Russia is the 11th largest economy in the world with a nominal gross domestic product of $1.6 trillion in 2019. The Russian economy has been hit particularly hard by the Covid-19 pandemic shutdown of the economy. Because Russia’s economy is heavily dependent on its status as a producer and exporter of oil, natural gas, steel, and aluminum, Russia is susceptible to movements in global commodity prices, which have fallen almost 10% during the second quarter of this year. Economists expect Russian GDP to fall 5.5% in 2020. The Central Bank of the Russian Federation recently cut its key policy interest rate in June by 100 basis points to 4.5%. The central bank expects inflation to rise between 3.8% and 4.8% by year end. Although the number of registered unemployed has been rising, analysts expect the Russian unemployment rate to remain below 5.0% in 2020.

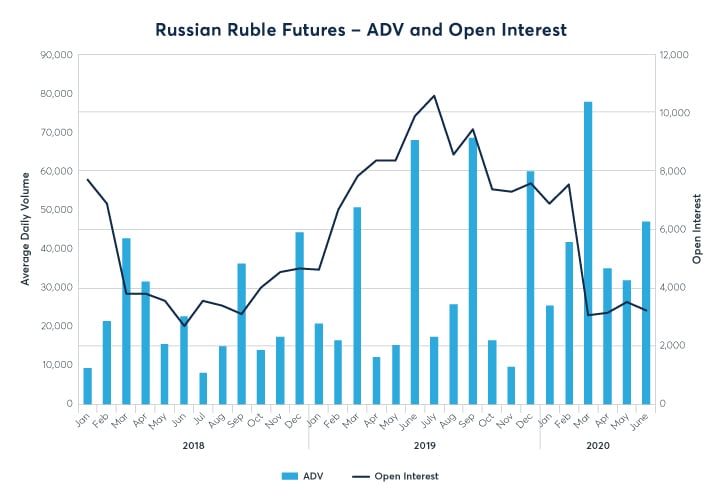

- RUB Futures YTD ADV of 5,812 ($207M notional); up 43% vs 2019

- RUB Futures Q2-2020 ADV of 5,093 up 23% vs Q2-2019

- RUB Futures notional OI in June of $1.02B up 22% vs May 2020

- Record monthly ADV achieved in March 2020 with volume reaching 10,386 contracts

- Tight bid-ask spreads across all trading hours by dedicated market makers providing liquidity across all time zones.

- CME’s RUB/USD futures contract offers a useful tool for risk managers to hedge their RUB currency risks.

- CME offers a venue to access Russian assets along with the benefit of facing a regulated, central counterparty with reduced credit risk.

- 45% savings with Norwegian Krone (NOK/USD)

- 30% savings with Australian Dollar (AUD/USD)

- 25% savings with Brent and WTI Crude

- 20% savings with Brazilian Real (BRL/USD)

Standard futures

Globex: 6R Bloomberg: RUA Curncy Reuters: 0#RUSS:

Block minimum threshold: 50

Available in Monthlies and Quarterlies

Bringing together market participants and their liquidity, from pension funds to banks, from hedge funds to corporates, from 150+ countries nearly 24 hours a day, ready for market-impacting events

Choose a Block or an EFRP – where you can still privately negotiate your trades, but submit them directly into our clearing systems to free up credit lines and mitigate bilateral exposure – whether you are trading in Brazil or anywhere else in the world.

CME Group offers position-netting and capital and margin efficiencies with cleared OTC (including NDFs) and listed FX:

55 Futures, 24 Options, 26 CSFs and 12 NDFs.

$100B of daily FX volume and the firm liquidity you need to manage FX risk – from rupee to rand.

RUB/USD Futures

View QuotesRUB/USD Options

View Quotes-

-

- BRL/USD Largest off-shore liquidity pool, up 41% YOY

-

-

-

- ZAR/USD Largest off-shore liquidity pool, margin offsets up to 35%

-

-

-

- Emerging Markets Home EMFX: Explore our full suite of Emerging Markets Currencies

-