-

CME Globex Notices: May 14, 2018

-

-

- To

- CME Globex and Market Data Customers

-

- From

- Global Market Solutions & Services (GMSS)

-

- #

- 20180514

-

- Notice Date

- 17 May 2018

-

Topics in this issue include:

- Critical System Updates

- New Functionality

- New - FIX tag 442-MultiLegReportingType - This Week New

- Globex MDP3 SBE Schema Update - August 12

- Streamlined MDP SBE Schema Update - August 26

- Product Launches

- New - Additional CME CF Cryptocurrency Pricing Data - June 4 New

- New - Eurodollar Term Mid-Curve Options - June 10 New

- Product Changes

- Strike Price Increment for Brent Crude Oil Last Day Financial Calendar Spread Option - 1 Month - This Week

- New - Changes to Bursa Malaysia Derivatives (BMD) USD RBD Palm Olein Futures - May 24 New

- Listing Cycle Expansion for Black Sea Wheat Financially Settled (Platts) Futures - June 3

- Strike Price Increment for Silver Options and Silver Weekly Options - June 3

- New - Listing Cycle Expansion for European Union Allowance (EUA) Futures - June 10 New

- New - FIX Tag Changes for CBOT Grain Options - June 10 New

- Listing Cycle Changes and Delisting of E-mini Nifty 50 Index Futures - June 28

- Events and Announcements

-

Critical System Updates

MDP 3.0 Performance Enhancements - This Week

Effective this Sunday, May 20 (trade date Monday, May 7), CME Group will continue performance improvements on the following CME Globex MDP 3.0 channels. In internal testing, these enhancements improved MDP 3.0 performance up to 60%.

These enhancements will not impact iLink order routing or market structure dynamics.

MDP 3.0 Performance Enhancements Launch Date Impacted MDP 3.0 Channels May 20 CME Interest Rate Options – 313

CME Globex FX Futures II – 320

CME Globex FX Options II – 321

NYMEX Globex Crude & Crude Refined Futures – 382

DME Globex Futures - 440June 3 CME Globex Equity Futures excluding ES – 318 CBOT Globex Equity Index Futures - 342

CBOT Globex Interest Rate Options - 345

CBOT Globex Commodity Futures II – 346

NYMEX Globex Emissions Futures – 380

NYMEX Globex Nat Gas & Other Non-Crude Energy Futures - 386June 10 CME Globex Equity Futures (ES) – 310

COMEX Globex Futures - 360

COMEX Globex Options - 361

NYMEX Globex Emissions Options - 381

NYMEX Globex Crude & Crude Refined Options – 383

NYMEX Globex Metals, Softs & Alternative Markets Futures - 384

NYMEX Globex Metals, Softs & Alternative Markets Options – 385

NYMEX Globex Nat Gas & Other Non-Crude Energy Options – 387

DME Globex Options – 441June 24 CME Globex Equity Options (ES) – 311

CME Globex Commodity Options – 317

CME Globex Equity Options excluding ES - 319

CBOT Globex Commodity Options – 341

CBOT Globex Equity Index Options – 343

BMD Globex Futures – 430

BMD Globex Options - 431

KRX Globex Futures - 450

MGEX Globex Options - 461UpdateUpdate - Price Precision Extension - 2018

† Denotes update to the article

CME Group is implementing end-to-end technology changes to support increased price granularity. Currently, CME Group systems support a maximum of 7 decimals. With this initiative, products with up to 9 decimals may be listed and traded. †On Sunday, January 13 (trade date Monday, January 14), pending regulatory approval, the 2-Year Treasury Note futures and spreads will move from 7 decimals to 8 to support trading at 1/8 of 1/32.

Customers are encouraged to move to support 9 decimals now; but there are no plans to list a product that uses the 9th decimal at this time.

Starting Sunday, August 12, the price precision extension rollout will begin with MDP 3.0. †With this release, customer certification will be required for MDP 3.0 and Streamlined SBE.

