-

CME Globex Notices: June 25, 2018

-

-

- To

- CME Globex and Market Data Customers

-

- From

- Global Market Solutions and Services

-

- #

- 20180625

-

- Notice Date

- 28 June 2018

-

Topics in this issue include:

- Critical System Updates

- CME Globex API Secure Logon: iLink and Drop Copy - This Week

- Update - Price Precision Extension - 2018 Update

- New Functionality

- Globex MDP3 SBE Schema Update - August 12

- Streamlined MDP SBE Schema Update - August 26

- Product Launches

- Light Sweet Crude vs. Brent Crude Last Day Financial Spreads - This Week

- Freight Platts Futures - This Week

- Gold TAS and Silver TAS Spreads - July 15

- New - Options on Black Sea Wheat and Black Sea Corn - July 15 New

- New - California Low Carbon Fuel Standard (PRIMA) Futures - July 15 New

- Eris Swap Futures on Globex - 4Q 2018

- Product Changes

- Listing Cycle Changes and Delisting of E-mini Nifty 50 Index Futures - This Week

- Changes to Gold Options Matching Algorithm: Resting Order Eliminations - This Week

- Change to Minimum Price Increment for BTIC on S&P Total Return Index Futures - This Week

- Changes to Globex Non-Reviewable Trading Ranges - This Week

- Change to Maximum Order Quantity for Various Agricultural Options - July 15

- New - Changes to Circuit Breakers for Brent Last Day Financial Futures - July 15 New

- New - Change to Maximum Order Quantity and TOP Order Allocation Maximum for Corn and Soybean Futures - Starting July 29 New

- Events and Announcements

- New - Messaging Efficiency Program Q2 2018 Benchmarks New

- Settlement Files on FTP.CMEGROUP.COM - This Week

- 10Gbps Offering - October 1

- Critical System Updates

-

Critical System Updates

CME Globex API Secure Logon: iLink and Drop Copy - This Week

CME Group is committed to our customers’ information security. To ensure the highest levels of security, CME Group has launched the CME Globex API Secure Logon in Q1 2018 to harden iLink and Drop Copy 4.0 session authentication.

The new Secure Logon is in production and will be supported in parallel with the current model with surcharges until Friday, June 29. Any iLink or Drop Copy Target sessions that connect using plain text password are subject to surcharges as follows:

- Sunday, June 3 – Friday, June 29: $500/session/month

Only Secure Logons will be supported starting:

- Monday, June 11 - in New Release

- Sunday, July 1 - in Production

The Client Impact Assessment provides more detailed process and messaging information.

A new iLink and Drop Copy certification suite is currently available in AutoCert+. iLink and Drop Copy 4.0 customer systems must complete this mandatory certification.

The CME Globex API Secure Logon is now available for customer testing in New Release.

Please contact your Global Account Manager with any questions or concerns in the U.S. at +1 312 634 8700, in Europe at +44 203 379 3754 or in Asia at +65 6593 5505 for additional information.

