Packaged trades between Treasury futures and related forward-starting interest rate swaps.

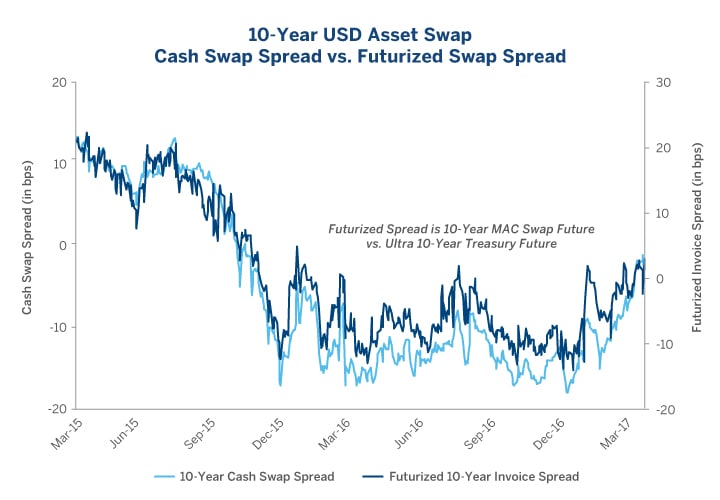

Invoice Swap Spread trading typically involves buying (selling) a Treasury Future and paying (receiving) fixed on a related interest rate swap with a similar risk profile. This spread trade represents the difference between forward yields on Treasury Futures, and the fixed rate on comparable interest rate swaps.

Privately negotiated off-exchange transactions, with the treasury futures leg submitted to CME Clearing as an EFR transaction under Rule 538, and the swap leg processed independently.

Recent Developments for EFR trading

Modifications to Rule 538 enable packages of multiple invoice spreads to be traded in the same manner.

For example:

- Calendar Spreads between sequential months (e.g. Sep16 5-Yr Invoice Spread versus Dec16 5-Yr Invoice Spread)

- Tenor Switches between invoice spreads (e.g. Dec 16 2-Yr Invoice Spread versus Dec 16 30-Yr Invoice Spread)

Invoice Spreads can be traded on the CBOT designated contract market as an intercommodity spread between the Treasury future and a listed Interest Rate Swap.

- Product design retains common trading conventions: swap effective/maturity dates match the CTD, swap notional maintains approximate DV01 neutrality with Treasury futures and swap fixed rate is traded as a basis to the CTD forward yield.

- In addition to centralized trading on CME Globex, you can also submit two-sided orders as committed-cross or transact as a block trade submitted to CME ClearPort (subject to quantity thresholds).

- Product design retains common trading conventions: swap effective/maturity dates match the CTD, swap notional maintains approximate DV01 neutrality with Treasury futures and swap fixed rate is traded as a basis to the CTD forward yield.

- In addition to centralized trading on CME Globex, you can also submit two-sided orders as committed-cross or transact as a block trade submitted to CME ClearPort (subject to quantity thresholds).

- Product design retains common trading conventions: swap effective/maturity dates match the CTD, swap notional maintains approximate DV01 neutrality with Treasury futures and swap fixed rate is traded as a basis to the CTD forward yield.

- In addition to centralized trading on CME Globex, you can also submit two-sided orders as committed-cross or transact as a block trade submitted to CME ClearPort (subject to quantity thresholds).

Recent Developments for CME Globex Invoice Spreads

New product extensions expand spread types and access to the 10-year point:

- Adjusted minimum quantity for privately negotiated transactions

- Negotiation available using Directed RFQ via CME Direct