-

CME Globex Notices: June 11, 2018

-

-

- To

- CME Globex and Market Data Customers

-

- From

- Global Market Solutions and Services

-

- #

- 20180611

-

- Notice Date

- 14 June 2018

-

Topics in this issue include:

- Critical System Updates

- New Functionality

- Globex MDP3 SBE Schema Update - August 12

- Streamlined MDP SBE Schema Update - August 26

- Product Launches

- Wet Freight Baltic Mini Daily Futures - June 24

- Light Sweet Crude vs. Brent Crude Last Day Financial Spreads - July 1

- Freight Platts Futures - July 1

- Eris Swap Futures on Globex - 4Q 2018

- Product Changes

- FIX Tag Changes for CBOT Grain Options UDS Group - June 24

- FIX Tag Change to KC HRW-Chicago SRW Wheat Inter-Commodity Spread Options - June 24

- Update - Match Algorithm Changes for Soybean August-November Calendar Spread Options - June 24 Update

- Listing Cycle Expansion for Freight Route Futures - June 24

- Renaming Brent CFD Future - June 24

- New - TOP Order Allocation Minimum/Maximum Quantity Changes - June 24 New

- Listing Cycle Changes and Delisting of E-mini Nifty 50 Index Futures - June 28

- Changes to Gold Options Matching Algorithm - July 1

- New - Change to Minimum Price Increment for BTIC on S&P Total Return Index Futures - July 1 New

- New - Changes to Globex Non-Reviewable Trading Ranges - July 1 New

- Events and Announcements

- New - iLink Message Specification Update New

- New - Settlement Files on FTP.CMEGROUP.COM - July 2 New

- 10Gbps Offering - October 1

-

Critical System Updates

MDP 3.0 Performance Enhancements - June 24

Effective Sunday, June 24 (trade date Monday, June 25), CME Group will continue performance improvements on the following CME Globex MDP 3.0 channels. In internal testing, these enhancements improved MDP 3.0 performance up to 60%.

These enhancements will not impact iLink order routing or market structure dynamics.

MDP 3.0 Performance Enhancements Launch Date Impacted MDP 3.0 Channels June 24 CME Globex Equity Options (ES) – 311

CME Globex Commodity Options – 317

CME Globex Equity Options excluding ES - 319

CBOT Globex Commodity Options – 341

CBOT Globex Equity Index Options – 343

BMD Globex Futures – 430

BMD Globex Options - 431

KRX Globex Futures - 450

MGEX Globex Options - 461New New - Covered UDS Max Order Quantity Enhancement - June 24

Effective Sunday, June 24 (trade date Monday, June 25), CME Globex will enhance the maximum quantity allowed for a Covered User Defined Spread (UDS).

A Covered UDS with a single outright option:

The maximum quantity of the option product will be recognized as the maximum order quantity for the entire UDS.

A Covered UDS with an option spread (Combo):

The maximum quantity of the option product will be recognized as the maximum order quantity for the entire UDS and the spread quantity will be used in validating the maximum order quantity. (e.g. in the treasury options a user can trade 49,999 covered butterflies which would be 49,999 x 99,998 x 49,999 x futures quantity)

This enhancement is currently available in New Release for customer testing.

CME Globex API Secure Logon – iLink and Drop Copy

CME Group is committed to our customers’ information security. To ensure the highest levels of security, CME Group has launched the CME Globex API Secure Logon in Q1 2018 to harden iLink and Drop Copy 4.0 session authentication.

The new Secure Logon is in production and will be supported in parallel with the current model with surcharges until Friday, June 29. Any iLink or Drop Copy Target sessions that connect using plain text password are subject to surcharges as follows:

- Sunday, June 3 – Friday, June 29: $500/session/month

Only Secure Logons will be supported starting:

- Monday, June 11 - in New Release

- Sunday, July 1 - in Production

The Client Impact Assessment provides more detailed process and messaging information.

A new iLink and Drop Copy certification suite is currently available in AutoCert+. iLink and Drop Copy 4.0 customer systems must complete this mandatory certification.

The CME Globex API Secure Logon is now available for customer testing in New Release.

Please contact your Global Account Manager with any questions or concerns in the U.S. at +1 312 634 8700, in Europe at +44 203 379 3754 or in Asia at +65 6593 5505 for additional information.