†On Sunday, November 4, a production test instrument for the 2-Year Treasury Note futures will be launched on CME Globex. This new test instrument will give customers the ability to confirm system readiness for the introduction of 8-digit decimal price precision. Upon launch of the production test instrument, customer systems will be required to support 8 decimal precision or have the ability to ignore market data on this new instrument.

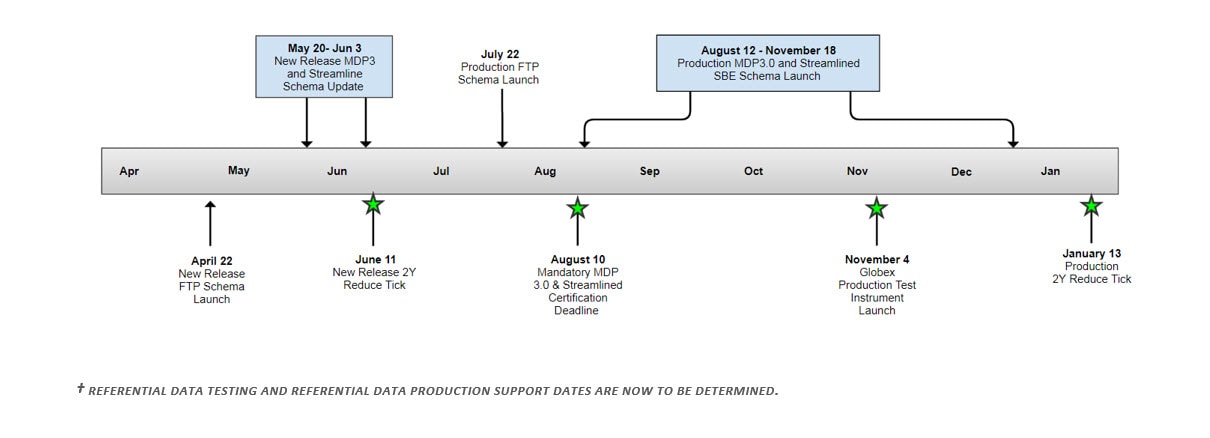

Price Precision Timeline:

For complete updated rollout information and dates, refer to Key Events and Dates in the Client Impact Assessment.

The Client Impact Assessment includes additional information on the following:

- CME Globex iLink

- CME Globex MDP3 †and Mandatory Certification

- Streamlined MDP †and Mandatory Certification

- ITC

- CME Globex Drop Copy

- Referential Data

- †Production Globex Test Instrument

These changes are currently available in New Release for customer testing. †The 2-Year Treasury Note futures will be listed with 1/8 of 1/32 tick in New Release on Monday, June 11.

CME Globex API Secure Logon – iLink and Drop Copy

CME Group is committed to our customers’ information security. To ensure the highest levels of security, CME Group has launched the CME Globex API Secure Logon in Q1 2018 to harden iLink and Drop Copy 4.0 session authentication.

The new Secure Logon is in production and will be supported in parallel with the current model with surcharges until Friday, June 29. Any iLink or Drop Copy Target sessions that connect using plain text password are subject to surcharges as follows:

- Sunday April 29 – Friday June 1: $100/session/month

- Sunday June 3 – Friday June 29: $500/session/month

Only Secure Logons will be supported starting Sunday, July 1.

The Client Impact Assessment provides more detailed process and messaging information.

A new iLink and Drop Copy certification suite is currently available in AutoCert+. iLink and Drop Copy 4.0 customer systems must complete this mandatory certification.

The CME Globex API Secure Logon is now available for customer testing in New Release.

Please contact your Global Account Manager with any questions or concerns in the U.S. at +1 312 634 8700, in Europe at +44 203 379 3754 or in Asia at +65 6593 5505 for additional information.

New Functionality

NewNew - FIX tag 442-MultiLegReportingType - This Week

Effective May 17, FIX tag 442-MultiLegReportingType will be added to the iLink Message Specification Execution Report – Trade Correction section. Tag 442- MultiLegReportingType is sent in the event of a trade correction. The tag is returned on the execution report of a trade correction message and Indicates if the acknowledgment message is sent for an outright, leg of spread, or spread.

