- 17 Jul 2020

- By Sara Dorland

In 2009, CME Group launched a cash-settled cheese contract settled to the announced National Dairy Products Sales Report (NDPSR) cheese price. NDPSR is a Cheddar cheese price based on manufacturers’ weekly reported sales of 40-pound block and 500-pound barrel packaged products. Historically, Cheddar and American-style cheese were the largest categories of cheese production and consumption in the United States. Therefore, Class III milk (U.S. milk used in cheese manufacturing) prices are established based on these products. Since that time, Italian-style cheese production has increased, and as of 2019, comprised 42% of total cheese production. American cheese was 40% of total output that year.

Most natural cheese transactions employ CME blocks as a reference price. Buyers and sellers of processed cheese tend to look to 500-pound barrels as a price indicator. As a result, most U.S. cheese uses commodity Cheddar, often adjusted for moisture or other quality attributes, as a baseline to price product for sale to customers. For instance, Mozzarella, Monterrey Jack or Parmesan cheese sales commonly reference the CME Spot Cheddar block weekly average as a base price. Manufacturers typically employ the Class III milk price, or sometimes cheese-yield values, to establish the cost of milk used in the cheese-making process. Cheese-yield formulas use prices for CME blocks, CME barrels, or a combination of the two to price milk to farms.

With a shift toward natural cheese consumption and U.S. cheese exports and away from processed cheese consumption, the influence of block cheese on commercial transactions has increased in recent years. That said, the NDPSR price still reflects nearly balanced proportions of block and barrel sales each week. The Agricultural Markets Services (AMS), a division of the United States Department of Agriculture (USDA), is responsible for collecting the sales information from plants that goes into the weekly NDSPR block, barrel, and cheese prices. While the reporting of package-style Cheddar cheese to establish Class III milk prices has remained consistent, commercially, the production, use, and consumption of block and barrel Cheddar cheese are quite different. In the mid-2000s, manufacturers added 640-pound block production. Since that time, manufacturers have added more 640-pound block production capacity, which is currently not captured by the NDPSR reports.

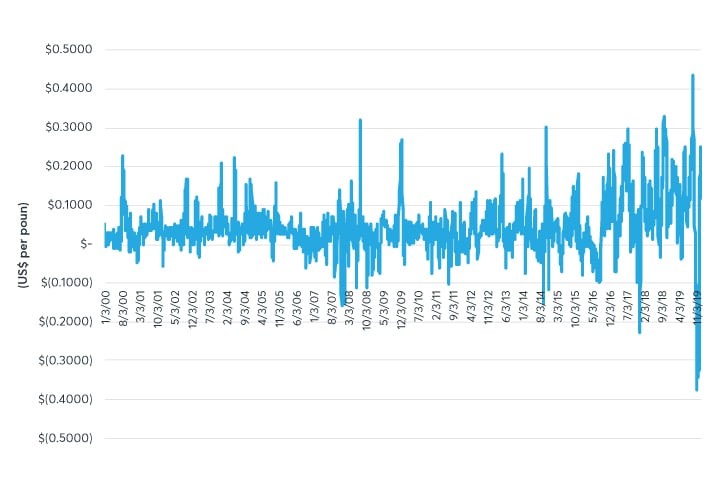

Although blocks and barrels are both Cheddar cheese products, their end uses are diverse. Typically, manufacturers use block Cheddar cheese for chunks, loaves, shreds, and snack-sized natural cheeses, while barrels are often consumed in the processed cheese category. The different channels can create unique and often dissimilar demand cycles and trends as well as varied seasonal patterns. That can cause the price disparity between Cheddar blocks and barrels to be volatile and prone to large swings (see Figure 1).

Source: Dairy Market News, CME Daily Cheese Price History

As a result of these variances and differences, hedgers attempting to manage margins related to either product can experience more significant hedge slippage when employing cash-settled cheese futures contracts alone. The new block cheese contract can be a useful tool for managing price exposure for cheese purchased or sold based on the CME Cheddar block spot market. Hedging barrel cheese price risk can be accomplished by using a combination of cash-settled cheese futures as well as blocks.