UpdateUpdate - Price Precision Extension - 2018

† Denotes update to the article

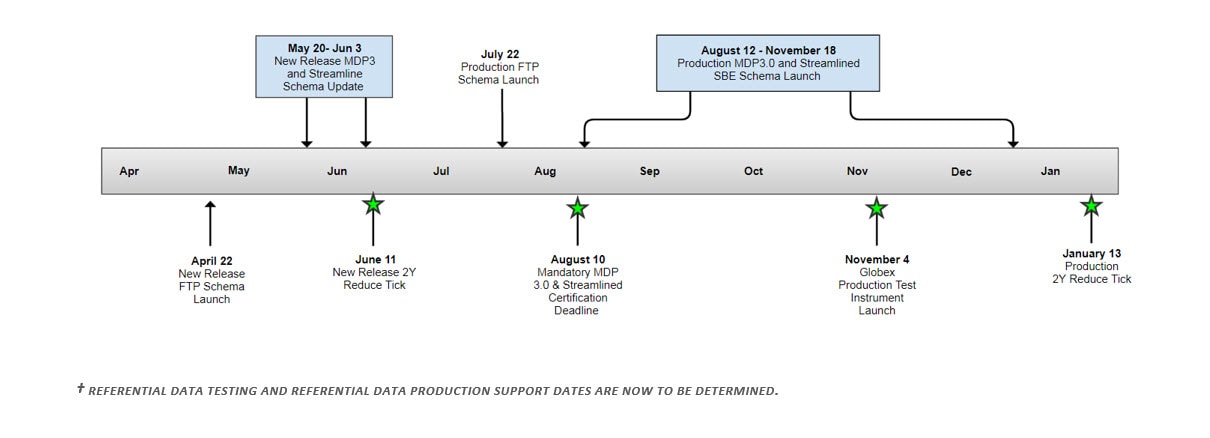

CME Group is implementing end-to-end technology changes to support increased price granularity. Currently, CME Group systems support a maximum of 7 decimals. With this initiative, products with up to 9 decimals may be listed and traded. On Sunday, January 13, 2019 (trade date Monday, January 14), pending regulatory approval, the 2-Year Treasury Note futures, all 2-Year Treasury Future Spreads (including Calendar Spreads, Tail Spreads and Inter-Commodity Spreads with a 2-Year Treasury Future) along with the futures portion of covered options UDS, will move from 7 decimals to 8 to support trading at 1/8 of 1/32.

Customers are encouraged to move to support 9 decimals now; but there are no plans to list a product that uses the 9th decimal at this time.

With this release, customer certification will be required for MDP 3.0 and Streamlined SBE. The new Market Data templates are currently available in New Release and the AutoCert+ test suite is now available for certification.

Starting Sunday, August 12, the price precision extension rollout will begin with MDP 3.0 in production over several weekend.

On Sunday, November 4, a production test instrument for the 2-Year Treasury Note futures will be launched on CME Globex. This new test instrument will give customers the ability to confirm system readiness for the introduction of 8-digit decimal price precision. Upon the launch of this test instrument, clients whose systems are not yet prepared to handle 8 decimal precision must ensure their systems have the ability to ignore market data and iLink/Drop Copy execution reports on this new instrument.

Price Precision Timeline:

Customer Mock Trading Sessions

To ensure customers can process the market data, CME Group will offer three customer mock trading sessions prior to each schema rollout group and Globex test instrument launch:

- Saturday, July 28

- Saturday, August 25

- Saturday, October 20

Customers are required to register and join the conference bridge line to participate in the mock trading sessions.

For complete impacts, rollout information and dates, please refer to Key Events and Dates in the Client Impact Assessment.

The Client Impact Assessment includes additional information on the following:

- CME Globex iLink

- CME Globex MDP3 and Mandatory Certification

- Streamlined MDP and Mandatory Certification

- ITC

- CME Globex Drop Copy

- Referential Data

- Production Globex Test Instrument

† Please watch the Price Precision Extension Technology Webinar for a technical impact overview.

These changes are currently available in New Release for customer testing. The 2-Year Treasury Note futures are available in New Release with 1/8 of 1/32 tick.

New Functionality

Globex MDP3 SBE Schema Update - August 12

Starting Sunday, August 12, in conjunction with the price precision initiative, CME Group will update the schema for all Globex MDP3 SBE market data channels. Please view the rollout schedule. This release will not support template extension, however the order of the fields will be preserved in the new templates. Please review an overview of changes.

The new version 9 schema is currently available New Release for customer testing.

Streamlined MDP SBE Schema Update - August 26

Starting Sunday, August 26, in conjunction with the price precision initiative, CME Group will update the schema for streamlined SBE market data channels to support schema version 9 to ensure consistency between market data channels. Please view the rollout schedule. This release will not support template extension; however, the order of the fields will be preserved in the new templates. Please review an overview of changes.

The new version 9 schema is currently available is currently available in New Release for customer testing New Release public FTP.

Please Note: The schema update timeline for Streamlined Equity Indices and CME CF Cryptocurrency Pricing channels will be announced at a later date.

Product Launches

Light Sweet Crude vs. Brent Crude Last Day Financial Spreads - This Week

Effective this Sunday, July 1 (trade date Monday, July 2), calendar spreads between the Light Sweet Crude Oil futures vs. Brent Crude Oil Last Day Financial futures Inter-Commodity spreads will be listed on CME Globex and for submission for clearing via CME Clearport.

Light Sweet Crude Futures vs. Brent Crude Oil Last Day Financial Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupTag 762-

SecuritySubTypeListing Cycle Light Sweet Crude Oil Futures vs Brent Crude Oil Last Day Financial Futures CL IE IP

(Inter-Commodity Spread)The first 12 months, Jan-Mar, Mar-Jun, Jun-Sep and Sep-Dec for the nearest 12 months and all combinations of Jun-Dec for nearest 48 months The spreads are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

Freight Platts Futures - This Week

Effective this Sunday, July 1 (trade date Monday, July 2), the following Freight Platts futures will be listed for trading on CME Globex and for submission for clearing via CME ClearPort.