FIX tag 442-MultiLegReportingType Tag FIX Name Req Valid Values Format Description 442 MultiLegReportingType N 1=Outright

2=Leg of Spread

3=SpreadInt(1) Indicates if acknowledgment message is sent for an outright, leg of spread, or spread. Globex MDP3 SBE Schema Update - August 12

Starting Sunday, August 12, in conjunction with the price precision initiative, CME Group will update the schema for all Globex MDP3 SBE market data channels. Please view the rollout schedule. This release will not support template extension, however the order of the fields will be preserved in the new templates. Please review an overview of changes.

The new version 9 schema is currently available on the New Release public FTP. Customers can begin testing schema version 9 in New Release on Sunday, May 20.

Streamlined MDP SBE Schema Update - August 26

Starting Sunday, August 26, in conjunction with the price precision initiative, CME Group will update the schema for streamlined SBE market data channels to support schema version 9 to ensure consistency between market data channels. Please view the rollout schedule. This release will not support template extension; however, the order of the fields will be preserved in the new templates. Please review an overview of changes.

The new version 9 schema is currently available on the New Release public FTP. Customers can begin testing schema version 9 in New Release on Sunday, May 20.

Please Note: The schema update timeline for Streamlined Equity Indices, Eris Exchange and Bitcoin channels will be announced at a later date.

Product Launches

NewNew - Additional CME CF Cryptocurrency Pricing Data - June 4

Starting Monday, June 4, CME Group and Crypto Facilities (CF) will launch two additional cryptocurrency pricing products designed to give clients a reliable pricing index source.

The pricing data will be offered via streamlined CME CF Cryptocurrency Pricing Market Data feed on channel 213.

The feed will publish the following standardized reference rate and real time index pricing data:

- Reference Rates to provide a final settlement price in U.S. dollars shortly after 4 p.m. London time each day.

- CME CF Ether-Dollar Reference Rates (ETH_RR_USD)

- Real Time Indices to allow users access to real-time cryptocurrency prices.

- CME CF Ether-Dollar Real Time Index (ETH_RTI_USD)

The additional cryptocurrency pricing data will be available for testing in New Release on Monday, May 21. Certification is not required.

NewNew - Eurodollar Term Mid-Curve Options - June 10

Effective Sunday, June 10 (trade date Monday, June 11), Eurodollar Term Mid-Curve options will be listed for trading on CME Globex, trading floor, and for submission for clearing via CME ClearPort

Eurodollar Term Mid-Curve Options Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupMarket Data Channel 3-Month Mid-Curve Options TE2 G3 (UDS: U$) 313 6-Month Mid-Curve Options TE3 G6 (UDS: U$) 313 9-Month Mid-Curve Options TE4 G4 (UDS: U$) 313 This change will be available for customer testing in New Release on Monday, May 21.

These contracts are listed with, and subject to, the rules and regulations of CME.

Product Changes

Strike Price Increment for Brent Crude Oil Last Day Financial Calendar Spread Option - 1 Month - This Week

Effective this Sunday, May 20 (trade date Monday, May 21), the strike price listing rules for Brent Crude Oil Last Day Financial Calendar Spread options - 1 Month will be modified on CME Globex.

Strike Price Increment for Brent Crude Oil Last Day Financial Calendar Spread Option - 1 Month Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Strike Listing Rule New Strike Listing Rule Brent Crude Oil Last Day Financial Calendar Spread Option - 1 Month 9C OT Dynamic strikes only at $0.05 per barrel strike increment. Minimum 20 strikes at $0.05 per barrel strike increment above and below the at-the-money strike then 10 strikes at $0.25 per barrel strike increment above and below the highest and lowest $0.05 per barrel increment strikes then 4 strikes at $0.50 per barrel strike increment above and below the highest and lowest $0.25 per barrel increment strikes plus dynamic strikes at $0.05 per barrel strike increment for the nearest 36 months.

Dynamic strikes only for months 37+ at $0.05 per barrel strike increment.This change is currently for customer testing in New Release.

This contract is listed with, and subject to, the rules and regulations of NYMEX.