Futures markets are designed to provide buyers and sellers the ability to hedge future exposure related to the purchase or sale of physical commodities. While forward contracts can provide buyers or sellers a means to manage some price exposure, the terms are non-standard, and the arrangement relies on the agreement between private parties. A restaurant, for example, could use the CME cheese futures markets to secure a price for months in the future that coincide with a promotion. That same market affords a seller the ability to protect cheese inventory that will be aged and sold in five to six months. The use of futures and options contracts facilitates hedging price exposure with a standardized contract through a centralized exchange reducing counterparty risk.

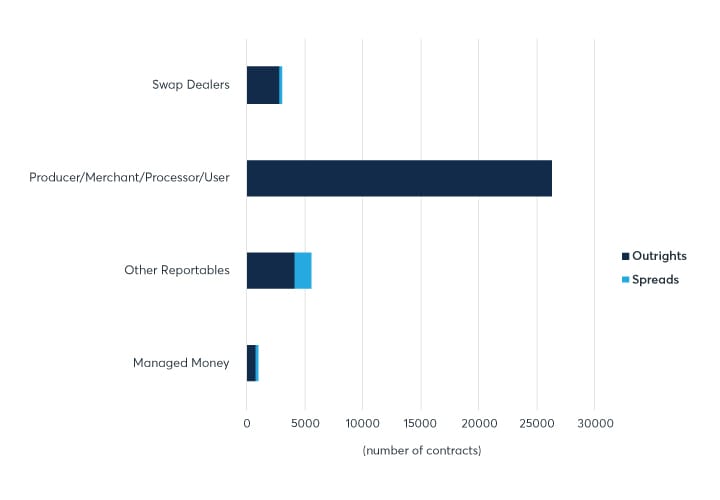

This section summarizes market participants by firm type to help demonstrate different trading strategies and approaches to the newly minted block cheese futures and options contracts. The following hedging examples will focus on the category of dairy producers as well as users and processors, excluding swap, managed money, and other reportable traders from the illustrations. As it relates to the existing cash-settled cheese contract, the commercial category accounted for 73% of the total commitment of traders as of Dec. 31, 2019 (see Figure 2).

Source: CFTC Commitment of Traders Report

This paper develops samples of commodity price risk management related to the purchase and sale of cheese based on the CME spot reference prices. The risk mitigation strategies provided in this paper will rely on typical commercial transactions to illustrate how the block and cash-settled cheese contracts can be used, separately or together, to offset commodity price risk often encountered in dairy markets. The following are a few caveats when contemplating the examples that follow:

- Firms buying or selling physical dairy commodities, like cheese, desire use of financial products like futures or options to hedge business risk.

- The goals and objectives of individual companies differ and will be highly dependent on a business’ goals and the demands of its stakeholders. Risk-management programs, daily volume, trade size, and price sensitivity also vary across the spectrum of buyers and sellers and are conditioned on management constraints.

- Because cheese producers and consumers are exposed to price fluctuations of the underlying commodity over extended periods, trading and strategies may need to be employed over many periods and with multiple contracts.

The examples that follow are meant to illustrate how the new CME block cheese futures and options contracts can be employed to mitigate risk and are not to be construed as investment or risk management advice for any individual or company.

Often management evaluates a cheese buyer’s performance based on a budgeted margin objective during a fiscal year. Budgets might be characteristically based on the historical price performance of a commodity or future expectation of price for that same product. Based on internal criteria, procurement departments will establish a purchase target for the fiscal period. From there, purchasing managers can employ a multitude of techniques, including derivatives, to mitigate price risk related to variable commodity prices against a fixed menu price or to secure set margins for planned promotions. While there is no guarantee that markets and budgets will always align, the market provides a hedge against commodity price risk.

