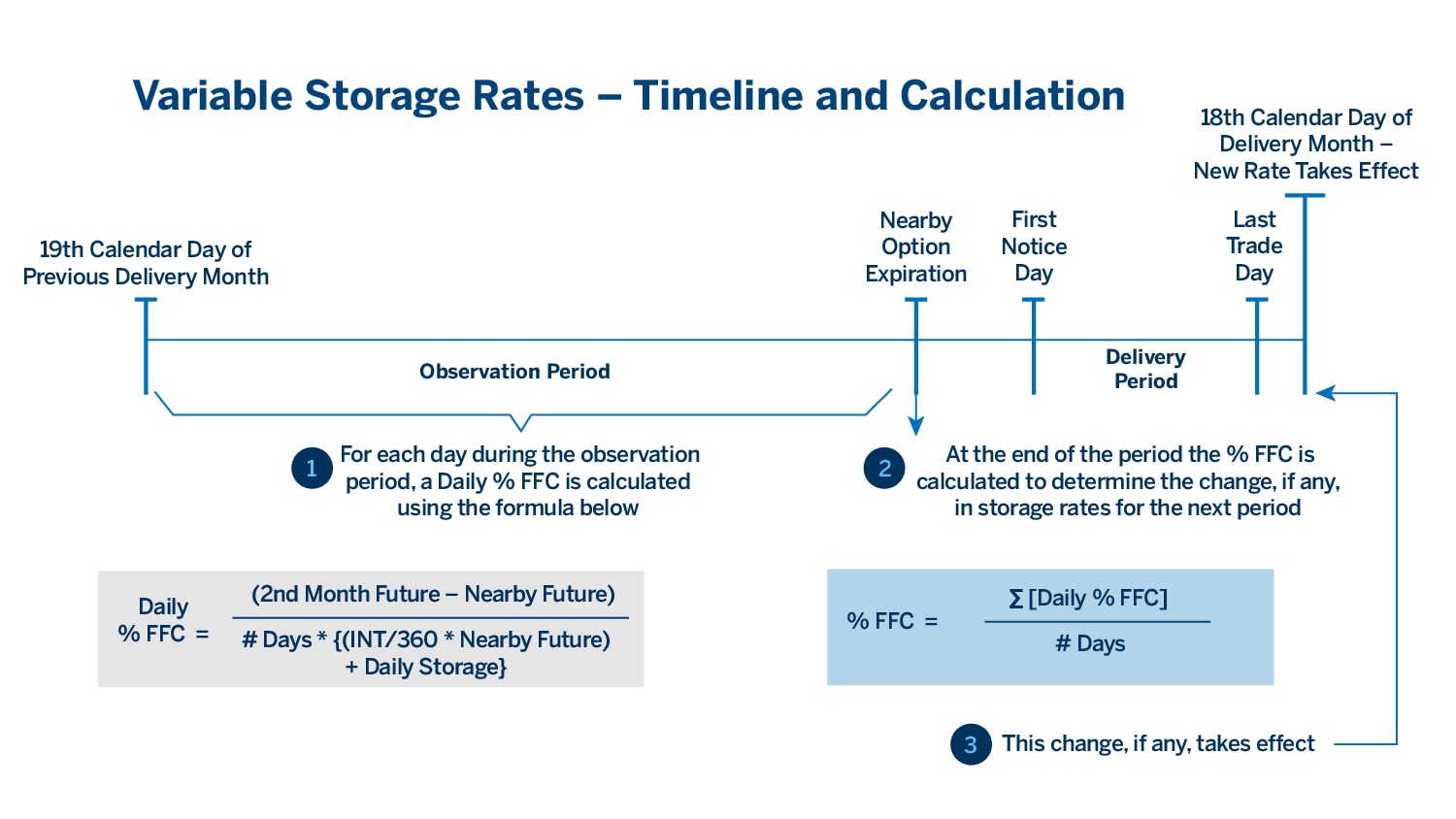

Variable Storage Rates (VSR) is a market-based determinant of maximum allowable storage charges for outstanding wheat shipping certificates. It triggers higher maximum allowable storage charges that allow wider spreads when spreads are near financial full carry and lower maximum allowable storage charges when spreads are narrow or inverted. Market participants may follow the daily VSR calculations during the observation period at the "VSR Calculator" link below.