UpdateUpdate - Price Precision Extension - 2018

† Denotes update to the article

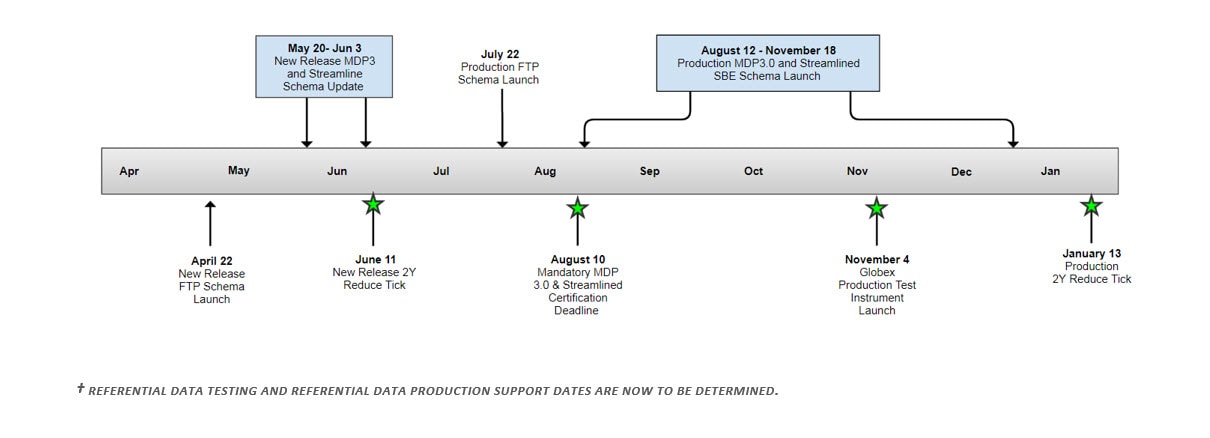

CME Group is implementing end-to-end technology changes to support increased price granularity. Currently, CME Group systems support a maximum of 7 decimals. With this initiative, products with up to 9 decimals may be listed and traded. On Sunday, January 13 (trade date Monday, January 14), pending regulatory approval, the 2-Year Treasury Note futures, all 2-Year Treasury Future Spreads (including Calendar Spreads, Tail Spreads and Inter-Commodity Spreads with a 2-Year Treasury Future) along with the futures portion of covered options UDS, will move from 7 decimals to 8 to support trading at 1/8 of 1/32.

Customers are encouraged to move to support 9 decimals now; but there are no plans to list a product that uses the 9th decimal at this time.

†With this release, customer certification will be required for MDP 3.0 and Streamlined SBE. The new Market Data templates are currently available in New Release and the AutoCert+ tool will be available for certification beginning Sunday, June 17.

Starting Sunday, August 12, the price precision extension rollout will begin with MDP 3.0 in production over several weekend.

On Sunday, November 4, a production test instrument for the 2-Year Treasury Note futures will be launched on CME Globex. This new test instrument will give customers the ability to confirm system readiness for the introduction of 8-digit decimal price precision. Upon the launch of this test instrument, clients whose systems are not yet prepared to handle 8 decimal precision must ensure their systems have the ability to ignore market data and iLink/Drop Copy execution reports on this new instrument.

Price Precision Timeline:

Customer Mock Trading Sessions:

To ensure customers can process the market data, CME Group will offer three customer mock trading sessions prior to each schema rollout group and Globex test instrument launch:

- Saturday, July 28

- Saturday, August 25

- Saturday, October 20

Customers are required to register and join the conference bridge line to participate in the mock trading sessions.

For complete impacts, rollout information and dates, please refer to Key Events and Dates in the Client Impact Assessment.

The Client Impact Assessment includes additional information on the following:

- CME Globex iLink

- CME Globex MDP3 and Mandatory Certification

- Streamlined MDP and Mandatory Certification

- ITC

- CME Globex Drop Copy

- Referential Data

- Production Globex Test Instrument

These changes are currently available in New Release for customer testing. The 2-Year Treasury Note futures are now available in New Release with 1/8 of 1/32 tick.

New Functionality

Globex MDP3 SBE Schema Update - August 12

Starting Sunday, August 12, in conjunction with the price precision initiative, CME Group will update the schema for all Globex MDP3 SBE market data channels. Please view the rollout schedule. This release will not support template extension, however the order of the fields will be preserved in the new templates. Please review an overview of changes.

The new version 9 schema is currently available New Release for customer testing.

