-

CME Globex Notice: July 2, 2018

-

-

- To

- CME Globex and Market Data Customers

-

- From

- Global Market Solutions and Services

-

- #

- 20180702

-

- Notice Date

- 05 July 2018

-

Topics in this issue include:

- Critical System Updates

- Price Precision Extension - 2018

- New Functionality

- Globex MDP3 SBE Schema Update - August 12

- Streamlined MDP SBE Schema Update - August 26

- Product Launches

- Gold TAS and Silver TAS Spreads - July 15

- Options on Black Sea Wheat and Black Sea Corn - July 15

- California Low Carbon Fuel Standard (PRIMA) Futures - July 15

- New - Asia LPG and Naphtha Spread Futures - July 29 New

- New - Propane OPIS vs Argus Spread Futures - July 29 New

- Eris Swap Futures on Globex - 4Q 2018

- Product Changes

- New - Delisting and Removal of EU Wheat Futures and Option - This Week New

- Change to Maximum Order Quantity for Various Agricultural Options - July 15

- Changes to Circuit Breakers for Brent Last Day Financial Futures - July 15

- Change to Maximum Order Quantity and TOP Order Allocation Maximum for Corn and Soybean Futures - Starting July 29

- New - Changes to CME FX Futures and Options Circuit Breaker Rules - July 29 New

- New - Change to Minimum Price Increment for U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Futures: Resting Order Eliminations - July 29 New

- Events and Announcements

- 10Gbps Offering - October 1

- Critical System Updates

-

Critical System Updates

Price Precision Extension - 2018

CME Group is implementing end-to-end technology changes to support increased price granularity. Currently, CME Group systems support a maximum of 7 decimals. With this initiative, products with up to 9 decimals may be listed and traded. On Sunday, January 13, 2019 (trade date Monday, January 14), pending regulatory approval, the 2-Year Treasury Note futures, all 2-Year Treasury Future Spreads (including Calendar Spreads, Tail Spreads and Inter-Commodity Spreads with a 2-Year Treasury Future) along with the futures portion of covered options UDS, will move from 7 decimals to 8 to support trading at 1/8 of 1/32.

Customers are encouraged to move to support 9 decimals now; but there are no plans to list a product that uses the 9th decimal at this time.

With this release, customer certification will be required for MDP 3.0 and Streamlined SBE. The new Market Data templates are currently available in New Release and the AutoCert+ test suite is now available for certification.

Starting Sunday, August 12, the price precision extension rollout will begin with MDP 3.0 in production over several weekends.

On Sunday, November 4, a production test instrument for the 2-Year Treasury Note futures will be launched on CME Globex. This new test instrument will give customers the ability to confirm system readiness for the introduction of 8-digit decimal price precision. Upon the launch of this test instrument, clients whose systems are not yet prepared to handle 8 decimal precision must ensure their systems have the ability to ignore market data and iLink/Drop Copy execution reports on this new instrument.

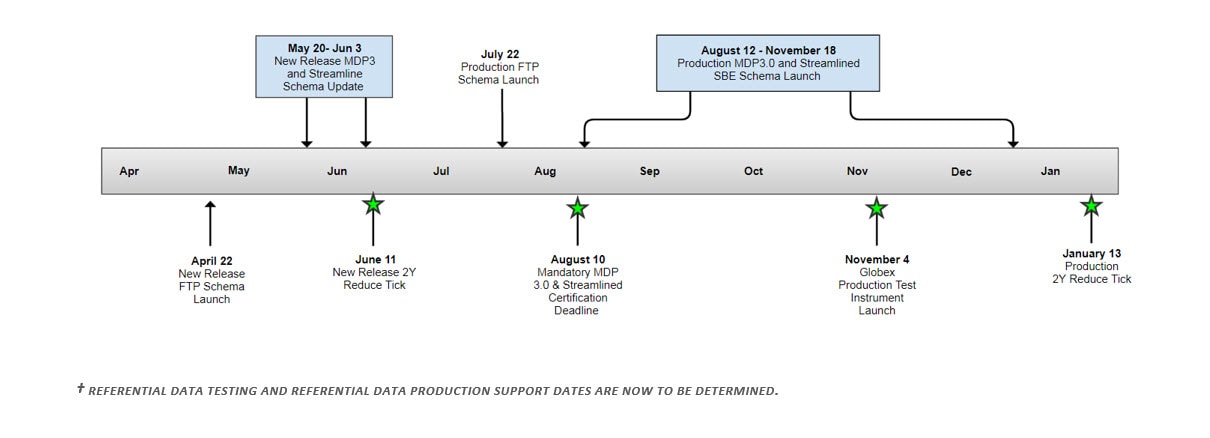

Price Precision Timeline:

Customer Mock Trading Sessions

To ensure customers can process the market data, CME Group will offer three customer mock trading sessions prior to each schema rollout group and Globex test instrument launch:

- Saturday, July 28

- Saturday, August 25

- Saturday, October 20

Customers are required to register and join the conference bridge line to participate in the mock trading sessions.

