User Help System

Multi-Leg Transactions

A multi-leg transaction contains more than one leg associated with a given order number. Strips, Packs, Bundles and Calendar spreads are examples of multi-leg transactions.

Selecting a value from the Strip/Pack/Bundle drop-down enables the End term dropdown. When selected, this automatically creates a mutli-leg transaction, with each tradable month in the Start and End term range corresponding to a leg. Each contract is displayed separately on the Trade Ticket, similarly to how legs of a spread are displayed.

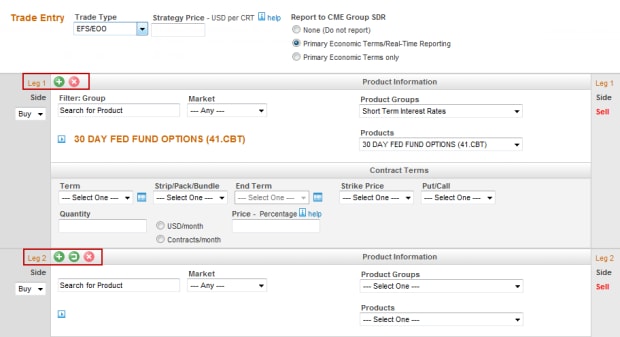

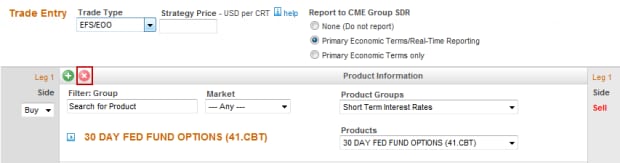

Adding Legs to a Transaction

Add an initial leg to begin the transaction. Add subsequent legs to the transaction to create a multi-leg transaction.

See Single-Side Trade Entry for single-side trades, and Dual-Side Trade Entry for dual-side trades.

- To enter a multi-leg transaction:

- To add additional legs to a transaction, click :

.

.

- To enter information for the new leg, follow product information entry steps:

- If Allocation information has not been completed, follow allocation entry steps:

Note: To copy product information to another leg, click:

- To remove a leg from a multi-leg transaction:

To remove a leg, click:

Strategy Pricing

The Strategy Price appears when a second leg is added for the same product.

If a strategy price is entered without leg prices, CME prices the legs. The calculated leg prices are shown on the Confirm & Submit page for review.

If leg prices are entered, CME ignores any strategy price that is entered.

CME ClearPort supports the following strategy types:

- Outright

- Daily Strip

- Monthly Strip

- Pack

- Butterfly

- Standard Calendar

- Equities Calendar

- Foreign Exchange Calendar

- Bundle

- Condor

- Generic

- with price Support (intra-commodity spreads)

- with no price Support (inter-commodity spreads)

- Pack Spread

- Pack Butterfly

- Month vs. Pack