User Help System

Creating ICC (CME Globex) Account

The following instructions illustrate the process to create a clearing account, entitled for Inline Credit Controls (ICC).

ICC Account Creation Overview:

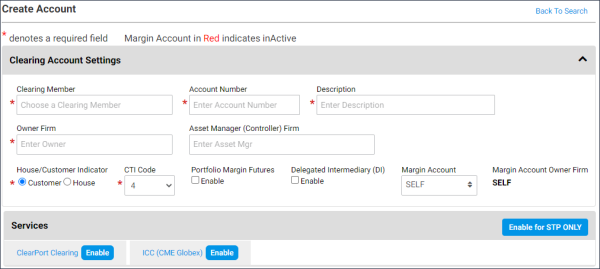

- Clearing Account Settings: Clearing Firm, unique account number, relationships to entities, additional account configuration.

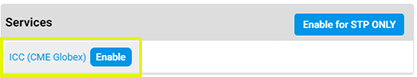

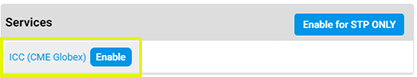

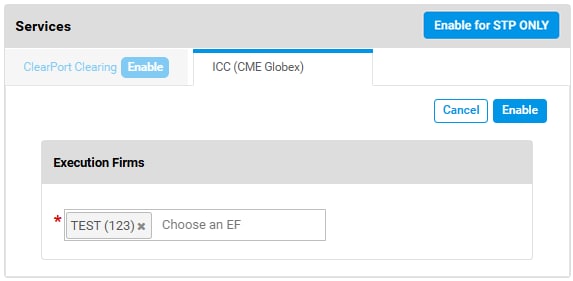

- Clearing Account Services: Select ICC (CME Globex) tab, then complete additional fields.

- Execution Firm(s): Entity authorized to use the account for order submission (trade).

The Execution Firm ID is three alphanumeric characters. Sometimes this is the same as the Clearing Firm ID. Executing Firm ID is also called: Execution Firm, Executing Firm, CME Globex API, CME Globex API ID, Trading Member Firm (TMF), Trading Firm and Badge Firm.

- Credit Controls: Set account level product trading limits.

- From Account Management Service, perform an account search.

If the account does not exist, select Create New Account.

- On the page that appears, specify Clearing Account Settings.

Note: Required fields are indicated by a red asterisk (*).

The Clearing Account Settings pane includes a button  to minimize its appearance.

to minimize its appearance.

Example: ICC (CME Globex) and Spot FX enabled accounts do not require Market / Product / Broker permissions.

Inline Credit Controls (ICC) - CME Globex

- Specify Execution Firm(s)* details.

As you type, matching execution firms appear in a list; select to add.

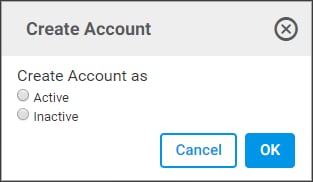

- Select Create, then specify whether to create as Active or .

- To complete account creation, go to Managing ICC Credit Controls and set (optional) Clearing Member and Execution Firm product limits.

Note: By default order management uses firm-wide policy settings to manage orders maximum allowable product limits.

To manage order handling from unregistered accounts or for products with unset limits go to Entity Risk Management - Policy & Threshold Settings.

Additional Services: