What if you could manage your delta risk of expiring cash-settled options days ahead of time?

BTIC and TACO allow traders to execute a basis trade to an eligible futures contract’s underlying cash index level. Option traders use TACO and BTIC for managing the delta risk of expiring cash-settled options. Historically, these traders could only do this during the trading session immediately preceding the index’s opening or closing auctions.

But now, BTIC+ and TACO+ introduces T+ trading, allowing traders to execute a BTIC or TACO trade for a given trading session, days in advance.

While the traditional BTIC and TACO are basis transactions that deliver the outright index futures contract the same day, BTIC+ and TACO+ are futures contracts that deliver a live BTIC or TACO transaction on the specified delivery date.

As you are aware, traditional BTIC trades are not shown in your position because they are always translated to an ES future at the end of the day. However, BTIC+ contracts are futures that will reside in your position until the delivery date.

On the delivery date, your BTIC+ futures contracts will expire and deliver an already live BTIC trade.

Unless you execute an offsetting BTIC trade, your end of day position will reflect a purchase of 10 ES futures contracts.

Trade example

On Thursday, November 7, you want to trade ES futures at a basis to the official close of the S&P 500 index on Wednesday, November 13. You buy 10 contracts of the ES1X913 future at -2.0. You now have an open position of long 10, ES1X913 contracts at -2.0 that you will carry.

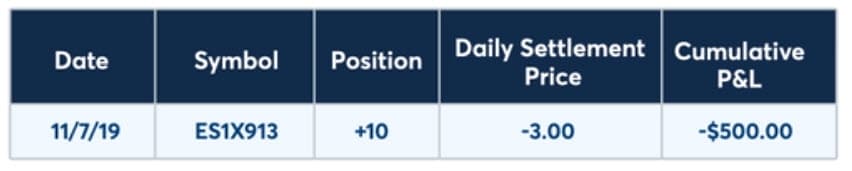

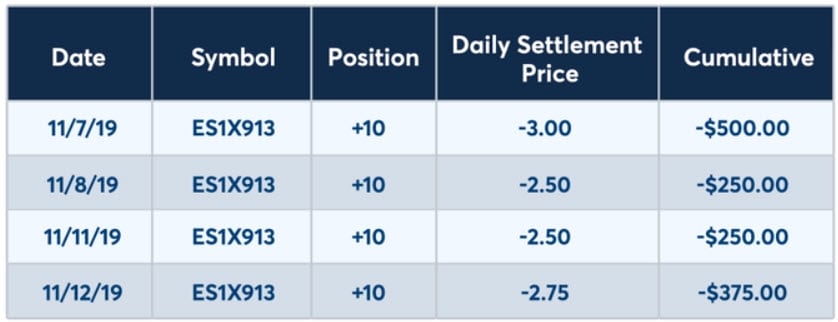

By the end of the day, the S&P 500 futures to cash basis has moved lower by one index point. Since the pricing convention for BTIC+ is the futures contract versus the cash settlement of the S&P 500 index, the ES1X913 contract’s daily settlement price is established at -3.0. Your long position of 10 BTIC+ contracts will be marked-to-market, and settlement variation calculated and applied, exactly as for any CME Group futures contract.

The daily settlement price of -3.0, less the traded basis price of -2.0, becomes a loss of one index point. Times the traded quantity of 10 contracts times the contract multiplier of $50 dollars. This generates a $500.00 mark-to-market loss.

Suppose that the next day, Friday, November 8, the basis moves again and the ES1X913 contract settles at -2.50. The mark-to-market on your open position is calculated per usual as:

Today’s settlement price of -2.50 less yesterday’s settlement price of -3.0, generates a 0.50 gain for the day times the trade quantity of 10 contracts; times the contract multiplier of 50 dollars

This generates a $250, mark-to-market gain for the November 8 trading session. This process will repeat daily just like any other CME Group futures contract.

The following Tuesday, November 12, is the last trading day of the BTIC+ contract ES1X913. On this day, the contract’s daily settlement is -2.75. Your final position is still long 10 contracts.

Because you have a final position in this deliverable BTIC+ futures contract at the conclusion of the last trading day, the BTIC+ contract ES1X913 will be converted to a live BTIC transaction, namely the ESTZ9 for the Wednesday, November 13 trading session –– at the last settlement price of -2.75.

Like other traditional BTIC transactions, the long 10 ESTZ9 position can be traded out of, increased, or held during Wednesday’s trading session, and your final, end of day BTIC position on November 13 will be processed as normal.

To recap, the original BTIC+ future was purchased at -2.0. You expected that you would be purchasing ES futures on the delivery date at two points lower than the cash index settlement, but the final outright ES futures trade is processed at a basis of -2.75; but not to worry.

The -.75 margin variation accumulated per BTIC+ futures contract is offset by the unplanned .75 gain generated by purchasing each ES futures contract 2.75 lower than the official cash close.

Your total $375 loss on the BTIC+ position is offset by the additional discounted price on the purchase of your ES futures. That discounted savings of .75 times the contract multiplier of fifty dollars, equals a $375 benefit to you.

In the end, your net purchase price is, as you expected, the index closing value minus two.

To take advantage of the benefits that T+ trading provides it is important to fully understand the underlying products being delivered and the exact dates of last trade date and the delivery date.

Test your knowledge

ACCREDITED COURSE

In case you didn’t know, the CFA Institute allows its members to self-determine and report continuing education credits earned from external sources. CFA Institute members are encouraged to self-document such credits in their online CE tracker. CME Institute offers a variety of courses, webinars, and white papers to support your professional education.

What did you think of this course?

To help us improve our education materials, please provide your feedback.