India is one of the world’s fastest growing economies and the 5th largest with a nominal gross domestic product of $2.9 trillion in 2019. India was already facing an economic slowdown before the Covid-19 outbreak pushed the government to impose a nationwide lockdown that began in late March and has subsequently been extended multiple times at least until the end of June. Economists expect India’s GDP to contract by five percent during 2020. Prime Minister Narendra Modi’s government recently announced a $266 billion support package – worth around 10% of India’s GDP – containing both fiscal and monetary measures to mitigate the economic fallout. Analysts expect India's growth to rebound to 6.2% in 2021. Economists anticipate India’s inflation rate will hit 3.3% in 2020. India's unemployment rate fell to 11% in June from a record high of 23.5% in the previous two months, as many businesses resumed operations following weeks of closures due to the coronavirus pandemic.

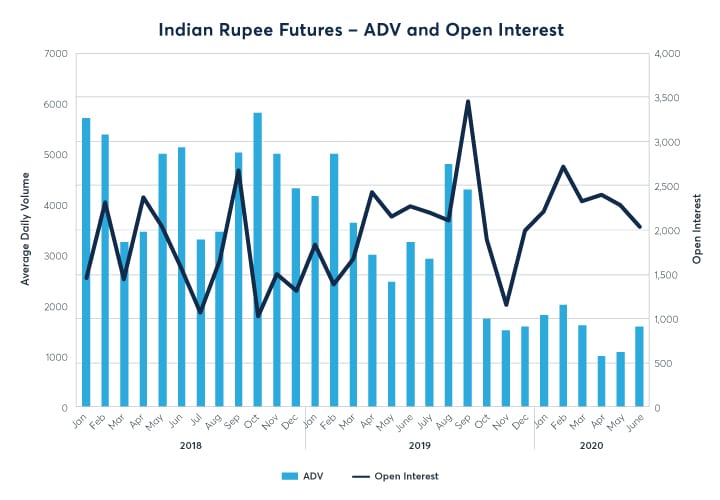

- YTD ADV for Indian Rupee Futures in notional terms notional at $96M

- YTD Average Open Interest in notional terms at $191, up 51% YoY

- Increased liquidity visible in tighter bid-ask spreads across all trading hours

- Increased activity from market participants across different customer segments and regions

- Multiple contract sizes allow for increased trading flexibility and broader market participation.

- Significant margin offsets are available, with currencies and commodities.

- Participants can get attractive pricing for larger sizes via block price makers who can price all maturities and who are available in all time zones.

- Monthly expiries offer greater choice to market participants

- 35% savings with Australian Dollar (AUD/USD)

- 25% savings with Brazilian Real (BRL/USD)

- 25% savings with South African Rand (ZAR/USD)

Standard futures

CME Globex: SIR Bloomberg: SIRA Curncy Bloomberg: SIRA Curncy Reuters: 0#SRI:

Block minimum threshold: 10

Available in Monthlies and Quarterlies

Micro futures

CME Globex: MIR Bloomberg: MIRA Curncy Reuters: 0#MRI:

Bringing together market participants and their liquidity, from pension funds to banks, from hedge funds to corporates, from more than 150 countries nearly 24 hours a day, ready for market-impacting events.

Choose a block or an EFRP where you can still privately negotiate your trades, but submit them directly into our clearing systems to free up credit lines and mitigate bilateral exposure – whether you are trading in India or anywhere else in the world.

Through position-netting and by utilizing the capital and margin efficiencies of cleared and listed FX:

55 futures, 24 options, 26 CSFs and 12 NDFs

$100 billion of daily FX volume and the firm liquidity you need to manage FX risk, from rupee to rand.

Indian Rupee Futures

View Quotes-

-

- ZAR/USD Largest off-shore liquidity pool, margin offsets up to 35%

-

-

-

- RUB/USD Largest off-shore liquidity pool, up 9.3% YTD

-

-

-

- Emerging Markets Home EMFX: Explore our full suite of Emerging Markets Currencies

-