Streamlined MDP SBE Schema Update - August 26

Starting Sunday, August 26, in conjunction with the price precision initiative, CME Group will update the schema for streamlined SBE market data channels to support schema version 9 to ensure consistency between market data channels. Please view the rollout schedule. This release will not support template extension; however, the order of the fields will be preserved in the new templates. Please review an overview of changes.

The new version 9 schema is currently available is currently available in New Release for customer testing New Release public FTP.

Please Note: The schema update timeline for Streamlined Equity Indices, Eris Exchange and Bitcoin channels will be announced at a later date.

Product Launches

Wet Freight Baltic Mini Daily Futures - June 24

Effective Sunday, June 24 (trade date Monday, June 25), these Wet Freight Baltic Mini Daily futures will be listed for trading on CME Globex and for submission for clearing via CME ClearPort.

Wet Freight Baltic Mini Daily Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupMarket Data Channel Mini Freight Route TC2 (Baltic) Daily Futures TMD FT 386 Mini Freight Route TC14 (Baltic) Daily Futures T4D FT 386 Mini Freight Route TD3C (Baltic) Daily Futures TLD FT 386 Mini Freight Route TD20 (Baltic) Daily Futures T2M FT 386 These wet freight Baltic Mini Daily futures are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of NYMEX

Light Sweet Crude vs. Brent Crude Last Day Financial Spreads - July 1

Effective Sunday, July 1 (trade date Monday, July 2), calendar spreads between the Light Sweet Crude Oil futures vs. Brent Crude Oil Last Day Financial futures Inter-Commodity spreads will be listed on CME Globex and for submission for clearing via CME Clearport.

Light Sweet Crude Futures vs. Brent Crude Oil Last Day Financial Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupTag 762-

SecuritySubTypeListing Cycle Light Sweet Crude Oil Futures vs Brent Crude Oil Last Day Financial Futures CL IE IP

(Inter-Commodity Spread)The first 12 months, Jan-Mar, Mar-Jun, Jun-Sep and Sep-Dec for the nearest 12 months and all combinations of Jun-Dec for nearest 48 months The spreads will be made available for customer testing in New Release on Monday, June 18.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

Freight Platts Futures - July 1

Effective Sunday, July 1 (trade date Monday, July 2), the following Freight Platts futures will be listed for trading on CME Globex and for submission for clearing via CME ClearPort.

Freight Platts Monthly Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupMarket Data Channel Freight Route TC5 (Platts) BALMO Futures THB FT 386 Freight Route TD3C (Platts) Futures TD3 FT 386 Freight Route TD3C (Platts) BALMO Futures T3B FT 386 These Freight Platts futures will be available for customer testing in New Release on Monday, June 25.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

Eris Swap Futures on Globex - 4Q 2018

In Q4 2018, pending regulatory approval, CME Group will list Eris Swap Futures on the CBOT designated contract market (DCM) for trading on CME Globex. Eris swap futures Block Trade transactions can also be submitted via CME Direct or CME ClearPort.

The Eris Swap futures will function similarly and trade alongside the MAC Swap Futures, bringing together the two leading interest rate swap futures on a single exchange venue.

Eris Swap futures will be listed for quarterly IMM starting contracts, with fixed MAC coupons, and underlying tenors of 2, 3, 4, 5, 7, 10, 12, 15, 20, and 30-years.

The Client Impact Assessment includes information on the following:

- Order Entry Considerations

- Pricing conventions

- Trading Eligibility

- Market Data Considerations

- Market Data Channels

- Product Specifications

- Eris Swap Futures Security Type

- Eris Swap Futures Product Code

- Standard Calendar Spreads (SP)

- Changing Minimum Price Increment

- Contract Month Convention

- Eris Swap Futures Market Data through CME DataMine.

- Risk Management Services

These futures will be made available in New Release for customer testing on a date to be announced in a future Globex notice.

