User Help System

Access Manager

Using Access Manager, Clearing Firm Risk Managers can manage permissions for CME Globex accounts to submit orders for restricted products.

- Clearing Firm Risk Managers are automatically assigned permissions to use Access Manager.

- Access Manager does not keep a record of open orders or start of day positions.

- Open positions and resting orders, entered before the restriction period, are valid until acted upon or contract expiration.

- Authorized users can permit accounts to submit orders for restricted products during the restricted period before contract expiration; see Granting Account Permissions - Individual / All Accounts)

The following MAC Secured Overnight Financing Rate (SOFR) Swap and MAC Swap futures are restricted five trading / business days prior to the last trading day for the expiring contract

|

Product |

iLink: TAG 1151-SECURITY GROUP MDP 3.0: TAG 6937-ASSET |

iLink: TAG 55-SYMBOL MDP 3.0 TAG 1151 - SECURITY GROUP |

|

30-Year USD MAC SOFR Swap Futures |

SM |

|

|

20-Year MAC SOFR Swap Futures |

S2 |

|

|

10-Year MAC SOFR Swap Futures |

SN |

|

|

7-Year MAC SOFR Swap Futures |

S7 |

|

|

5-Year MAC SOFR Swap Futures |

SF |

|

|

2-Year MAC SOFR Swap Futures |

SJ |

|

|

30-Year USD MAC Swap Futures |

SM |

|

|

20-Year USD MAC Swap Futures |

S2 |

|

|

10-Year USD MAC Swap Futures |

SN |

|

|

7-Year USD MAC Swap Futures |

S7 |

|

|

5-Year USD MAC Swap Futures |

SF |

|

|

2-Year USD MAC Swap Futures |

SJ |

Note: For additional information, see Interest Rate Swaps on the Client Systems wiki.

For trading days, hours and restricted periods see Trading Hours - Globex and CME Group Holiday Calendar

The following Crude Oil futures are restricted two trading / business days prior to the last trading day for the expiring contract

|

Product |

iLink: TAG 1151-SECURITY GROUP MDP 3.0: TAG 6937-ASSET |

iLink: TAG 55-SYMBOL MDP 3.0 TAG 1151 - SECURITY GROUP |

|

Crude Oil Futures |

CL |

|

|

WTI Crude Oil London Trade at Market Futures |

TM |

|

|

WTI Crude Oil Singapore Trade at Marker Futures |

TS |

The Crude Oil TAS future is restricted one trading / business day prior to the last trading day for the expiring contract

|

Product |

iLink: TAG 1151-SECURITY GROUP MDP 3.0: TAG 6937-ASSET |

iLink: TAG 55-SYMBOL MDP 3.0 TAG 1151 - SECURITY GROUP |

|

Crude Oil TAS Futures |

CT |

Note:For all CL products, Executing Firms are automatically defaulted to permit all accounts to trade during the restricted period.

To enforce the restricted period, use the revoke function.

For trading days, hours and restricted periods see Trading Hours - Globex and CME Group Holiday Calendar

The following COMEX London Spot Gold / Silver futures are restricted one calendar day prior to the last trading day for the expiring contract

|

Product |

iLink: TAG 1151-SECURITY GROUP MDP 3.0: TAG 6937-ASSET |

iLink: TAG 55-SYMBOL MDP 3.0 TAG 1151 - SECURITY GROUP |

|

COMEX London Spot Gold |

GSP |

|

|

COMEX London Spot Silver |

SSP |

Note: For additional information, see Precious Metals Spot Spreads and London Spot Gold / London Spot Silver on the Client Systems wiki.

For trading days, hours and restricted periods see Trading Hours - Globex and CME Group Holiday Calendar

Use the Access Manager to:

The below instructions illustrate the process to manage account permissions to trade restricted products, including:

- View Active Permissions

- Grant Permissions to execution firm accounts

- Individual

- All Accounts

- Revoke Active Permissions for execution firm accounts

- Individual

- All accounts

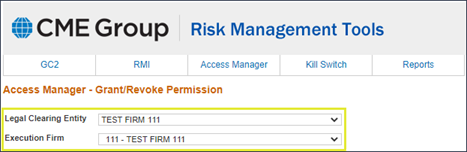

Viewing Active Permissions

- To view active permissions:

- From the Access Manager tab, select Grant / Revoke Permission.

The Access Manager - Grant / Revoke Permission page appears.

- Select Legal Clearing Entity and Execution Firm to manage.

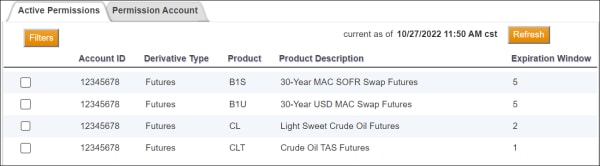

Active permissions appear in a list.

Available functions:

- Filters: Select appropriate criteria, and select Apply. Filtered rows are removed from list and a message displays indicating filters are applied.

- Refresh: Cancel active filters.

- SelectAll: Selects all permission assignments in the list.

- ClearSelected: Deselect selected checkboxes.

- Revoke: Removes permission assignment and blocks the account from submitting buy / sell orders for the restricted product.

Note: Clearing Firm Risk Managers can view a summary report of all Firm / Account product permissions by accessing the Access Manager Report > Active Permissions by Legal Clearing Entity.

See Report - Active Permissions by Legal Clearing Entity.

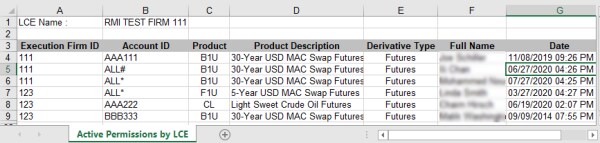

Report - Active Permissions by Legal Clearing Entity

Clearing Firm Risk Managers can access a report that lists all active permissions for a given Legal Clearing Entity (LCE).

- To access the active permissions report:

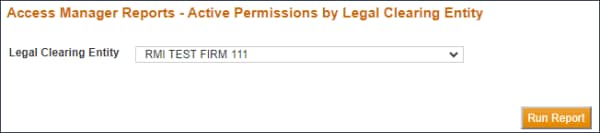

- From the Reports tab, select Access Manager > Active Permissions by Legal Clearing Entity.

- Select the Legal Clearing Entity from the drop down menu, then select Run Report (

).

).

If you have access to one LCE, it is automatically selected.

A MS Excel compatible report (ActivePermissionsByLegalClearingEntity_date.xls) is downloaded to the default web browser directory.

Information included in the report details active permissions assigned to execution firms and accounts associated with the LCE.

- Execution Firm ID

- Account ID

- Product Information

- Product

- Product Description

- Derivative Type

- Full Name of the user that assigned the permission for the account and execution firm

- Date: Effective date the permissions was assigned