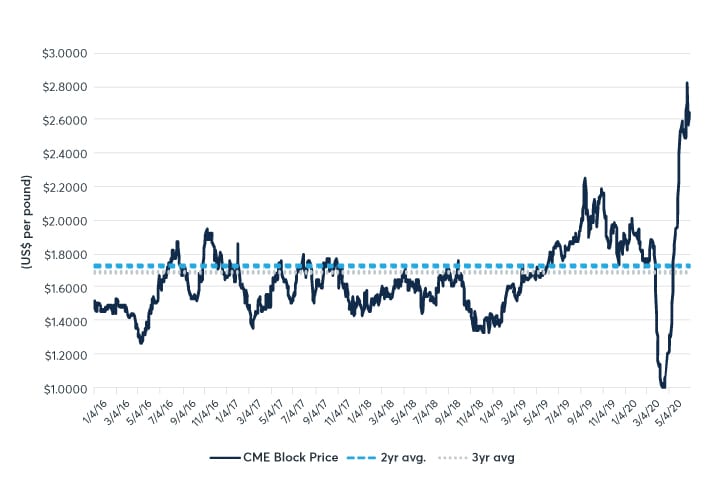

As an example, a restaurant may want to buy natural cheese slices and shreds at the end of January for the entire year, avoiding unforeseen events that could result in higher cheese prices that negatively impact financial performance and cause the company to miss its earnings targets. In 2019, CME Spot Cheddar block prices touched multi-year highs when prices reached $2.2325/lb. on Sept. 16, 2019, which caused concern for domestic cheese buyers as costs increased and remained high for months compared to recent years. Similarly, prices remained persistently high at the beginning of 2020. On Jan. 31, 2020, CME Block Cheese futures APR20 to JUN20 projected an average price of $1.8187/lb. While that price was above the two- and three-year averages, given fundamental data, this company would like to protect 10% of its forecast purchase for 2020 (see Figure 3) based on Block Cheese futures as of Jan. 31, 2020. It would then review further coverage opportunities at the end of the quarter and going forward to protect cheese.

There are several ways a purchasing agent could mitigate commodity price risk associated with future cheese purchases. The buyer could work with her cheese supplier to establish a fixed-price contract over the desired period, or should the company’s policies permit, the buyer could use cheese futures contracts to lay off risk into the market. In this example, whether the restaurant or the cheese supplier initiates the hedge, one of the companies is exposed to the commodity price risk associated with either a fixed-price cheese sales commitment (the cheese supplier) or fixed-price cheese purchase (the cheese buyer).

Source: Dairy Market News Daily CME Block Price; CME Block futures as of 6/30/2020

In either case, the hedger is unprotected and subject to risks if the value of the CME Spot Block Cheddar cheese market increases during the fiscal year. Therefore, the hedger desires to buy a futures contract to mitigate the risk related to market appreciation.

These are the assumptions for the example:

