User Help System

FX Link and FX Spot+ Credit Management

CME FX Link and FX Spot+ credit is managed through the Entity Risk Management (ERM) application. ERM allows Credit Risk Administrators to set and manage credit limits and monitor Credit Group utilization for both FX Link and FX Spot+ at the entity and firm level by product or Net Open Position (NOP).

NOP controls the aggregate net long and net short currency pair positions. It is applied to each currency pair, but enforced separately for each currency.

This guide describes features and functions used by Credit Administrators to navigate ERM and perform functions necessary for credit risk management, including:

- Accessing Spot FX Firm settings

- Spot FX and Trading Firm limits: At the Spot FX and/or Trading Firm (including execution firms associated with a trading firm) set product level (Long/Short) and/or NOP limits.

Note: Product level (Long/Short) and NOP limits are optional, however, at least one must be set to permit trading.

- Managing Thresholds and Alerts: Specify email addresses to receive a notification when a percentage (50-100%) of Spot FX, trading firm NOP and/or product limits have been breached.

- Account Setup

View a PDF version of the FX Link and FX Spot+ Credit Management User Guide

Support Resources

Related Resources

- Account Management Service (AMS): Create, view and manage accounts, including Spot FX firm associations with trading firms/account owners and execution firms (GFIDs).

- Risk Monitor: View daily account and Spot FX firm activity summary, view activated threshold alerts, audit trail of account / firm activity, list of rejected trades, account and Spot FX firm limit usage, as a chart or table.

Support

- For login or access issues, contact Enterprise Application & System Entitlements (EASE) or go to the CME Group Login page.

- For onboarding assistance and application functionality, contact Global Account Management.

- For credit questions or issues contact FX Spot Credit.

- For more details about credit functionality on CME FX Link and FX Spot+, refer to the CME FX Link and FX Spot+ Credit Overview.

Spot FX Onboarding, Registration, and Support

Prior to requesting access and using the application, the following is required:

- CME Group Login ID: including multi-factor authentication

- Authenticates user access and application entitlements to ERM, AMS, Risk Monitor

- Submitted on onboarding/access forms to identify Primary FX and Spot FX firms and users

- For security purposes, a Middle Office Admin Manager is required to submit an access request form.

If the firm does not have a Middle Office Manager, contact CME Global Account Management.

After completion of onboarding, admins and users will receive email notification and Spot FX firms will be available for management.

User Roles

Users will be assigned permission for roles that are suitable for their business function. The following roles are available:

- Primary FX Firm Admin: The Primary FX Firm, also known as Central FX Prime Broker (CFXPB), to manage bilateral FX physical settlement. A Primary FX Firm is the principal to all transactions. This model supports an all-to-all marketplace. The Primary FX Firm Admin users have full view and modification capabilities to set limits on each Spot FX Firm [Prime Broker (PB) or Direct Trading Participant].

- Primary FX Firm Viewer: The Primary FX Firm Viewer users have full view information capabilities to view limits on each Spot FX Firm (PB or Direct Trading Participant).

- Spot FX Firm Admin: The Spot FX Firm (PB or Direct Trading Participant) settles their transactions with the Primary FX Firm and their Trading Firms. The Spot FX Firm Admins are assigned limits from the Primary FX firm and in turn set limits on their Trading Firms. The Spot FX Firm are assigned limits from the Primary FX firm and in turn set limits on their Prime Clients.

The Spot FX Firm Admin users have full view and modification capabilities to set and view credit limits from their Spot FX Firm to related Trading Firms and to view limits assigned to their Spot FX Firm from the Primary FX Firm.

- Spot FX Firm Viewer: The Spot FX Firm Viewer users have full view information capabilities to view credit limits from their Spot FX Firm to related Trading Firms and to view limits assigned to their Spot FX Firm from the Primary FX Firm.

Log In

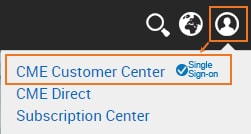

- To login to Entity Risk Management:

- Navigate to cmegroup.com., select the Login / Profile icon (

), then select CME Customer Center (single sign on).

), then select CME Customer Center (single sign on).

- On the page that appears, enter the CME Group Login ID and Password, then select Login .

Note: To register for a CME Group Login ID, view CME Group Login Registration.