Product Changes

FIX Tag Changes for CBOT Grain Options UDS Group - June 24

Effective Sunday, June 24 (for trade date Monday, June 25), the values in the following FIX tags will be changed for CBOT Grain options UDS group:

- iLink: tag 55-Symbol

- MDP 3.0 tag 1151-SecurityGroup

FIX tag Changes for CBOT Grain Options UDS Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group (UDS)New

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group

(UDS)Corn Options OZC OC CY GG Corn Weekly Options ZC1-ZC5 OC CY GG Short-Dated New Crop Corn Options OCD OC CY GG Soybean Options OZS SQ PZ GG Soybean Weekly Options ZS1-ZS5 SQ PZ GG Short-Dated New Crop Soybean Options OSD SQ PZ GG South American Short-Dated New Crop Soybean Options SRS SQ PZ GG Chicago SRW Wheat Options OZW OW WZ GG Chicago SRW Wheat Weekly Options ZW1-ZW5 OW WZ GG Short Dated New Crop Chicago SRW Wheat Options OWD OW WZ GG KC HRW Wheat Options OKE OK 1G GG KC HRW Wheat Weekly Options OE1-OE5 OK 1G GG Short-Dated New Crop KC HRW Wheat Options KWE OK 1G GG Corn CSOs CZ8, CZ9, CZ6, 12C, CZ7, CZC Y1 Y2 Y2 Soybean CSOs SZ1, SZ3, SZ5, SZK, 12S, SC7, SZ8, SZ0, SZ4, CZS, SZ9, SZH Q1 Q2 Y2 Wheat CSOs WC3, WC6, CZW, WCM, 12W, CWZ W1 Z2 Y2 KC Wheat CSOs KC6, KCR, 12K, CKZ, CK3, KZC K3 K4 Y2 Chicago SRW Wheat-Corn Intercommodity Spread Options ZCW Q3 Q4 Y2 These changes are currently available for customer testing in New Release.

To facilitate the change, customers are asked to cancel all Good ‘Till Cancel (GTC) and Good ‘Till Date (GTD) UDS orders after the close on June 22. After 16:00 CT on June 22, all remaining GT orders for these spreads will be cancelled or deleted by the CME Global Command Center (GCC).

These contracts are listed with, and subject to, the rules and regulations of CBOT.

FIX Tag Change to KC HRW-Chicago SRW Wheat Inter-Commodity Spread Options - June 24

Effective Sunday, June 24 (for trade date Monday, June 25), the values in the following FIX tags will be changed the KC HRW-Chicago SRW Wheat Inter-Commodity Spread options:

- iLink: tag 55-Symbol

- MDP 3.0 tag 1151-SecurityGroup

FIX tag Changes for KC HRW-Chicago SRW Wheat Inter-Commodity Spread options Product MDP 3.0: tag 6937-Asset Current iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group

New

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group (UDS)New

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group

(UDS)KC HRW-Chicago SRW Wheat Intercommodity Spread Options KWC KW Q3 KX Y2 These changes are currently available for customer testing in New Release.

To facilitate the change, customers are asked to cancel all Good ‘Till Cancel (GTC) and Good ‘Till Date (GTD) UDS after the close on June 22. After 16:00 CT on June 22, all remaining GT orders for these spreads will be cancelled or deleted by the CME Global Command Center (GCC).

These contracts are listed with, and subject to, the rules and regulations of CBOT.

UpdateUpdate - Match Algorithm Changes for Soybean August-November Calendar Spread Options - June 24

† Denotes update to the article

Effective Sunday, June 24 (trade date Monday, June 25), the match algorithm will change from Split FIFO and Pro-Rata (tag 1142=K) to Threshold Pro-Rata (tag 1142=O) for the Soybean August-November Calendar Spread options. This change is to support the Fix Tag Changes for CBOT Grain Options UDS Group to allow all grain options to share the same matching algorithm. There will be no impact to the trading functionality.

Match Algorithm Changes for Soybean August-November Calendar Spread Options Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group†iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group

(UDS)Soybean August-November Calendar Spread Options SZ4 Q1 †Q2 These options are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of CBOT.

Listing Cycle Expansion for Freight Route Futures - June 24

Effective Sunday, June 24 (trade date Monday, June 25), the listing cycle for the following Freight Route futures will be expanded on CME Globex.

Listing Cycle Expansion for Freight Route Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Listing Schedule New Listing Schedule Freight Route TD20 (Baltic) Futures T2D FT Monthly contracts listed for the current year and the next 2 calendar years Monthly contracts listed for the current year and the next 3 calendar years Freight Route TD20 (Baltic) Futures TL FT Monthly contracts listed for the current year and the next 2 calendar years Monthly contracts listed for the current year and the next 3 calendar years Freight Route TC2 (Baltic) Futures TM FT Monthly contracts listed for the current year and the next 2 calendar years Monthly contracts listed for the current year and the next 3 calendar years Freight Route TC14 (Baltic) Futures FRC FT Monthly contracts listed for the current year and the next 2 calendar years Monthly contracts listed for the current year and the next 3 calendar years Freight Route TC5 (Platts) Futures TH FT Monthly contracts listed for the current year and the next 2 calendar years Monthly contracts listed for the current year and the next 3 calendar years In addition to the above listing cycle expansions we will also be harmonizing all rollover schedules to be annual on expiry of the December contract.