| Assumptions | Factor |

|---|---|

| 2020 monthly volume Cheddar Blocks (in pounds) | 1,000,000 |

| Reference price | CME Spot Cheddar blocks |

| Contract basis | CME Spot Cheddar blocks + $0.035/lb. |

| Hedge volume target | 10% |

| Hedge price target (in dollars/pound) | $1.8187 |

| Time | Apr 20 – Jun 20 |

| Hedge tool | CME Block Cheese futures |

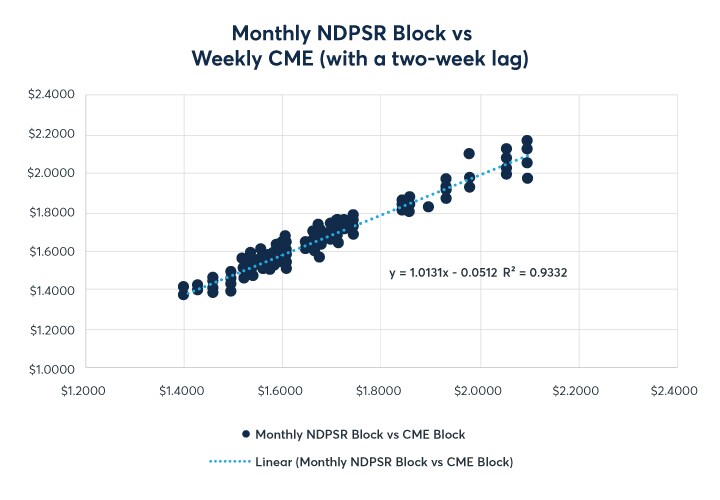

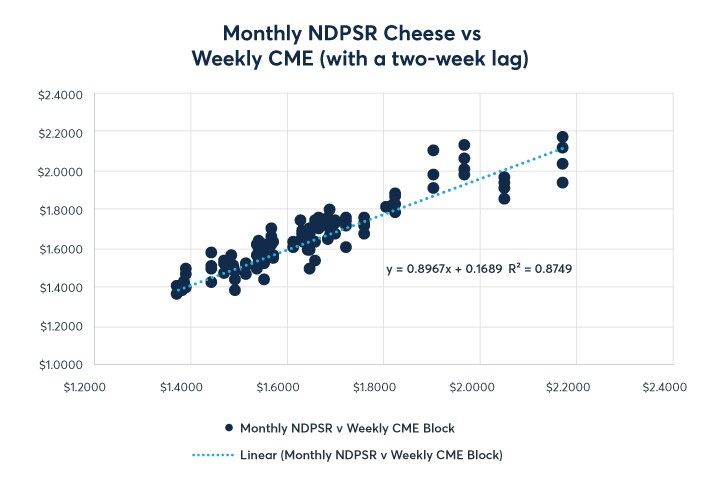

Before executing the first trade, the finance or accounting teams will likely require the risk management team to determine whether hedge accounting is appropriate. This involves completing a regression analysis of the underlying commodity, in this example, CME Spot Cheddar blocks vs. NDPSR blocks or NDPSR cheese, the settlement mechanism for the Block Cheese futures contract. Qualification for hedge accounting requires a minimum of 80% correlation.

While it is possible to relate weekly NDPSR to weekly CME Spot cheese prices, it would require the hedger to unwind positions each week for the correlation results to be applicable. In most cases, hedgers tend to allow the futures contracts to go to expiration without unwinding within a contract period. The regressions in Figures 4 and 5 assume the monthly futures contracts, held to expiration, are used to hedge cheese that was purchased based on the weekly CME Spot block price. For those with price exposure to CME Spot blocks, the Block Cheese contract provides a 92.3% correlation, meaning the derivative should result in less than 8% unexplained variance or hedge ineffectiveness over time; said another way, the NDPSR block cheese price can explain 92% of the price change in the weekly CME Spot block price. The Cash-Settled Cheese futures provide a 69.7% correlation over the same time, which is insufficient to qualify for a hedge account. As mentioned above, the volatility of the block-barrel spread (Figure 3) has affected the efficacy of Cash-Settled Cheese futures as a hedge for price exposure related to Cheddar blocks only. Over the past four years, there have been substantial spans where the barrel price declines while the block price increases. Although less prevalent, the opposite can also be true. Therefore, when compared to using Block Cheese futures and options, employing Cash-Settled Cheese futures to hedge a CME block price exposure could result in higher amounts of hedge ineffectiveness causing unexpected impacts to earnings.

Source: CME Block Price; CME Block Cheese futures as of 3/31/2020 and NDPR weekly/monthly price per AMS

Based on the elevated futures price expectations through Q3 2020, the buyer opted to hedge the first 10% of her monthly price exposure using five (5) Block Cheese futures contracts per month. In this example, the company’s internal policy is to hedge 5-10% of risk exposure at the current price levels. The Block Cheese futures contracts are 20,000 pounds each; therefore, to hedge 10% of a one-million-pound per month exposure, the buyer needs to procure five (5) contracts per month. The example hedge would look like the following for April to June 2020:

| CME Pricing Period | Purchase Period | Futures Contract Month | Commodity Cheddar purchase (lbs.) | Block Cheese Futures (lbs.) | Block Cheese Futures Price |

|---|---|---|---|---|---|

| Mar 23 to Apr 25 | Mar 29 to May 2 | Apr-2020 | 1,000,000 | 100,000 | $1.8640 |

| Apr 26 to May 23 | May 3 to May 30 | May-2020 | 1,000,000 | 100,000 | $1.8410 |

| May 24 to Jun 20 | May 31 to Jun. 27 | Jun-2020 | 1,000,000 | 100,000 | $1.8420 |

Hedging the exposure would result in an average NDPSR block cheese price of $1.849/lb. Given a basis assumption of 3.5 cents per pound, that would be a targeted cheese cost of $1.8840/lb. over the life of the hedge.

The settlement procedure would be similar each month. To illustrate the settlement process, June 2020 would provide the results of the hedge:

| Cash Transactions | Futures Transactions | Target | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Week Ending | Purchase Price (Prior week CME Block Weekly Avg. +$0.035) | Actual Cheese Cost | Block Cheese Futures (lbs.) | Block Futures Price | NDPSR Block Price | Hedge Gain/ (Loss) | Adjust. Block Cheese Cost | Targeted Cheese Cost | Hedge Effective-ness |

| May 23 | $1.6265 | $32,530 | 20,000 | $1.8420 | $2.2566 | $8,292 | $24,238 | $37,680 | ($13,442) |

