The 2016 BIS Triannual survey indicates that volume in the U.S. dollar/Chilean peso cross grew by more than 200% over the last 10 years, reflecting the strong growth of the Chilean economy and its powerful commodity export business.

- Market participants can take advantage of the onshore and off-shore liquidity provided by a number of participants.

- Traded electronically and via blocks, the Chilean peso futures contract is available to global participants looking for specific exposure to Chile

- The largest offshore venue for Chilean Peso FX futures

- 50% savings with Brazilian Real (BRL/USD)

- 45% savings with Mexican Peso (MXN/USD)

- 30% savings with Copper (HG)

CME Globex: CHP Bloomberg: PLCA Reuters: 0#1PHC:

Bringing together market participants and their liquidity, from pension funds to banks, from hedge funds to corporates, from more than 150 countries nearly 24 hours a day, ready for market-impacting events.

Choose a block or an EFRP – where you can still privately negotiate your trades, but submit them directly into our clearing systems to free up credit lines and mitigate bilateral exposure – whether you are trading in Chile or anywhere else in the world.

Through position-netting and by utilizing the capital and margin efficiencies of cleared and listed FX:

55 Futures, 24 Options, 26 CSFs and 12 NDFs

$100b of daily FX volume and the firm liquidity you need to manage FX risk – from peso to pound.

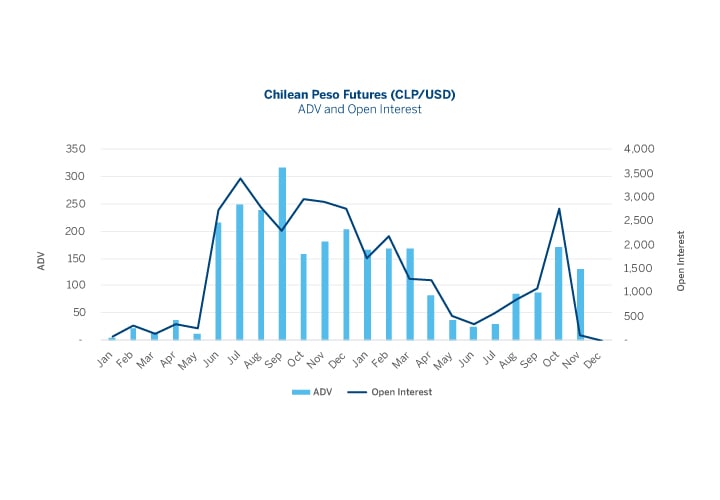

Chilean Peso/US Dollar (CLP/USD) Futures

View Quotes-

-

- ZAR/USD Largest off-shore liquidity pool, margin offsets up to 35%

-

-

-

- RUB/USD Largest off-shore liquidity pool, up 9.3% YTD

-

-

-

- Emerging Markets Home EMFX: Explore our full suite of Emerging Markets Currencies

-