- What is the CME Direct Market Data Fee Policy?

- Will volume from both CME Globex and CME ClearPort venues count toward achieving the ADV threshold?

- Will all named parties on a CME Direct ClearPort deal be eligible for applied volume?

- If I trade CME Group markets through other applications, will I qualify for the waiver?

- If I am already paying for market data on another platform, do I still have to pay for market data on CME Direct?

- My firm is enrolled in the Pay Per User Program. Can our CME Direct market data fees be included in the program? Does the Pay Per User Program (PPU) apply?

- My firm is enrolled in the Asia Market Data Incentive (AMDI) Program. Can our CME Direct market data fees be included in the program?

- If I only use CME Direct for CME ClearPort deal entry, will I be charged for market data?

- Will I be charged market data fees if I am permissioned for market data in CME Direct but do not log in for a full calendar month?

- What is the standard monthly fee for market data?

- What is meant by “Device”?

- Will CME Direct Mobile be charged as an independent device for real-time market data?

- Will fees for market data of a newly permissioned Exchange, after the initial qualification period be billed immediately?

- Will CME Group bill customer firms directly?

- Can my clearing firm deduct my data fees directly from my trading account?

- Where can I find a list of all users on CME Direct for my company?

- How does my firm adjust market data permissions for the exchange data we do not use?

- How will the policy apply to CME Direct Administrator IDs?

- What is the first step in the licensing process?

- Why do I want to map my CME Direct companies?

- Are customers required to sign an ILA?

- Where can I find more information regarding the Information License Agreement and related schedules?

- Contact Information

Fees will be charged per standard market data policy, on a per Device, per Exchange, per month basis. Users can qualify for a market data fee waiver by meeting a volume threshold on the CME Direct platform. For 2022, the volume threshold has been set to an average daily volume (ADV) of one per calendar quarter per DCM. For January 2023 and onwards, the average daily volume (ADV) will be set to ten. The waiver applies only to the four CME Group exchanges, CME, CBOT, NYMEX and COMEX. Standard fees apply for Dubai Mercantile Exchange market data.

Yes, volume from both CME Globex transactions and CME ClearPort deals entered via CME Direct will count towards ADV for the quarter.

Yes, any named party on a CME ClearPort deal entered via CME Direct will benefit. This includes named brokers and traders who are not the submitters of the transaction.

No, only trades submitted through CME Direct are eligible.

Yes, unless your company is enrolled in another CME Group market data program (see next two questions for further detail).

Yes, firms who are in the Pay Per User Program (Netting) may include CME Direct.

Yes, firms who are in the AMDI Program may include CME Direct.

CME Direct can be used for deal entry to CME ClearPort without market data being permissioned. Market permission sets under the over-the-counter (OTC) venues are not billable.

Yes, if you are an enabled CME Direct user and permissioned for market data at any point during the month, you will be charged.

Fees will be charged on a per Device basis for each Exchange permissioned where the ADV threshold is not met:

- $130.01 per month for CME

- $130.01 per month for CBOT

- $130.01 per month for COMEX

- $130.01 per month for NYMEX

- $98.50 per month for DME (DME is not an eligible exchange for the waiver program)*

*Fee schedule above is effective April 1, 2025. For current information regarding fees, visit our Real-Time Professional Fees page

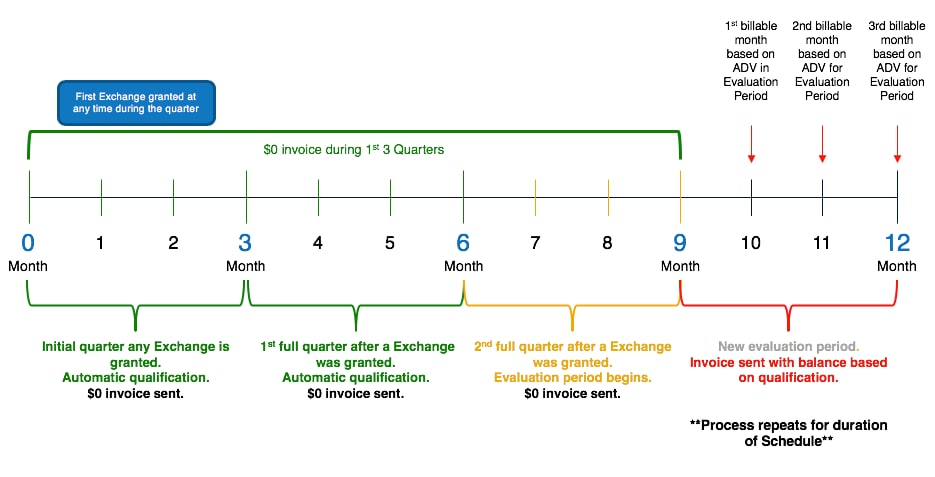

Fees and waivers will be applied monthly based on the previous quarter’s usage evaluation. The first granted Exchanges automatically qualify in the first calendar quarter they are enabled and the following two quarters. In the third quarter after access to market data on the first Exchange is permissioned, quarterly evaluation begins.

During an evaluation quarter, trading activity is assessed on each Exchange listed above independently. Users who achieve the ADV threshold will qualify for the waiver. The qualification applies to the bill for each month in the next calendar quarter.

CME Group defines Device as any display unit (fixed or portable), piece of software or method, which may access, receive, process or display the Information, whether in whole or part, through the Service. CME reserves the sole right to determine what constitutes a Device.

No, CME Direct Mobile devices qualify as a waived device.

No, the newly added market data will qualify as waived for the balance of the quarter it is granted and then go into evaluation as referenced above.

Yes, CME Group will bill customer firms directly for real-time market data access on CME Direct.

No, firms will be invoiced by CME Group and are required to pay CME Group directly.

Firm Administrators can see all entitled users for their firm in the User Admin view section of CME Direct. This list includes enabled and disabled users.

Firm Administrators can adjust market data permissions from the User Admin view in CME Direct. Additionally, users can be disabled from the User Admin view.

Firm Administrators can complete all administrative tasks without the need for market data permissioned, including cancelling and holding company CME Globex orders. If an Administrator wants market data permissioned, the policy will waive fees for a single admin when at least one trading user at the firm has met the ADV threshold on a per Exchange basis.

CME Group recommends entities that have registered for CME Direct under multiple entity names to submit a Company Mapping form as soon as possible. The form provides the opportunity to group multiple entity names and affiliates together under one Master License streamlining the paperwork and billing.

An affiliate is defined as an entity that controls, is controlled by or is under common control with a party. Control means the ownership or control, directly or indirectly, of at least 50% or more of all of the voting shares (or other securities or rights) entitled to vote for the election of directors or other governing authority.

Grouping associated entities will prevent multiple user IDs across companies from getting charged multiple times.

Your company will need to determine the Master Licensed Entity, which is the entity who will hold a licensing agreement with CME Group and any companies, including affiliates, who will be a party to this License.

Yes, all firms will be required to complete an Information License Agreement (ILA) and related schedules to ensure continued market data access via CME Direct.

Global Account Management

U.S.: +1 312 634 8395

Europe: +44 20 3379 3754

Asia: +65 6593 5505

Enterprise Application & System Entitlements (EASE)

U.S.: +1 312 456 1560

Europe: +44 203 379 3802

Asia: +65 6593 5536