| May 30 | $1.9270 | $38,540 | 20,000 | $1.8420 | $2.2566 | $8,292 | $30,248 | $37,680 | ($7,432) |

| June 6 | $2.1275 | $42,550 | 20,000 | $1.8420 | $2.2566 | $8,292 | $34,258 | $37,680 | ($3,422) |

| June 13 | $2.5325 | $50,650 | 20,000 | $1.8420 | $2.2566 | $8,292 | $42,358 | $37,680 | $4,678 |

| June 20 | $2.5800 | $51,600 | 20,000 | $1.8420 | $2.2566 | $8,292 | $43,308 | $37,680 | $5,628 |

| Cash cheese cost | $215,870 | Futures gain/(loss) | $41,560 | $174,410 | $188,400 | ($13,990) | |||

In this example, the buyer hedged 100,000 pounds of CME block-based cheese with a targeted expense of $188,400. The hedged price was $174,410 — the sum of the cash cheese price of $215,870 and the futures gain of $41,560. That resulted in $13,990 in hedge ineffectiveness, within the tolerance given the 92.3% r2.

To provide a comparison to today’s more commonly used tool, here are the results had the buyer in this example used the Cash-Settled Cheese futures contract for the same hedge.

| Cash Transactions | Futures Transactions | Target | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Week Ending | Purchase Price (Prior week CME Block Weekly Avg. +$0.035) | Actual Cheese Cost | Cash-Settled Cheese Futures (lbs.) | Cash-Settled Cheese Futures Price | NDPSR Cheese Price | Hedge Gain/ (Loss) | Adjust. Block Cheese Cost | Targeted Cheese Cost | Hedge Effective-ness |

| May 23 | $1.6265 | $32,530 | 20,000 | $1.8170 | $2.2152 | $7,964 | $24,566 | $37,040 | ($12,474) |

| May 30 | $1.9270 | $38,540 | 20,000 | $1.8170 | $2.2152 | $7,964 | $30,576 | $37,040 | ($6,464) |

| June 6 | $2.1275 | $42,550 | 20,000 | $1.8170 | $2.2152 | $7,964 | $34,586 | $37,040 | ($2,454) |

| June 13 | $2.5325 | $50,650 | 20,000 | $1.8170 | $2.2152 | $7,964 | $42,686 | $37,040 | $5,646 |

| June 20 | $2.5800 | $51,600 | 20,000 | $1.8170 | $2.2152 | $7,964 | $43,636 | $37,040 | $6,596 |

| Cash cheese cost | $191,600 | Futures gain/(loss) | $39,820 | $176,050 | $185,200 | ($9,150) | |||

In this example, the buyer hedged 100,000 pounds of CME block-based cheese with a targeted expense of $185,200. The hedged price was $176,050 — the sum of the cash cheese price of $191,600 and the futures gain of $39,820. That resulted in $9,150 in hedge ineffectiveness. The hedge results were worse than the buyer expected due to the unexpected price change related to barrels that were not offset by changes in the CME block cheese markets.

In Figures 7 and 8, the spot market increased, resulting in a futures gain. However, in Figure 7, the Block Cheese futures gains and losses were offset by corresponding changes in the cash markets. In Figure 8, changes in the CME barrel market reduced the futures gains because the changes were not offset in the cash block markets, resulting in unpredictable and unexpected costs.

This example provides a similar, but inverse, demonstration of hedging price exposure related to the sale of cheese, illustrated in Example 1 above. A characteristic of cheese is age, with the most common categories being fresh, medium, and aged. For the aged type, processors store cheese for several months, typically ranging from four to eighteen months. In this example, a processor has commodity price risk associated with an unknown selling price six months in the future versus a known cost of cheese in the warehouse. Selling a block cheese contract could lay off price risk to the market.

As an example, a cheese processor might be interested in selling aged cheese six months from the October 2019 make date to avoid unforeseen events that could result in lower cheese prices that negatively impact financial performance and cause the company to miss its earnings targets. Prices were persistently high at the beginning of 2020. On Jan. 31, 2020, CME MAR20 Block Cheese futures projected an average price of $1.9010/lb. That price was well above the two- and three-year averages, but given fundamental data, this company would like to protect 40% of its forecast sales for March of 2020 based on Block Cheese futures as of Jan. 31, 2020. The processor would then review further coverage opportunities at the end of the quarter.