Freight Platts Monthly Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupMarket Data Channel Freight Route TC5 (Platts) BALMO Futures THB FT 386 Freight Route TD3C (Platts) Futures TD3 FT 386 Freight Route TD3C (Platts) BALMO Futures T3B FT 386 These Freight Platts futures are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

Gold TAS and Silver TAS Spreads - July 15

Effective Sunday, July 15 (trade date Monday, July 16), the CME Group will add Gold TAS and Silver TAS spreads for the first 2 TAS months on CME Globex.

Gold TAS and Silver TAS Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupTag 762- SecuritySubType Gold TAS GCT TG EC – TAS Calendar Spreads Silver TAS SIT MT EC – TAS Calendar Spreads The spreads will be available for customer testing in New Release on Monday, July 2.

These contracts are listed with, and subject to, the rules and regulations of COMEX.

New New - Options on Black Sea Wheat and Black Sea Corn - July 15

Effective Sunday, July 15 (trade date Monday, July 16), the following Agricultural options will be listed for trading on CME Globex and for submission for clearing via CME ClearPort.

Options on Black Sea Wheat and Black Sea Corn Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupMarket Data Channel Options on Black Sea Wheat Financially Settled (Platts) Futures BWO W2 341 Options on Black Sea Corn Financially Settled (Platts) Futures BSO CG 341 These products will be available for customer testing in New Release on Monday, July 9.

These contracts are listed with, and subject to, the rules and regulations of CBOT.New New - California Low Carbon Fuel Standard (PRIMA) Futures - July 15

Effective Sunday, July 15 (trade date Monday, July 16), California Low Carbon Fuel Standard (PRIMA) futures will be listed for trading on CME Globex and for submission for clearing via CME ClearPort. With this launch, a new unit of measure (tag 996-UnitOfMeasure=ENVCRD) Environmental Credit will be introduced. The unit of measure can be found in the MDP 3.0 Security Definition message.

California Low Carbon Fuel Standard (PRIMA) Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupMarket Data Channel tag 996-UnitOfMeasure California Low Carbon Fuel Standard (PRIMA) Futures LCF VX 380 ENVCRD These futures will be available for customer testing in New Release on Monday, July 2.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

Eris Swap Futures on Globex - 4Q 2018

In Q4 2018, pending regulatory approval, CME Group will list Eris Swap Futures on the CBOT designated contract market (DCM) for trading on CME Globex. Eris swap futures Block Trade transactions can also be submitted via CME Direct or CME ClearPort.

The Eris Swap futures will function similarly and trade alongside the MAC Swap Futures, bringing together the two leading interest rate swap futures on a single exchange venue.

Eris Swap futures will be listed for quarterly IMM starting contracts, with fixed MAC coupons, and underlying tenors of 2, 3, 4, 5, 7, 10, 12, 15, 20, and 30-years.

The Client Impact Assessment includes information on the following:

- Order Entry Considerations

- Pricing conventions

- Trading Eligibility

- Market Data Considerations

- Market Data Channels

- Product Specifications

- Eris Swap Futures Security Type

- Eris Swap Futures Product Code

- Standard Calendar Spreads (SP)

- Changing Minimum Price Increment

- Contract Month Convention

- Eris Swap Futures Market Data through CME DataMine.

- Risk Management Services

These futures will be made available in New Release for customer testing on a date to be announced in a future Globex notice.

Product Changes

Listing Cycle Changes and Delisting of E-mini Nifty 50 Index Futures - This Week

On Monday, February 26, the E-mini Nifty 50 Index futures September 2018 and December 2018 contract months were removed from CME Globex. With this change, the June 2018 contract will be the last available contract month listed for trading. Following the expiration of the June 2018 contract month, on Thursday, June 28, E-mini Nifty 50 Index futures will be delisted and removed from CME Globex at the close of business.

Listing Cycle Changes and Delisting of E-mini Nifty 50 Index Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Listing Schedule New Listing Schedule E-mini Nifty 50 Index Futures MNF FN Four months in the March Quarterly Cycle and two nearest serial months Monthly contracts listed up to and including June 2018 These contracts are listed with, and subject to, the rules and regulations of CME.