Nearby spreads that average 80 percent of financial full carry or greater will trigger an increase in maximum allowable storage charges by 10/100s of one cent per bushel per day (approximately 3 cents per bushel per month) following the nearby delivery period. Conversely, nearby spreads that average 50 percent of financial full carry or less will trigger a decrease in maximum allowable storage charges by 10/100s of once cent per bushel per day following the nearby delivery period. Should nearby spreads average over 50 percent of financial full carry and less than 80 percent of financial full carry, the maximum allowable storage charges will remain the same as in the previous period. There is no upper limit for maximum allowable storage charges under VSR, but the minimum rate is 16.5/100s of one cent per bushel per day in Wheat, Mini-Sized Wheat, KC HRW and Mini-Sized KC HRW Wheat futures and 26.5/100s of one cent per bushel per day in Hard Red Spring Wheat futures. NOTE: the minimum rate is increasing from 16.5/100s of one cent per bushel per day to 26.5/100s of one cent per bushel per day following the expiration of the December 2026 Wheat, Mini-Sized Wheat, KC HRW, and Mini-Sized KC HRW Wheat futures. See SER #9483

Wheat and Mini-Sized Wheat Futures – (Decrease)

The March 2026 – May 2026 Wheat calendar spread averaged 45.50 percent of financial full carry during the period of December 19, 2025 through February 20, 2026. VSR results that are less than 50-percent of financial full carry trigger a decrease in the maximum premium charge. Therefore, the maximum premium charge that a Wheat futures regular delivery facility may charge holders of its outstanding shipping certificates will decrease from the current maximum charge of 26.5/100s of one cent per bushel per day (approximately 8 cents per bushel per month) to 16.5/100s of one cent per bushel per day (approximately 5 cents per bushel per month) on March 19, 2026.

KC HRW & Mini-Sized KC HRW Wheat Futures – (No Change)

The March 2026 – May 2026 KC HRW Wheat calendar spread averaged 56.00 percent of financial full carry during the period of December 19, 2025 through February 20, 2026. VSR results that fall between 50- and 80-percent of financial full carry do not trigger any changes in the maximum premium charge. Therefore, the maximum premium charge that a KC HRW Wheat futures regular delivery facility may charge holders of its outstanding shipping certificates will not change from the current maximum charge of 26.5/100s of one cent per bushel per day (approximately 8 cents per bushel per month).

Hard Red Spring Wheat Futures – (No Change)

The March 2026 – May 2026 Hard Red Spring Wheat calendar spread averaged 56.74 percent of financial full carry during the period of December 19, 2025 through February 20, 2026. VSR results that fall between 50- and 80-percent of financial full carry do not trigger any changes in the maximum premium charge. Therefore, the maximum premium charge that a Hard Red Spring Wheat futures regular delivery facility may charge holders of its outstanding shipping certificates will not change from the current maximum charge of 36.5/100s of one cent per bushel per day (approximately 11 cents per bushel per month).

The Next Evaluation Period

The next evaluation period will measure the May 2026 – July 2026 calendar spread relative to financial full carry during the period of March 19, 2026 to April 24, 2026 with the next possible adjustment to contract premium charges on May 19, 2026.

-

- SER-7872 - Implementation of Variable Storage Rate (VSR) Mechanism in the KC HRW Wheat Futures and Mini-Sized KC HRW Wheat Futures Contracts Effective with the 2018 March - May Spread - February 27, 2026

- SER-8187 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-8225 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-8343 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-8374 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-8408 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-8489 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-8445 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-8554 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-8656 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-8698 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-8727 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9104 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9121 - Amendments to the Variable Storage Rate (“VSR”) Mechanism for the Wheat, Mini-Sized Wheat, KC HRW Wheat, and Mini-Sized KC HRW Wheat Futures Contracts Commencing with the May – July VSR Observation Period - February 27, 2026

- SER-9161 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9186 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9211 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9246 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9368 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9396 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9422 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9475 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9526 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9560 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9580 - Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates - February 27, 2026

- SER-9605 - Variable Storage Rate (VSR) Results for Wheat, KC HRW Wheat, and Hard Red Spring Wheat Futures Premium (Storage) Rates - February 27, 2026

- SER-9636 - Variable Storage Rate (VSR) Results for Wheat, KC HRW Wheat, and Hard Red Spring Wheat Futures Premium (Storage) Rates - February 27, 2026

- SER-9694 - Variable Storage Rate (VSR) Results for Wheat, KC HRW Wheat, and Hard Red Spring Wheat Futures Premium (Storage) Rates - February 27, 2026

- SER-8619 - February 27, 2026