For complete impacts, rollout information and dates, please refer to Key Events and Dates in the Client Impact Assessment.

The Client Impact Assessment includes additional information on the following:

- CME Globex iLink

- CME Globex MDP3 and Mandatory Certification

- Streamlined MDP and Mandatory Certification

- ITC

- CME Globex Drop Copy

- Referential Data

- Production Globex Test Instrument

Please watch the Price Precision Extension Technology Webinar for a technical impact overview.

These changes are currently available in New Release for customer testing. The 2-Year Treasury Note futures are available in New Release with 1/8 of 1/32 tick.

New Functionality

Globex MDP3 SBE Schema Update - August 12

Starting Sunday, August 12, in conjunction with the price precision initiative, CME Group will update the schema for all Globex MDP3 SBE market data channels. Please view the rollout schedule. This release will not support template extension, however the order of the fields will be preserved in the new templates. Please review an overview of changes.

The new version 9 schema is currently available New Release for customer testing.

Streamlined MDP SBE Schema Update - August 26

Starting Sunday, August 26, in conjunction with the price precision initiative, CME Group will update the schema for streamlined SBE market data channels to support schema version 9 to ensure consistency between market data channels. Please view the rollout schedule. This release will not support template extension; however, the order of the fields will be preserved in the new templates. Please review an overview of changes.

The new version 9 schema is currently available is currently available in New Release for customer testing New Release public FTP.

Please Note: The schema update timeline for Streamlined Equity Indices and CME CF Cryptocurrency Pricing channels will be announced at a later date.

Product Launches

Gold TAS and Silver TAS Spreads - July 15

Effective Sunday, July 15 (trade date Monday, July 16), the CME Group will add Gold TAS and Silver TAS spreads for the first 2 TAS months on CME Globex.

Gold TAS and Silver TAS Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupTag 762- SecuritySubType Gold TAS GCT TG EC – TAS Calendar Spreads Silver TAS SIT MT EC – TAS Calendar Spreads The spreads are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of COMEX.

Options on Black Sea Wheat and Black Sea Corn - July 15

Effective Sunday, July 15 (trade date Monday, July 16), the following Agricultural options will be listed for trading on CME Globex and for submission for clearing via CME ClearPort.

Options on Black Sea Wheat and Black Sea Corn Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupMarket Data Channel Options on Black Sea Wheat Financially Settled (Platts) Futures BWO W2 341 Options on Black Sea Corn Financially Settled (Platts) Futures BSO CG 341 These products will be available for customer testing in New Release on Monday, July 9.

These contracts are listed with, and subject to, the rules and regulations of CBOT.California Low Carbon Fuel Standard (PRIMA) Futures - July 15

Effective Sunday, July 15 (trade date Monday, July 16), California Low Carbon Fuel Standard (PRIMA) futures will be listed for trading on CME Globex and for submission for clearing via CME ClearPort. With this launch, a new unit of measure (tag 996-UnitOfMeasure=ENVCRD) Environmental Credit will be introduced. The unit of measure can be found in the MDP 3.0 Security Definition message.

California Low Carbon Fuel Standard (PRIMA) Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupMarket Data Channel tag 996-UnitOfMeasure California Low Carbon Fuel Standard (PRIMA) Futures LCF VX 380 ENVCRD These futures are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

New New - Asia LPG and Naphtha Spread Futures - July 29

Effective Sunday, July 29 (trade date Monday, July 30), the Asia LPG and Naphtha spread futures will be listed for trading on CME Globex and for submission for clearing via CME ClearPort.

Asia LPG and Naphtha Spread Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupMarket Data Channel Argus Propane Far East Index vs. Japan C&F Naphtha (Platts) Futures 3NA ZZ 386 Argus Propane Far East Index vs. Japan C&F Naphtha (Platts) BALMO Futures 3NB ZZ 386 These futures will be available for customer testing in New Release on Monday, July 16.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

New New - Propane OPIS vs Argus Spread Futures - July 29

Effective Sunday, July 29 (trade date Monday, July 30), the Propane OPIS vs Argus Spread futures will be listed for trading on CME Globex and for submission for clearing via CME ClearPort.

