User Help System

CME Globex Credit Controls (GC2)

The CME Globex Credit Controls (GC2) function provides pre-execution risk controls that enable Clearing Firm or Partner Exchange Clearing Firm risk administrators to set exposure limits for CME Globex order and trade activity cleared by CME Clearing. The Clearing firm or partner exchange Clearing firm risk administrators can choose a set of real-time actions to follow if specified limits are breached, including e-mail notifications, order blocking, and order cancellation.

GC2 Functions

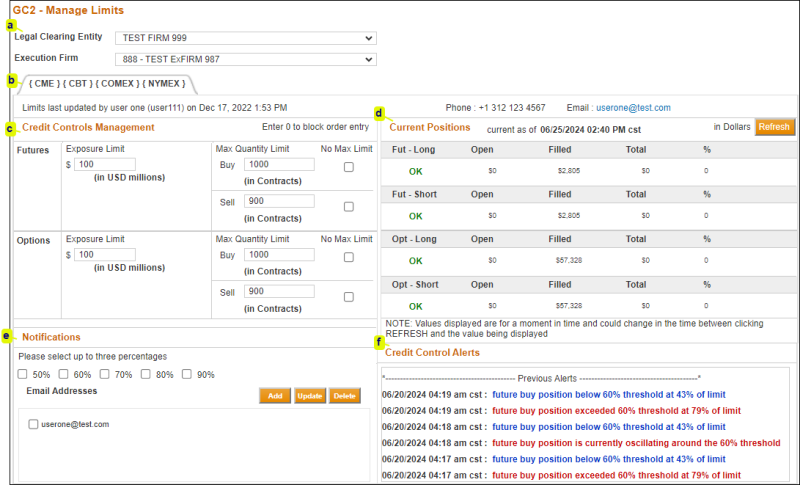

The GC2 function incorporates Execution Firm ID / Exchange group functionality. Predefined groups appear with associated credit control settings for the selected (active) tab.

For a given Legal Clearing Entity and Execution Firm, authorized GC2 Risk administrators can manage limits and other risk settings described below.

- Credit Controls Management

- Exposure and Maximum Quantity Limits

- Notifications

- Positions

- Credit Control Alerts

Credit Controls Management

To set up CME Globex Credit Controls, follow these steps:

- Select the Legal Clearing Entity / Execution Firm to manage.

- Exchange Grouping (optional): Newly added exchanges will have a “0” exposure limit and appear in a separate tab. This means that the firm is blocked from the newly added exchanges.

Customers can request to re-group / modify exchange groupings or set up a new group.

Requested updates will be effective at the next Sunday start‐up.

- Credit Controls Management: To enable trading, the GC2 Risk Administrator must enter the Exposure Limit / Max Quantity Limits for Futures and Options for each Executing Firm ID / Exchange group.

- Manage Futures and Options exposure / quantity limits for:

- Futures on the Buy / Sell side (Long / Short)

- Options on the Buy / Sell side (Long / Short)

The Exposure Limit is applied to both Long and Short trades and positions.

Note: If both Exposure Limits and Max Quantity Limits are set, the most conservative value is used.

- Max Quantity Limits - In addition to currency based Exposure Limits, the risk administrator can enter the optional Max Quantity Limit (Buy/Sell) for Futures and Options by group.

To enter Max Quantity Limits, Uncheck the No Max Limit checkbox.

Newly created execution firms will have a “0” exposure limit. This means that the firm is blocked. To enable trading, the clearing firm admin must enter a value.

Exposure limits added to newly created firms or exchanges will take effect at 16:45 CT each weeknight or upon Sunday start-up.

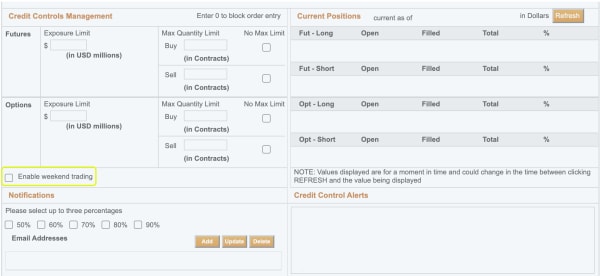

Enable weekend trading: By default, weekend trading is not enabled.

This feature is available for authorized clearing firm risk administrators to allow (checked) or restrict (unchecked) weekend trading at the execution firm(s)/exchange group level.

When unchecked, limit values (Exposure and Max Quantity Limit) will be set to zero (0) for the weekend. Before the next weekday trading session begins, limit values will automatically revert to the previous weekday value.

To be effective for the weekend trading session, updates must be submitted before 4:00 p.m. CT Friday.

- Current Positions: Open and filled positions are calculated for a product complex per Executing Firm ID / Exchange group.

To update the Current Positions area, select Refresh .

- Total Futures Long (Fut - Long) = Sum of all weighted quantity open long futures orders + Sum of all weighted long fills - Sum of all weighted short fills.

- Total Futures Short (Fut - Short) = Sum of all weighted quantity open short futures orders + Sum of all weighted short fills – Sum of all weighted long fills.

- Total Options Long(Opt - Long) = Sum of all weighted quantity open long options orders + Sum of all weighted long fills – Sum of all weighted short fills.

- Total Options Short (Opt - Short) = Sum of all weighted quantity open short options orders + Sum of all weighted short fills – Sum of all weighted long fills.

For additional information, see: Position Calculations

- Notifications: This area identifies the three threshold percentages when notifications occur. The area also identifies the email address(es) of the recipient(s) of the alerts when the 100% threshold is reached. These percentages are selected by the GC2 Risk Administrator.

Note: At least one email address must be entered per Executing Firm ID / Exchange group.

Time Frame for Changes

The following table summarizes when CME Globex Credit Controls (GC2) updates are effective.

- Clearing firms have the ability to apply exposure limits to Executing Firm IDs created on or transferred mid-week. Limits are applied by 16:45 CT.

- Filled positions are not carried over between trading days and are reset to zero at 16:30 Central Time (CT).

- Basis Trade at Cash Open (TACO) products operate on unique contract terms and trading schedule.

After trade execution (fill), positions are reset as specified in the Client Systems Wiki - Basis Trade at Cash Open.

| Type of Change | Realtime | 16:30-16:45 Monday through Friday or upon Sunday start-up | Next Sunday Start-up |

|---|---|---|---|

|

Exposure Limits |

X |

|

|

|

Max Quantity Limits |

X |

|

|

|

Executing Firm ID / Exchange Regrouping |

|

|

X |

|

New Firms |

|

X |

|

|

Clearing Mapping Relationships |

|

X |

|