What it calculates: The FX Options Vol Converter calculates and converts listed CME FX options premiums, fixed strike data, rules, and formats into an OTC-equivalent volatility surface, in OTC standard tenors, deltas, and quote conventions – creating comparable pricing across major options pairs.

What it creates: Provides price transparency between the OTC and CME options markets – already aligned in style, value date, expiration time, and underlying price convergence – so that market participants can monitor price relationship and make more informed decisions across both markets.

Gain transparency, stay up-to-date, improve decision making:

- Evaluate OTC-equivalent pricing across eight tenors and a full delta surface, delayed only by 15 minutes

- Drilldown into the underlying CME contracts driving each value

- Act on the optimal trade, with the ability to analyze price divergences in all deltas and all maturities

For example, a portfolio manager at a US-based asset management firm is interested in hedging a French security investment maturing in two weeks with a 35 delta European put. The portfolio manager checks a couple of relationship pricing sources and gets implied volatility quotes of 7.65% and 7.70% on the offer. He or she decides to look at the pricing available on CME, as it would also be preferred from a best-execution standpoint to trade on a central order book and may be able to work the order to achieve a better fill. While he or she has access to CME quotes on their trading system, it would be more useful and efficient to have a quick reference price in OTC-equivalent terms ‒ rather than try to convert the CME premium quotes to volatilities and make all the appropriate adjustments in deltas to properly compare with the OTC prices.

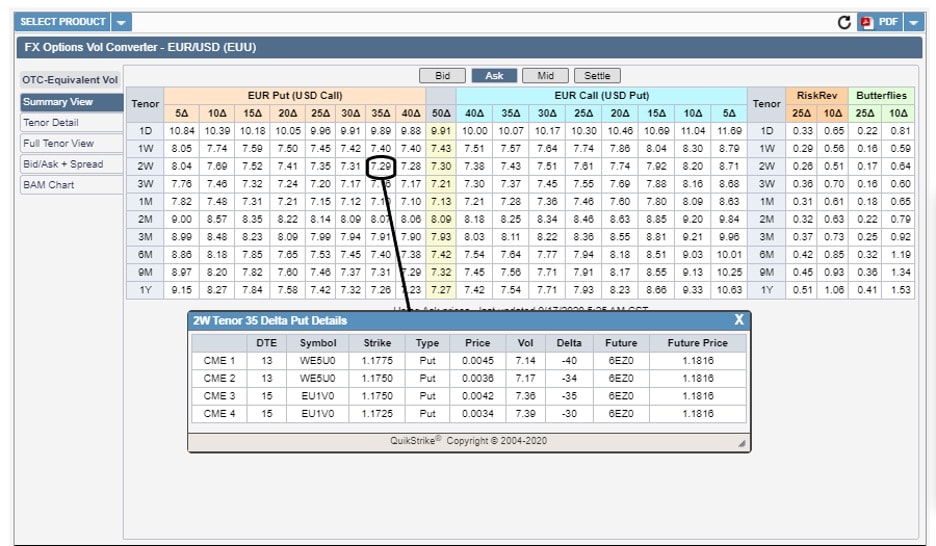

The portfolio manager decides to access the CME Group FX Options Vol Converter, selects the main surface view, selects the “Ask” market view to see the offer side of the market, and finds the EUR/USD 2W 35 delta put bucket, which indicates an implied volatility price of 7.29%.

Since this is a significantly better price, the portfolio manager decides to investigate further by clicking on the 7.29% volatility to access a dropdown that displays the CME instruments most closely responsible for generating this data point. The dropdown displays the four CME contracts that are nearest the selected tenor/delta combination (usually a shorter tenor with higher/lower deltas and a longer tenor with higher/lower deltas). In this instance, the choices are a 35 or 30 delta strike for a 14-day maturity and a 36 or 31 delta strike for a 17-day maturity. The four contracts are displayed with their symbols, strikes, and price inputs so the portfolio manager can select the preferred contract and immediately compare it with the live quotes received on their trading system. He or she selects the 14-day 35 delta put with a price of $0.0042 (Vol=7.50%*) with futures at 1.1839. Using his or her trading system, the portfolio manager confirms that the contract is trading at an attractive price and proceeds with the trade.

*The implied volatility in the drilldown will almost always be different than the one in the OTC bucket, as the drilldown reflects original listed options prices and volatility pre-conversion. The difference may be more pronounced the bigger the interpolation between the CME standard contract tenor/delta and the OTC bucket tenor/delta.

Learn to trade FX options

Discover how options on futures can help you mitigate downside risk and diversify your portfolio. Learn all the fundamentals you need to start trading FX options.

Act on what you see in the Vol Converter

Trade 24 different currencies and follow market data in real time, on CME Direct, our fast, secure, highly configurable trading front-end. Made for execution certainty and compliance, with more convenience.

Follow the volume and stay up to date across all our FX options products here: cmegroup.com/fxoptions

Explore the historical data used for the FX Options Vol Converter Tool via CME DataMine, or to learn about licensing real-time data, please contact cmedatasales@cmegroup.com.