Propane OPIS vs Argus Spread Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupMarket Data Channel Mont Belvieu LDH Propane (OPIS) vs. Argus Propane Far East Index Futures PMF JR 386 Mont Belvieu Non-LDH Propane (OPIS) vs. Argus Propane Far East Index Futures

PNF JR 386 These futures will be available for customer testing in New Release on Monday, July 16.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

Eris Swap Futures on Globex - 4Q 2018

In Q4 2018, pending regulatory approval, CME Group will list Eris Swap Futures on the CBOT designated contract market (DCM) for trading on CME Globex. Eris swap futures Block Trade transactions can also be submitted via CME Direct or CME ClearPort.

The Eris Swap futures will function similarly and trade alongside the MAC Swap Futures, bringing together the two leading interest rate swap futures on a single exchange venue.

Eris Swap futures will be listed for quarterly IMM starting contracts, with fixed MAC coupons, and underlying tenors of 2, 3, 4, 5, 7, 10, 12, 15, 20, and 30-years.

The Client Impact Assessment includes information on the following:

- Order Entry Considerations

- Pricing conventions

- Trading Eligibility

- Market Data Considerations

- Market Data Channels

- Product Specifications

- Eris Swap Futures Security Type

- Eris Swap Futures Product Code

- Standard Calendar Spreads (SP)

- Changing Minimum Price Increment

- Contract Month Convention

- Eris Swap Futures Market Data through CME DataMine.

- Risk Management Services

These futures will be made available in New Release for customer testing on a date to be announced in a future Globex notice.

Product Changes

New New - Delisting and Removal of EU Wheat Futures and Option - This Week

On Monday, July 2 EU Wheat futures and options were delisted and on Friday, July 6 these futures and options will be removed from CME Globex at close of business.

Delisting and Removal of EU Wheat Futures and Options Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupEU Wheat Futures WEU M3 EU Wheat Options WEO MU These futures and options currently have no open interest.

Change to Maximum Order Quantity for Various Agricultural Options - July 15

Effective Sunday, July 15 (for trade date Monday, July 16), the maximum order quantity will be increased for the following Agricultural options:

Change to Maximum Order Quantity for Various Agricultural Options Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent

tag 1140-MaxTradeVolNew

tag 1140-MaxTradeVolCorn Options OZC OC 1,000 3,000 Corn Weekly Options ZC1-ZC5 OC 1000 3,000 Soybean Options OZS SQ 1,000 3,000 Soybean Weekly Options ZS1-ZS5 SQ 1,000 3,000 Soybean Meal Options OZM ML 1,000 3,000 Soybean Meal Weekly Options ZM1-ZM5 ML 1,000 3,000 Soybean Oil Options OZL 0O 1,000 3,000 Soybean Oil Weekly Options ZL1-ZL5 0O 1,000 3,000 Chicago SRW Wheat Options OZW OW 1,000 3,000 Chicago SRW Wheat Weekly Options ZW1-ZW5 OW 1,000 3,000 KC HRW Wheat Options OKE OK 1,000 3,000 KC HRW Wheat Weekly Options OE1-OE5 OK 1,000 3,000 Feeder Cattle Options GF F0 500 1,000 Lean Hog Options HE 0H 500 1,000 Live Cattle Options LE L0 500 1,000 Cash-settled Butter Options CB C0 100 250 Cash-settled Cheese Options CSC CQ 100 250 Dry Whey Options DY Y0 100 250 Non-fat Dry Milk Options GNF N7 100 250 These changes are currently available for customer testing in New Release.

These contracts are listed with, and subject to, the rules and regulations of CME and CBOT.

Changes to Circuit Breakers for Brent Last Day Financial Futures - July 15

Effective Sunday, July 15 (trade date Monday, July 16), circuit breakers values will be modified for Brent Last Day Financial futures.

Changes to Circuit Breakers for Brent Last Day Financial Futures Product iLink: tag 1151-Security Group

MDP 3.0: tag 6937-AssetiLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent Circuit Breaker Settings New Circuit Breaker Settings Brent Last Day Financial Futures BZ OP Level 1: 500 Level 1: 700 Level 2: 1000 Level 2: 1400 Level 3: 1500 Level 3: 2100 Level 4: 2000 Level 4: 2800 Level 5: No Limit Level 5: No Limit This change is currently available for customer testing in New Release.

This product is listed with, and subject to, the rules and regulations of NYMEX.

