Pricing, Volatility & Strategy Tools

Use these QuikStrike tools to calculate fair value prices and Greeks on CME Group options, chart volatility and correlations, and test strategies in simulated markets.

Monitor for the onset of price uncertainty by analyzing changes in current implied volatilities versus the previous week's numbers, by expiration.

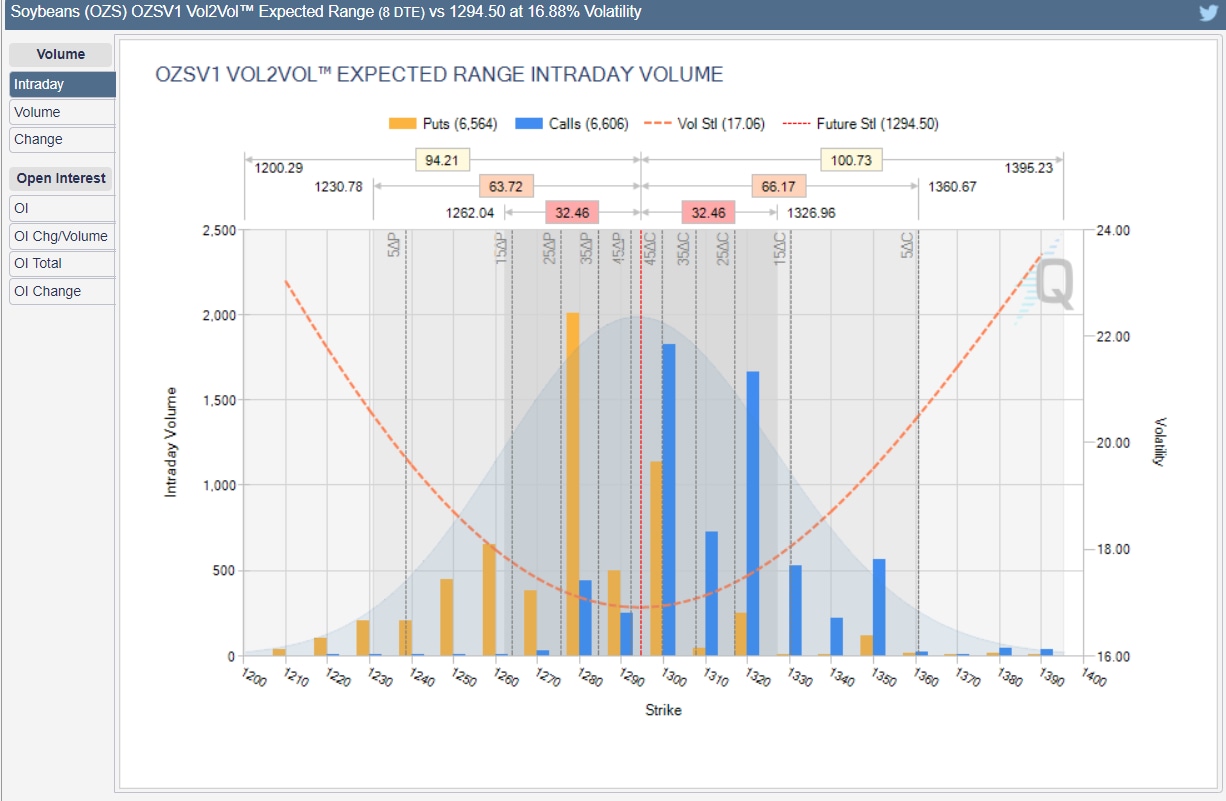

See how many standard deviations a strike is from the at-the-money (ATM) futures price. Chart open interest and volume to see where trading is focused and to gauge market sentiment on price.

Generate fair value prices and Greeks for any CME Group option on futures product, or price a generic option with our universal calculator.

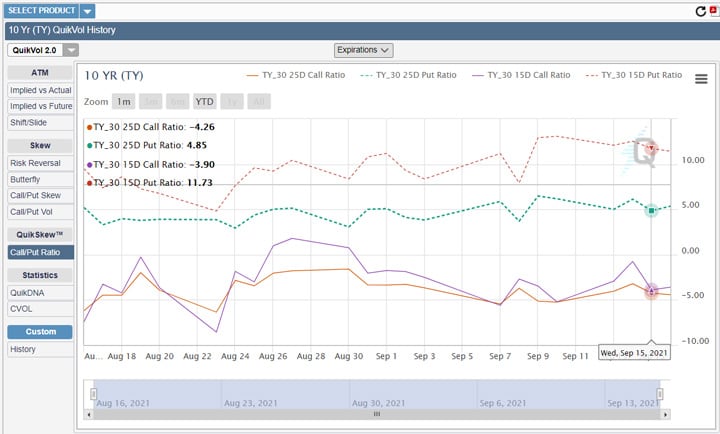

Chart and analyze historical volatility data including, implied and actual volatility, skew, constant maturity, and implied volatility cones.