These futures are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

Renaming Brent CFD Future - June 24

Effective Sunday, June 24 (trade date Monday, June 25), Brent CFD futures will be renamed to the following:

Renaming Brent CFD Futures Current Product Name New Product Name iLink: tag 1151-Security Group

MDP 3.0: tag 6937-AssetiLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupBrent CFD: Dated Brent (Platts) vs. Brent Third Month (Platts) Daily Futures Dated Brent (Platts) vs. Brent Second Month (BFOE) (Platts) Daily CFD Futures A59 BB Brent CFD: Dated Brent (Platts) vs. Brent Second Month (Platts) Daily Futures Dated Brent (Platts) vs. Brent First Month (BFOE) (Platts) Daily CFD Futures A6W BB Brent CFD: Dated Brent (Platts) vs. Brent Second Month (Platts) Weekly Futures Dated Brent (Platts) vs. Brent First Month (BFOE) (Platts) Weekly Futures CFB BB Brent CFD: Dated Brent (Platts) vs. Brent Third Month (Platts) Weekly Futures Dated Brent (Platts) vs. Brent Second Month (BFOE) (Platts) Weekly Futures CFC BB These changes are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

New New - TOP Order Allocation Minimum/Maximum Quantity Changes - June 24

Effective Sunday, June 24 (trade date Monday, June 25), the TOP order allocation minimum and maximum quantity will be increased for the following Kansas City Wheat options. This change is designed to harmonize TOP behavior across the CBOT options.

TOP Order Allocation Minimum/Maximum Quantity Changes Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupiLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group

(UDS)TOP Order Allocation Minimum Current TOP Order Allocation Minimum New TOP Order Allocation Maximum Current TOP Order Allocation Maximum New KC HRW Wheat Options OKE OK 1G 5 10 10 100 KC HRW Wheat Weekly Options OE1-OE5 OK 1G 5 10 10 100 Short-Dated New Crop KC HRW Wheat Options KWE OK 1G 5 10 10 100 KC Wheat CSOs KC6, KCR, 12K, CKZ, CK3, KZC K3 K4 5 10 10 100 These changes will be available for customer testing in New Release on Monday, June 18.

These contracts are listed with, and subject to, the rules and regulations of CBOT.

Listing Cycle Changes and Delisting of E-mini Nifty 50 Index Futures - June 28

On Monday, February 26, the E-mini Nifty 50 Index futures September 2018 and December 2018 contract months were removed from CME Globex. With this change, the June 2018 contract will be the last available contract month listed for trading. Following the expiration of the June 2018 contract month, on Thursday, June 28, E-mini Nifty 50 Index futures will be delisted and removed from CME Globex at the close of business.

Listing Cycle Changes and Delisting of E-mini Nifty 50 Index Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Listing Schedule New Listing Schedule E-mini Nifty 50 Index Futures MNF FN Four months in the March Quarterly Cycle and two nearest serial months Monthly contracts listed up to and including June 2018 These contracts are listed with, and subject to, the rules and regulations of CME.

Changes to Gold Options Matching Algorithm - July 1

Effective Sunday, July 1 (trade date Monday, July 2), the match algorithm will be changed from FIFO (tag 1142=F) to Split FIFO and Pro-Rata (tag 1142=K) for Gold options, Gold Weekly options, and spreads on CME Globex.

Changes to Gold Options Matching Algorithm Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupiLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group

(UDS)Gold Options OG OG 1Y Gold Weekly Options OG1-OG5 OG 1Y This change will be available for customer testing in New Release on Monday, June 25.

To facilitate the change, customers are asked to cancel all Good ‘Till Cancel (GTC) and Good ‘Till Date (GTD) orders after the close on Friday, June 29. After 16:00 CT on Friday, June 29, all remaining GT orders for these options and spreads will be cancelled or deleted by the CME Global Command Center (GCC).

These contracts are listed with, and subject to, the rules and regulations of COMEX.