Change to Maximum Order Quantity and TOP Order Allocation Maximum for Corn and Soybean Futures - Starting July 29

Starting Sunday, July 29 (for trade date Monday, July 30), through Friday, November 30, based on market participant feedback, CME Group will introduce a pilot program to amend the maximum order quantity and the TOP order allocation maximum for calendar spreads on Corn and Soybean futures. During the pilot program, these calendar spread markets will be monitored and evaluated to determine if the changes will remain in place or will be adjusted. The program is subject to early termination at the discretion of the Exchange and any changes to the program will be communicated via the Globex notice.

Changeto Maximum Order Quantity and TOP Order Allocation Maximum for Corn Futures and Soybean Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent

Maximum Order QuantityNew

Maximum Order QuantityCurrent

TOP Order Allocation MaximumNew

TOP Order Allocation MaximumCorn Futures ZC ZC 2500 10000 100 1000 Soybean Futures ZS ZS 2500 10000 100 1000 The pilot will be available for customer testing in New Release on Monday, July 16.

These contracts are listed with, and subject to, the rules and regulations of CBOT.

New New - Changes to CME FX Futures and Options Circuit Breaker Rules - July 29

Effective Sunday, July 29 (for trade date Monday, July 30), pending all relevant CFTC regulatory review periods, the circuit breaker rules for CME FX futures and options will be changed as follows:

- there shall be no price limits in the expiring primary FX futures contract only; and

- any non-expiring contract months of the primary FX futures contract or any contract months of any associated products of the primary FX futures contract shall have price fluctuation limits

For additional information, please refer to Special Executive Report S-8168.

The circuit breaker settings for all CME Globex products are defined in the CME Globex Product Reference.

These futures will be available for customer testing in New Release on Monday, July 16.

These contracts are listed with, and subject to, the rules and regulations of CME.

New New - Change to Minimum Price Increment for U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Futures: Resting Order Eliminations - July 29

Effective Sunday, July 29 (trade date Monday, July 30), the minimum price increment tag 969-MinPriceIncrement will be changed for the following.

U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Futures Product MDP 3.0: tag 6937-Asset iLink: tag 55-Symbol

MDP 3.0 tag 1151 - Security GroupCurrent tag 969 - MinPriceIncrement New tag 969 - MinPriceIncrement To facilitate the change, customers are asked to cancel all Good ‘Till Cancel (GTC) and Good ‘Till Date (GTD) orders after the close on July 27. After 16:00 CT on July 27 all remaining GT orders for this future will be cancelled or deleted by the CME Global Command Center (GCC). U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Futures BUS ST 1 100 This change will be available for customer testing in New Release on Monday, July 16.

These contracts are listed with, and subject to, the rules and regulations of NYMEX.

Events and Announcements

10Gbps Offering - October 1

To allow for greater than 1Gbps connectivity for market data distribution, CME Group now offers a 10Gbps fiber interface for CME LNet, EConnect, EConnect Secaucus and Globex Hub customers. Interested customers can now order the 10Gbps fiber interface from CME Group. By Monday, October 1, CME Group expects the bandwidth for the full market data feed to exceed 1Gbps and will modify traffic shaping to 2Gbps. For those customers that order the 10Gbps fiber interface, 1Gbps pricing will be in effect until Monday, October 1 when customers will be charged for 10Gbps as reflected in the chart below.

Offering 1Gbps Monthly Customer Fee 10Gbps Monthly Customer Fee CME LNet $8,000 $12,000 CME EConnect $4,000 $6,000 CME EConnect Secaucus $4,000 $6,000 CME Globex Hubs $1,000 $2,000 All CME LNet, EConnect, EConnect Secaucus and Globex Hub customers should review their existing market data subscriptions and determine which option they will use based on their bandwidth needs.

Options to consider:- Limit market data subscriptions to 1Gbps of bandwidth

- Choose to have multiple 1Gbps connections (additional monthly fee)

- Upgrade to a 10Gbps interface (new monthly fee)

- License space in CME Group Colocation Facility

Key Dates:

- June 1, 2018 – CME Group began accepting 10Gbps fiber interface orders for CME LNet, EConnect, EConnect Secaucus and Globex Hubs

- October 1, 2018 – CME Group will modify traffic shaping to 2Gbps and the regular fees for the 10Gbps interface offering will go into effect

Additional Resources:

- Bandwidth statistics, by channel: www.cmegroup.com/bandwidthstats

For more information on the 10Gbps offering, please contact your Global Account Manager.

Global Account Management

U.S.: +1 312 634 8700 gam@cmegroup.com

Europe: +44 20 3379 3754 gamemea@cmegroup.com

Asia: +65 6593 5505 gamasia@cmegroup.com

-