Changes to Gold Options Matching Algorithm: Resting Order Eliminations - This Week

Effective this Sunday, July 1 (trade date Monday, July 2), the match algorithm for Gold options, Gold Weekly options, and spreads will change from FIFO (tag 1142=F) to the configurable (tag 1142=K) match algorithm, with FIFO and LMM. For detailed information on the configuration of the K algorithm for these products, see the CME Globex Product Reference Sheet.

Changes to Gold Options Matching Algorithm Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupiLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group

(UDS)Important: To facilitate the change, customers are asked to cancel all Good ‘Till Cancel (GTC) and Good ‘Till Date (GTD) orders after the close on Friday, June 29. After 16:00 CT on Friday, June 29, all remaining GT orders for these options and spreads will be cancelled or deleted by the CME Global Command Center (GCC). Gold Options OG OG 1Y Gold Weekly Options OG1-OG5 OG 1Y This change is currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of COMEX.

Change to Minimum Price Increment for BTIC on S&P Total Return Index Futures - This Week

Effective this Sunday, July 1 (trade date Monday, July 2), the minimum price increment tag 969-MinPriceIncrement will be changed for the following.

BTIC on S&P Total Return Index Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent tag 969 - MinPriceIncrement New tag 969 - MinPriceIncrement BTIC on S&P 500 Total Return Index Futures TRB TB 0.10 0.05 These futures are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of CME.

Changes to Globex Non-Reviewable Trading Ranges - This Week

Effective this Sunday, July 1 (trade date Monday, July 2), the Globex Non-Reviewable Trading Ranges will be modified for following products.

Changes to Globex Non-Reviewable Trading Ranges Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupNon-Reviewable Range New Non-Reviewable Range Standard-Size US Dollar/Offshore RMB (CNH) Futures Contract CNH RM 650 300 E-micro US Dollar/Offshore RMB (CNH) Futures MNH RM 650 300 E-mini S&P Real Estate Select Sector Index Futures XAR XR 400 200 BTIC on E-mini S&P Real Estate Select Sector Index Futures XRT T2 100 50 These futures are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of CME.

Change to Maximum Order Quantity for Various Agricultural Options - July 15

Effective Sunday, July 15 (for trade date Monday, July 16), the maximum order quantity will be increased for the following Agricultural options:

Change to Maximum Order Quantity for Various Agricultural Options Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent

tag 1140-MaxTradeVolNew

tag 1140-MaxTradeVolCorn Options OZC OC 1,000 3,000 Corn Weekly Options ZC1-ZC5 OC 1000 3,000 Soybean Options OZS SQ 1,000 3,000 Soybean Weekly Options ZS1-ZS5 SQ 1,000 3,000 Soybean Meal Options OZM ML 1,000 3,000 Soybean Meal Weekly Options ZM1-ZM5 ML 1,000 3,000 Soybean Oil Options OZL 0O 1,000 3,000 Soybean Oil Weekly Options ZL1-ZL5 0O 1,000 3,000 Chicago SRW Wheat Options OZW OW 1,000 3,000 Chicago SRW Wheat Weekly Options ZW1-ZW5 OW 1,000 3,000 KC HRW Wheat Options OKE OK 1,000 3,000 KC HRW Wheat Weekly Options OE1-OE5 OK 1,000 3,000 Feeder Cattle Options GF F0 500 1,000 Lean Hog Options HE 0H 500 1,000 Live Cattle Options LE L0 500 1,000 Cash-settled Butter Options CB C0 100 250 Cash-settled Cheese Options CSC CQ 100 250 Dry Whey Options DY Y0 100 250 Non-fat Dry Milk Options GNF N7 100 250 These changes are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of CME and CBOT.

New New - Changes to Circuit Breakers for Brent Last Day Financial Futures - July 15

Effective Sunday, July 15 (trade date Monday, July 16), circuit breakers values will be modified for Brent Last Day Financial futures.

Changes to Circuit Breakers for Brent Last Day Financial Futures Product iLink: tag 1151-Security Group

MDP 3.0: tag 6937-AssetiLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Circuit Breaker Settings New Circuit Breaker Settings Brent Last Day Financial Futures BZ OP Level 1: 500 Level 1: 700 Level 2: 1000 Level 2: 1400 Level 3: 1500 Level 3: 2100 Level 4: 2000 Level 4: 2800 Level 5: No Limit Level 5: No Limit This change will be available for customer testing in New Release on Monday, July 2.

