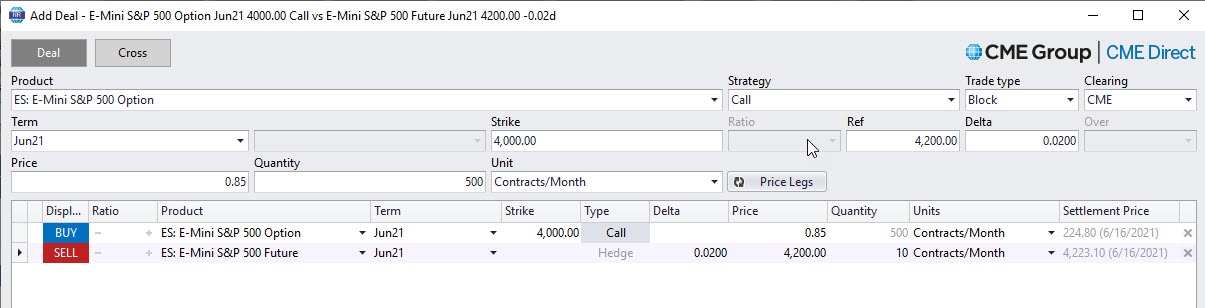

Get expanded access to deep E-mini Equity options liquidity with options blocks trading, allowing market participants to privately negotiate and execute large trades. Block trading enable participants to replicate certain trades traditionally executed in OTC markets or via other venues, but with greater flexibility, cost-efficiency and the benefits of centralized clearing at CME Group. Block trading is available for options on E-mini S&P 500 (ES), E-mini Russell 2000 (RTY), E-mini Nasdaq-100 futures (NQ).

- E-mini Equity Index futures can be blocked as part of a delta-neutral E-mini Equity options on futures block trade.

- 100% of the trade can be privately negotiated and consummated, and subsequently reported to CME Group.1

- Each S&P 500 option leg in a block trade must satisfy the 100-contract minimum and each Nasdaq-100 option leg in a block trade must satisfy the 20-contract minimum.2

- Reporting time window now extended from 5 to 15 minutes during non-US hours for all block-eligible equity index futures and options products.3

Get to know the fundamentals of block trading Equity Index options and review a trade example with E-mini S&P 500 options blocks.

Webinar: Navigating Equity Index blocks and EFRPs

Learn more about the growth, role, and rules for using Equity Index blocks and EFRPs, included recent enhancements, block trading highlights, and more.

Five reasons to trade E-mini S&P 500 options

Find out why market participants continue to turn to the deep, around-the-clock liquidity of E-mini S&P 500 (ES) options

Equity Index block alerts

Stay informed of all E-mini equity options block trade activity by signing up for block alerts.

A new way to access S&P 500 liquidity

Understand the main features of ES options blocks, including confidentiality while trading, reduced slippage, and flexibility in hedging large S&P 500 exposure.

E-mini Equity Index options block quick reference guide

Learn the fundamentals of E-mini Equity options blocks and view a list of resources to get started.

- http://www.cmegroup.com/rulebook/files/cme-group-Rule-526.pdf

- While the number of covering futures contracts can be below the option leg minimum, the delta of the futures contracts must equal the net delta of the option legs.

- Non-US trading hours are between 4pm-7am CT Monday-Friday on regular business days and at any time on the weekends.