A cheese processor could mitigate commodity price risk associated with deferred sales by selling fixed-price products to customers or using futures and options to protect inventory. In this example, the cheese processor initiated the hedge to reduce risks associated with a fixed-price cheese inventory against a variable-price sales commitment.

These are the assumptions for the example:

| Assumptions | Factor |

|---|---|

| 2020 monthly volume Cheddar Blocks (in pounds) | 1,000,000 |

| Reference price | CME Spot Cheddar blocks |

| Contract basis | CME Spot blocks + $0.035/lb. + $0.02/lb. per month |

| Hedge volume target | 40% |

| Hedge price target (in dollars/pound) | $1.9010 |

| Time | March 2020 |

| Hedge tool | CME Block Cheese futures |

Based on the elevated futures price expectations through Q2 2020, the manufacturer opted to hedge the first 40% of price exposure using twenty (20) Block Cheese futures contracts per month. In this example, the company’s internal policy is to hedge 35-60% of risk exposure at the current price levels. The block cheddar cheese was manufactured in October of 2019 at an average cost of $1.9363/lb. The example hedge would look like the following for March 2020:

| CME Pricing Period | Purchase Period | Futures | Aged cheese sale (lbs.) | Block Futures (lbs.) | Block Futures Price |

|---|---|---|---|---|---|

| Feb 23 to Mar 21 | Mar 1 to Mar 28 | Mar-2020 | 1,000,000 | 100,000 | $1.9010 |

Hedging the exposure would result in an average NDPSR block cheese price of $1.9010/lb. A basis assumption of 3.5 cents per pound and 2.0 cents per pound for six months would give a targeted cheese price of $2.0560/lb. over the life of the hedge.

The settlement procedure would be similar each month. To illustrate the settlement process, March 2020 would provide the results of the hedge:

| Cash Transactions | Futures Transactions | Target | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Week Ending | Selling Price (Prior week CME Block Weekly Avg. +$0.035 + $0.02/mo) | Actual Cheese Price | Block Cheese Futures (lbs.) | Block Cheese Futures Price | NDPSR Block Price | Hedge Gain/ (Loss) | Adjust. Block Cheese Price | Targeted Cheese Selling Price | Hedge Effective-ness |

| Mar 7 | $1.9015 | $190,150 | 100,000 | $1.9010 | $1.8133 | $8,770 | $198,920 | $205,600 | ($6,680) |

| Mar 14 | $1.9130 | $191,300 | 100,000 | $1.9010 | $1.8133 | $8,770 | $200,070 | $205,600 | ($5,530) |

| Mar 21 | $1.9475 | $194,750 | 100,000 | $1.9010 | $1.8133 | $8,770 | $203,520 | $205,600 | ($2,080) |

| Mar 28 | $2.0185 | $201,850 | 100,000 | $1.9010 | $1.8133 | $8,770 | $210,620 | $205,600 | $5,020 |

| Cash cheese cost | $778,050 | Futures gain/(loss) | $35,080 | $813,130 | $822,400 | ($9,270) | |||

In this example, the buyer hedged 400,000 pounds of CME Spot block-based cheese with a targeted selling price of $822,400. The hedged price was $813,130 — the sum of the cash cheese price of $778,050 and the futures gain of $35,080. That resulted in ($9,270) in hedge ineffectiveness, well within the tolerance given the 92.3% r2.

To provide a comparison to today’s more commonly used tool, here are the results had the buyer in this example used the Cash-Settled Cheese futures contract for the same hedge.

| Cash Transactions | Futures Transactions | Target | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Week Ending | Selling Price (Prior week CME Block Weekly Avg. +$0.035) | Actual Cheese Selling Price | Cash- Settled Cheese Futures (lbs.) | Cash- Settled Cheese Futures Price | NDPSR Cheese Price | Hedge Gain/ (Loss) | Adjust. Block Cheese Price | Targeted Cheese Selling Price | Hedge Effective-ness |

| Mar 7 | $1.9015 | $190,150 | 100,000 | $1.8550 | $1.7091 | $14,590 | $204,740 | $201,000 | $3,740 |

| Mar 14 | $1.9130 | $191,300 | 100,000 | $1.8550 | $1.7091 | $14,590 | $205,890 | $201,000 | $4,890 |

| Mar 21 | $1.9475 | $194,750 | 100,000 | $1.8550 | $1.7091 | $14,590 | $209,340 | $201,000 | $8,340 |

| Mar 28 | $2.0185 | $201,850 | 100,000 | $1.8550 | $1.7091 | $14,590 | $216,440 | $201,000 | $15,440 |

| Cash cheese cost | $778,050 | Futures gain/(loss) | $58,360 | $836,410 | $804,000 | $32,410 | |||