Track upcoming economic events and map to nearby expiring options contracts to manage related event risk.

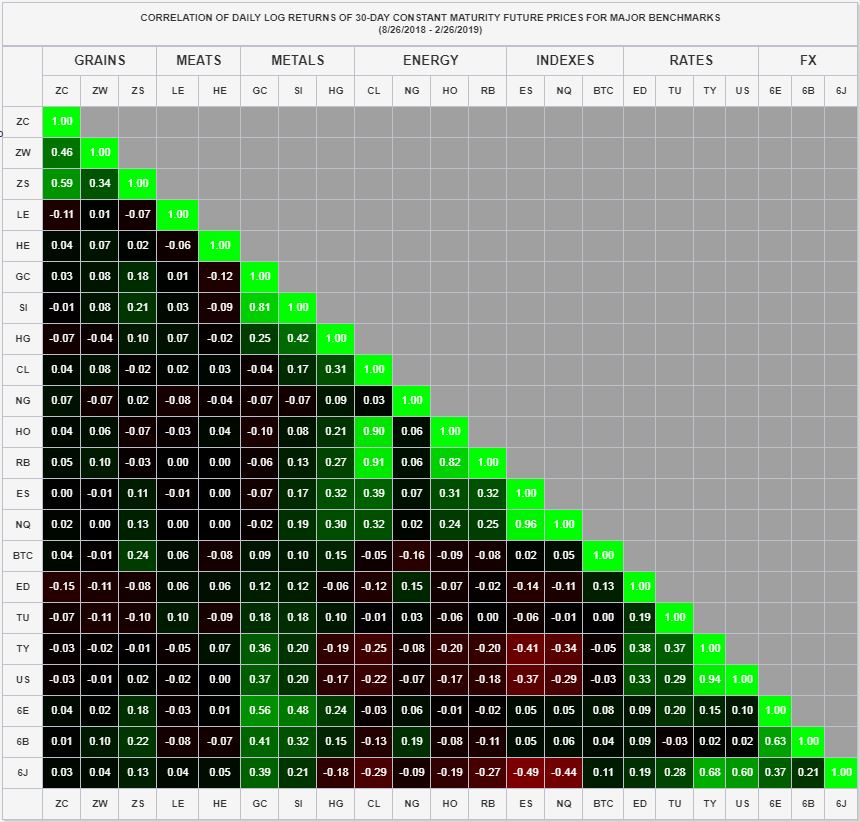

Easily analyze pairwise correlations of CME Group futures and options from different asset classes in charts. Available in multiple views: log returns; 30-day implied volatilities; or 20-day realized volatilities.

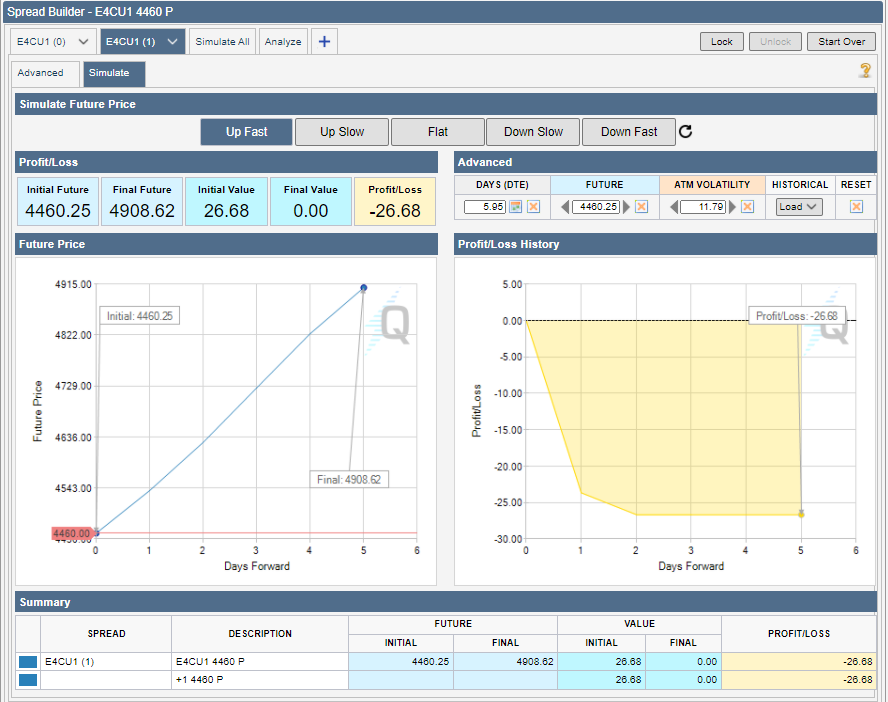

Compare how an option, futures or physical position would perform across different underlying price scenarios, in a risk-free simulated environment.

See how markets are pricing upcoming economic and geopolitical events through the lens of options volatility.

Browse More QuikStrike Tools

Find more insights from our full suite of QuikStrike tools to help you build and refine your trading strategies.