NewNew - Changes to Bursa Malaysia Derivatives (BMD) USD RBD Palm Olein Futures - May 24

Effective Thursday, May 24, and pending final regulatory approval, Bursa Malaysia Derivatives (BMD) USD RBD Palm Olein futures will be made available for trading on CME Globex with the following changes.

Expiration Change for Bursa Malaysia Derivatives (BMD) USD RBD Palm Olein Futures Product iLink: tag 1151-

Security Group

MDP 3.0: tag 6937-AssetiLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Expiration

(Malaysia Time)New Expiration

(Malaysia Time)USD RBD Palm Olein futures BL FPOL Expires at 1200 on the 15th day of the delivery month Expires at 1800 on the 25th calendar day, 2 months prior to delivery month These futures will be available for customer testing in New Release on Monday, May 21.

Listing Cycle Expansion for Black Sea Wheat Financially Settled (Platts) Futures - June 3

Effective Sunday, June 3 (trade date Monday, June 4), the listing cycle for Black Sea Wheat Financially Settled (Platts) futures will be expanded on CME Globex.

Black Sea Wheat Financially Settled (Platts) Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Listing Schedule New Listing Schedule Black Sea Wheat Financially Settled (Platts) Futures BWF WP Monthly contracts listed for twelve (12) consecutive months. Monthly contracts listed for fifteen (15) consecutive months. These contracts are listed with, and subject to, the rules and regulations of CBOT.

This change will be available for customer testing in New Release on Monday, May 28.

Strike Price Increment for Silver Options and Silver Weekly Options - June 3

Effective Sunday, June 3 (trade date Monday, June 4), the strike price listing rules for Silver options and Silver Weekly options will be modified on CME Globex.

Strike Price Increment for Silver Options and Silver Weekly Options Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Strike Listing Rule New Strike Listing Rule Silver Option SO SO Minimum 40 strikes at $0.25 per troy ounce strike increment above and below the at-the-money strike. If the underlying futures settle price is less than $10.00, then 10 strikes at $0.10 per troy ounce strike increment above and below the at-the-money strike in addition to the above $0.25 increment strikes. Dynamic strikes at $0.25 ($0.10 if the underlying futures settle price is below $10.00) per troy ounce strike increment above and below the highest and lowest pre-listed strikes. Minimum 40 strikes at $0.25 per troy ounce strike increment above and below the at-the-money strike plus dynamic strikes at $0.05 per troy ounce strike increment for the nearest 48 calendar months. If the underlying futures’ settle price for contract months 1-3 is less than $25.00 then additional strikes at $0.05 per troy ounce strike increment. Silver Weekly Option SO1–SO5 SO Minimum 20 strikes at $0.25 per troy ounce strike increment above and below the at-the-money strike. If the underlying futures settle price is less than $10.00, then 10 strikes at $0.10 per troy ounce strike increment above and below the at-the-money strike in addition to the above $0.25 increment strikes. Minimum 20 strikes at $0.05 per troy ounce strike increment above and below the at-the-money strike then 16 strikes at $0.25 per troy ounce strike increment above and below the highest and lowest $0.05 increment strikes plus dynamic strikes at $0.05 per troy ounce strike increment. The existing dynamic strike generation rule will also change to $0.05 intervals.

These options will be available for customer testing in New Release on Monday, May 21.

These contracts are listed with, and subject to, the rules and regulations of COMEX.

NewNew - Listing Cycle Expansion for European Union Allowance (EUA) Futures - June 10

Effective Sunday, June 10 (trade date Monday, June 11), the listing cycle for the following European Union Allowance (EUA) futures will be expanded on CME Globex.