New New - Change to Minimum Price Increment for BTIC on S&P Total Return Index Futures - July 1

Effective Sunday, July 1 (trade date Monday, July 2), the minimum price increment tag 969-MinPriceIncrement will be changed for the following.

BTIC on S&P Total Return Index Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent tag 969 - MinPriceIncrement New tag 969 - MinPriceIncrement BTIC on S&P 500 Total Return Index Futures TRB TB 0.10 0.05 These futures will be available for customer testing in New Release on Monday, June 25.

These contracts are listed with, and subject to, the rules and regulations of CME.

New New - Changes to Globex Non-Reviewable Trading Ranges - July 1

Effective Sunday, July 1 (trade date Monday, July 2), the Globex Non-Reviewable Trading Ranges will be modified for following products.

Changes to Globex Non-Reviewable Trading Ranges Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupNon-Reviewable Range New Non-Reviewable Range Standard-Size US Dollar/Offshore RMB (CNH) Futures Contract CNH RM 650 300 E-micro US Dollar/Offshore RMB (CNH) Futures MNH RM 650 300 E-mini S&P Real Estate Select Sector Index Futures XAR XR 400 200 BTIC on E-mini S&P Real Estate Select Sector Index Futures XRT T2 100 50 These futures will be available for customer testing in New Release on Monday, June 25.

These contracts are listed with, and subject to, the rules and regulations of CME.

Events and Announcements

New New - iLink Message Specification Update

The iLink message specifications in the Client Systems Wiki have been updated to more accurately reflect validation for messages sent by CME Globex to the client.

iLink tag 9717 - Symbol is now a required tag for Execution Report – Order Status Request Acknowledgement (tag 35-MsgType=8, tag 150-ExecType=I) message. Previously, this tag was flagged as optional.

The following iLink tags are now the optional tags for Execution Report – Order Status Request Acknowledgement (tag 35-MsgType=8, tag 150-ExecType=I) message.

Tag Current New Tag 1-Account Required Not Required Tag 11-ClOrdID Required Not Required Tag 40-OrdType Conditionally Not Required Tag 110-MinQty Required Not Required New New - Settlement Files on FTP.CMEGROUP.COM - July 2

Effective Monday, July 2, the CME Equity Select Sector futures and the CBOT Dow Jones Real Estate futures will be removed from the stlint settlement file on ftp.cmegroup.com. These products will instead be included in the stleqt file.

This change will better reflect the underlying asset class of Equity Index for these products.

10Gbps Offering - October 1

To allow for greater than 1Gbps connectivity for market data distribution, CME Group now offers a 10Gbps fiber interface for CME LNet, EConnect, EConnect Secaucus and Globex Hub customers. Interested customers can now order the 10Gbps fiber interface from CME Group. By Monday, October 1, CME Group expects the bandwidth for the full market data feed to exceed 1Gbps and will modify traffic shaping to 2Gbps. For those customers that order the 10Gbps fiber interface, 1Gbps pricing will be in effect until Monday, October 1 when customers will be charged for 10Gbps as reflected in the chart below.

Offering 1Gbps Monthly Customer Fee 10Gbps Monthly Customer Fee CME LNet $8,000 $12,000 CME EConnect $4,000 $6,000 CME EConnect Secaucus $4,000 $6,000 CME Globex Hubs $1,000 $2,000 All CME LNet, EConnect, EConnect Secaucus and Globex Hub customers should review their existing market data subscriptions and determine which option they will use based on their bandwidth needs.

Options to consider:- Limit market data subscriptions to 1Gbps of bandwidth

- Choose to have multiple 1Gbps connections (additional monthly fee)

- Upgrade to a 10Gbps interface (new monthly fee)

- License space in CME Group Colocation Facility

Key Dates:

- June 1, 2018 – CME Group began accepting 10Gbps fiber interface orders for CME LNet, EConnect, EConnect Secaucus and Globex Hubs

- October 1, 2018 – CME Group will modify traffic shaping to 2Gbps and the regular fees for the 10Gbps interface offering will go into effect

Additional Resources:

- Bandwidth statistics, by channel: www.cmegroup.com/bandwidthstats

For more information on the 10Gbps offering, please contact your Global Account Manager.

Global Account Management

U.S.: +1 312 634 8700 globalaccountmanagement@cmegroup.com

Europe: +44 20 3379 3754 gamemea@cmegroup.com

Asia: +65 6593 5505 gamasia@cmegroup.com

-