This tool is designed to show certain analytics for Treasury Products, including a list of securities that make up the deliverable basket, implied yields for the cheapest to deliver, and a conversion between strike prices and implied yields.

Clicking the PDF icon will show two options for printing the current page information - Portrait or Landscape. The recommended print format for this report (greatest resolution, etc.) is Landscape.

The help (question mark) button will show markers on key areas of the report with a short title or description of function or data displayed.

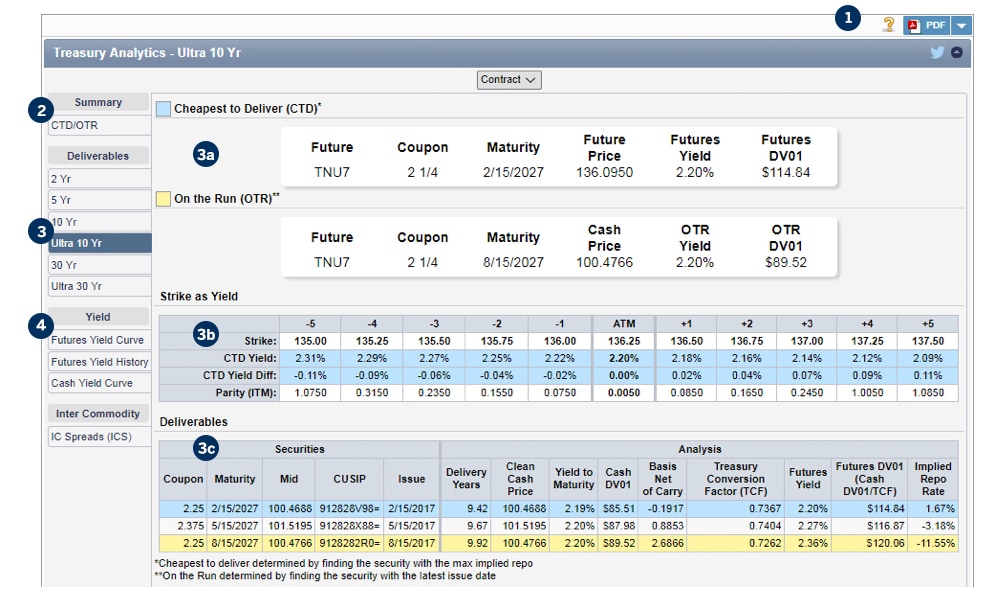

This page is a summary table of Cheapest-to-Deliver and On-the-Run statistics for each Outright Treasury Futures contract.

Statistics for each active treasury future (meaning there is currently open interest in that contract) are displayed under their corresponding product group:

a) Cheapest-to-Deliver and On-the-Run Overview

This bubble section displays the currently selected contract with the key yield and DV01 (dollar value of a basis point) values based on the settlement prices of the future for the cheapest-to-deliver and on-the-run cash underlying. This yield and DV01 can be used to approximate the yield of the future as the price changes throughout the day.

b) Strike as Yield Summary Table

The table shows the yield (and the difference from the yield for the future at settlement) for the current ATM strike and +/- 5 strikes around-the-money. Although there may be more than one expiration tied to the currently selected future. These yield values will be the same for each of these options since the calculation is based on the underlying tied to the option and not the option itself. The parity value (the difference between the strike and future price) is also displayed. This is present in order to give the user an idea of how much the yield may change based on movement in the underlying.

NOTE: The yield and DV01 from the future is used to determine the yields for each strike. For very big movements away from the settlement price, the yield and DV01 may change in value. However, for smaller movements, like the range displayed, the calculation is more than accurate.

c) Deliverable Basket

This table shows the current set of cash bonds available for delivery on the corresponding futures contract. The highlighted row at the top of the list is the cheapest to deliver based on the lowest Implied Repo Rate. The yield and DV01 are calculated based on the information in this table which utilizes the mid-price of the last available market for the cash bonds displayed.

Yield Curve

Displays the Treasury Futures Yield Curve based on the Implied Yields of each contract’s current CTD

Yield History

Displays historical CTD Implied Forward Yield for each Treasury Futures Contract

Cash Yield Curve

Displays the current yield curve for cash treasuries, as reported by Treasury.gov

The holder of a short position in a Treasury futures contract must deliver a cash Treasury security to the holder of the offsetting long futures position upon contract expiration. There are typically several cash securities available that fulfill the specification of the futures contract. Because of accrued interest, differing maturities, etc. of the various cash securities, there are differing cash flows associated with the deliver process. The cash security with the lowest cash flow cost is known as the Cheapest to Deliver.

The Yield for a futures contract is calculated as the yield to maturity of a cash security with the following specifications:

- Settlement Date = last delivery day for the futures contract

- Maturity Date = maturity date of the CTD cash security

- Coupon Rate = coupon rate per annum of the CTD cash security

- Bond Price = (futures price * conversion factor for CTD cash security) + (accrued Coupon interest on CTD cash security, from latest Coupon payment date to Settlement Date)

- Coupon Frequency = (Coupon Rate / 2) paid semiannually

- Day Count Basis = (actual / actual)

- Par Value = 100

DV01, sometimes called Dollar Duration, is the change in the value of a treasury (cash or futures) in dollars, for a one basis point (.01%) change in the yield.

The Conversion Factor for a cash Treasury security is the price of that security that would makes its yield to the futures delivery date equal to its coupon rate. Conversion Factors are calculated and published by the futures exchange and are used to calculate Yield and DV01.

The Implied Repo Rate (“repo” being short for “repurchase”) is the rate of return realized by borrowing to buy the appropriate amount of a cash Treasury security and simultaneously selling a comparable futures contract.