Listing Cycle Expansion for European Union Allowance (EUA) Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Listing Schedule New Listing Schedule In Delivery Month European Union Allowance (EUA) Futures EAF VX 3 months; 8 quarterlies Monthly contracts listed for 3 consecutive months, quarterly contracts listed for 8 consecutive quarters and all December contract months through and including 2025. These futures will be available for customer testing in New Release on Monday, May 28.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

NewNew - FIX Tag Changes for CBOT Grain Options - June 10

Effective Sunday, June 10 (trade date Monday, June 11), the values in the following FIX tags will be changed for the CBOT Grain options and spreads:

- iLink: tag 55-Symbol

- iLink: tag 1151-SecurityGroup

FIX Tag Changes for CBOT Grain Options Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group (UDS)New

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group (UDS)Corn Options OZC OC CY CG Corn Weekly Options ZC1-ZC5 OC CY CG Short-Dated New Crop Corn Options OCD OC CY CG Soybean Options OZS SQ PZ CG Soybean Weekly Options ZS1-ZS5 SQ PZ Y2 Short-Dated New Crop Soybean Options OSD SQ PZ Y2 South American Short-Dated New Crop Soybean Options SRS SQ PZ Y2 Chicago SRW Wheat Options OZW OW WZ Y2 Chicago SRW Wheat Weekly Options ZW1-ZW5 OW WZ Y2 Short Dated New Crop Chicago SRW Wheat Options OWD OW WZ Y2 KC HRW Wheat Options OKE OK 1G Y2 KC HRW Wheat Weekly Options OE1-OE5 OK 1G Y2 Short-Dated New Crop KC HRW Wheat Options KWE OK 1G Y2 Corn CSOs CZ8, CZ9, CZ6, 12C, CZ7, CZC Y1 Y2 Y2 Soybean CSOs SZ1, SZ3, SZ5, SZK, 12S, SC7, SZ8, SZ0, SZ4, CZS, SZ9, SZH Q1 Q2 Y2 Wheat CSOs WC3, WC6, CZW, WCM, 12W, CWZ W1 Z2 Y2 KC Wheat CSOs KC6, KCR, 12K, CKZ, CK3, KZC K3 K4 Y2 Chicago SRW Wheat-Corn Intercommodity Spread Options ZCW Q3 Q4 Y2 The values in the following FIX tags will be changed for KC HRW-Chicago SRW Wheat Inter-Commodity Spread options:

- iLink: tag 55-Symbol

- iLink: tag 1151-SecurityGroup

FIX Tag Changes for CBOT Grain Options Product MDP 3.0: tag 6937-Asset Current

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupNew

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group (UDS)New

iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security Group (UDS)KC HRW-Chicago SRW Wheat Intercommodity Spread Options KWC KW Q3 KX Y2 These changes will be available for customer testing in New Release on Monday, June 4.

To facilitate the change, customers are asked to cancel all Good ‘Till Cancel (GTC) and Good ‘Till Date (GTD) and UDS orders after the close on June 8. After 16:00 CT on June 8, all remaining GT orders for these options will be cancelled or deleted by the CME Global Command Center (GCC).

These contracts are listed with, and subject to, the rules and regulations of CBOT.

Listing Cycle Changes and Delisting of E-mini Nifty 50 Index Futures - June 28

On Monday, February 26, the E-mini Nifty 50 Index futures September 2018 and December 2018 contract months were removed from CME Globex. With this change, the June 2018 contract will be the last available contract month listed for trading. Following the expiration of the June 2018 contract month, on Thursday, June 28, E-mini Nifty 50 Index futures will be delisted and removed from CME Globex at the close of business.

Listing Cycle Changes and Delisting of E-mini Nifty 50 Index Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Listing Schedule New Listing Schedule E-mini Nifty 50 Index Futures MNF FN Four months in the March Quarterly Cycle and two nearest serial months Monthly contracts listed up to and including June 2018 These contracts are listed with, and subject to, the rules and regulations of CME.

Events and Announcements

NewNew - CME Group to List USD Eris Interest Rate Swap Futures - 4Q 2018

As previously announced, Eris Swap futures will be listed with and subject to the rules and regulations of CBOT starting in the fourth quarter of 2018, and existing open interest in the contracts will be transferred to CME Group at that time. The Eris futures will trade alongside the MAC Swap Futures, bringing together the two leading interest rate swap futures on a single exchange venue. Until the migration in late 2018, Eris Swap Futures will remain listed at Eris Exchange and cleared at CME Clearing, where they are subject to margin offsets with CME Group's interest rate futures.

An FAQ on the change is currently available.

Technical information on the launch and API considerations will be available in future CME Globex Notices.

-