This product is listed with, and subject to, the rules and regulations of NYMEX.

New New - Change to Maximum Order Quantity and TOP Order Allocation Maximum for Corn and Soybean Futures - Starting July 29

Starting Sunday, July 29 (for trade date Monday, July 30), through Friday, November 30, based on market participant feedback, CME Group will introduce a pilot program to amend the maximum order quantity and the TOP order allocation maximum for calendar spreads on Corn and Soybean futures. During the pilot program, these calendar spread markets will be monitored and evaluated to determine if the changes will remain in place or will be adjusted. The program is subject to early termination at the discretion of the Exchange and any changes to the program will be communicated via the Globex notice.

Changeto Maximum Order Quantity and TOP Order Allocation Maximum for Corn Futures and Soybean Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent

Maximum Order QuantityNew

Maximum Order QuantityCurrent

TOP Order Allocation MaximumNew

TOP Order Allocation MaximumCorn Futures ZC ZC 2500 10000 100 1000 Soybean Futures ZS ZS 2500 10000 100 1000 The pilot will be available for customer testing in New Release on Monday, July 16.

These contracts are listed with, and subject to, the rules and regulations of CBOT.

Events and Announcements

New New - Messaging Efficiency Program Q2 2018 Benchmarks

The Q3 2018 CME Globex Messaging Efficiency Program Product Group Benchmarks are now available. No changes were made to Q3 2018 Product Group Benchmarks vs. Q2 2018 Product Group Benchmarks and Product Group Benchmark Ratios are published quarterly, unless business circumstances for a particular product or product group require changes to be implemented more frequently.

The CME Globex Messaging Efficiency Program creates fair business guidelines by which customers are billed a surcharge for overly high message rates.

CME Globex firms who exceed the benchmark ratios in applicable product groups and are signed-up accordingly, receive email notifications of any potential surcharges and CME Globex firms who have access to the Firm Administrator Dashboard have the ability to view their messaging statistics on a T+1 basis.

Please contact your Global Account Manager in the U.S. at 312 634 8700, in Europe at 44 203 379 3754, or in Asia at 65 6593 5505 with any questions.

Settlement Files on FTP.CMEGROUP.COM - This Week

Effective this Monday, July 2, the CME Equity Select Sector futures and the CBOT Dow Jones Real Estate futures will be removed from the stlint settlement file on ftp.cmegroup.com. These products will instead be included in the stleqt file.

This change will better reflect the underlying asset class of Equity Index for these products.

10Gbps Offering - October 1

To allow for greater than 1Gbps connectivity for market data distribution, CME Group now offers a 10Gbps fiber interface for CME LNet, EConnect, EConnect Secaucus and Globex Hub customers. Interested customers can now order the 10Gbps fiber interface from CME Group. By Monday, October 1, CME Group expects the bandwidth for the full market data feed to exceed 1Gbps and will modify traffic shaping to 2Gbps. For those customers that order the 10Gbps fiber interface, 1Gbps pricing will be in effect until Monday, October 1 when customers will be charged for 10Gbps as reflected in the chart below.

Offering 1Gbps Monthly Customer Fee 10Gbps Monthly Customer Fee CME LNet $8,000 $12,000 CME EConnect $4,000 $6,000 CME EConnect Secaucus $4,000 $6,000 CME Globex Hubs $1,000 $2,000 All CME LNet, EConnect, EConnect Secaucus and Globex Hub customers should review their existing market data subscriptions and determine which option they will use based on their bandwidth needs.

Options to consider:- Limit market data subscriptions to 1Gbps of bandwidth

- Choose to have multiple 1Gbps connections (additional monthly fee)

- Upgrade to a 10Gbps interface (new monthly fee)

- License space in CME Group Colocation Facility

Key Dates:

- June 1, 2018 – CME Group began accepting 10Gbps fiber interface orders for CME LNet, EConnect, EConnect Secaucus and Globex Hubs

- October 1, 2018 – CME Group will modify traffic shaping to 2Gbps and the regular fees for the 10Gbps interface offering will go into effect

Additional Resources:

- Bandwidth statistics, by channel: www.cmegroup.com/bandwidthstats

For more information on the 10Gbps offering, please contact your Global Account Manager.

Global Account Management

U.S.: +1 312 634 8700 gam@cmegroup.com

Europe: +44 20 3379 3754 gamemea@cmegroup.com

Asia: +65 6593 5505 gamasia@cmegroup.com

-