To provide a comparison to today’s more commonly used tool, here are the results had the buyer in this example used the Cash-Settled Cheese futures contract for the same hedge.In this example, the buyer hedged 400,000 pounds of CME Spot block-based cheese with a targeted selling price of $804,000. The hedged price was $836,410 — the sum of the cash cheese price of $778,050 and the futures gain of $58,360. That resulted in $32,410 in hedge ineffectiveness. The hedge results were better than the seller expected due to the price declines related to barrels that were not offset by changes in CME block cheese markets. While the results were better than intended, the converse can also be true when barrels rise unexpectedly, resulting in higher NDPSR cheese prices that are not fully offset by the change in the cash block cheese value.

Over the past few years, hedging 500-pound barrels or processed cheese has been challenging for buyers, but more so for sellers. Much like the challenges buyers of CME block-based cheese have encountered with hedge ineffectiveness due to the unpredictable movement of barrels, barrel manufacturers, or firms with exposure, have also experienced higher-than-forecast amounts of hedge ineffectiveness when attempting to mitigate price risk using cash-settled cheese futures alone.

Typically, those looking to offset risks associated with holding inventories employ short (sell) futures. The expectation is that inverse movements in the futures markets would offset the cash gains or losses. Therefore, a barrel manufacturer would sell a futures contract to offset potential losses associated with holding inventory. While a Cash-Settled Cheese futures contract would mitigate a portion of the risk, when used alone, changes in the block market might not be reflected in the cash barrel market, resulting in a disconnect and potentially unforeseen results. Blocks often represent 50% of the cheese reported into the NDPSR cheese price. At times, though, blocks can drop as low as 44% and move as high as 61%. To avoid overhedging blocks and increasing hedge ineffectiveness, hedgers may consider the low end of the range to avoid excessive block coverage that negatively impacts hedge effectiveness. These ratios can fluctuate throughout the year, and hedgers should monitor to ensure proper hedge ratios. To improve the effectiveness of barrel hedges, the firm could seek to sell four (4) Cash-Settled Cheese contracts and buy (2) Block Cheese futures contracts to achieve an implied barrel cheese hedge for a single load of cheese.

| NDPSR Cheese Break-down (lbs.) | Hedge & Futures Contract Structure (lbs.) | ||||

|---|---|---|---|---|---|

| NDPSR Barrels (~50%) | Sell Cash-Settled Cheese Futures | Buy Block Cheese Futures | Implied Barrels | ||

| 40,000 | (80,000) | 40,000 | (40,000) | ||

There are several ways a manufacturer could manage commodity price risk associated with holding barrel stocks. The processor could work with her cheese customer to establish a fixed-price contract over the desired period, or should the company’s policies permit, the processor could use cheese futures contracts to lay off risk to the market.

Much like barrel cheese sellers, purchasers, typically foodservice buyers of processed cheese, struggle with the ability to hedge price exposure related to increases in the barrel price. Should the barrel market increase but block prices remain relatively stable, the Cash-Settled Cheese futures contracts may not fully offset the exposure resulting in higher degrees of hedge ineffectiveness. Buyers of barrel cheese can combine Block Cheese and Cash-Settled Cheese futures to imply a barrel price for hedging purposes. The math to establish the hedge would be identical to that in Figure 12.

There are several ways a buyer can manage commodity price risk associated with future barrel cheese purchases. The buyer can work with her cheese seller to establish a fixed-price contract over the desired period, or should the company’s policies permit, the buyer could use cheese futures contracts to lay off risk to the market. In either case, the cheese buyer or seller has an exposure related to fixing the future price.

The new block futures contract can provide hedgers with an additional tool that allows for more effective risk mitigation. The examples work to demonstrate application in real-world scenarios and the potential improvement in hedge effectiveness by employing the block contract alone or in conjuction with the cash-settled cheese contract. A fundamental premise of risk mitigation is that the futures or options contracts can offset risks experienced in the cash markets. Any mismatch could cause unexpected results affecting efficacy of a hedge program. The new block contract can help address these issues.