User Help System

Viewing and Managing Firm Risk Settings

Firm Admin users can view and manage their own firm, firm group and trader risk settings, including limits, alert notifications on limit thresholds, product restrictions and view an audit trail of risk setting changes.

The following information illustrates the process to access the Firm Limits function to manage risk settings.

BrokerTec Risk Limits

- To Manage Firm Risk Settings:

- From the application menu, select BrokerTec Risk Limits then use the filter to view an Entity type.

Optional: Select a specific Firm and Risk Group.

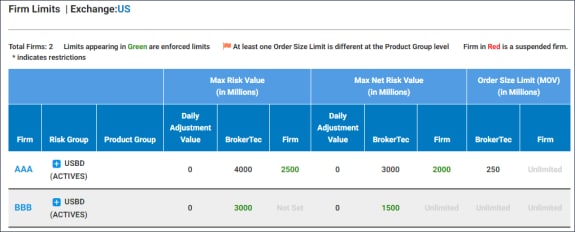

On the Firm Limits page, a list of Firm risk settings appears.

Firm users can only view firms that they are authorized to manage.

- Effective / Enforced limits appear in green

- Suspended firms appear in red.

Note: BrokerTec limits cannot be modified by Firm Admins.

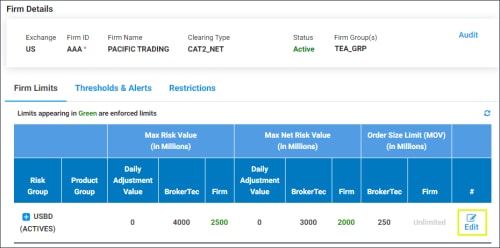

- To modify Firm limits, select Edit.

Note: To view a list of updates to BrokerTec Risk Management risk settings select the Audit function.

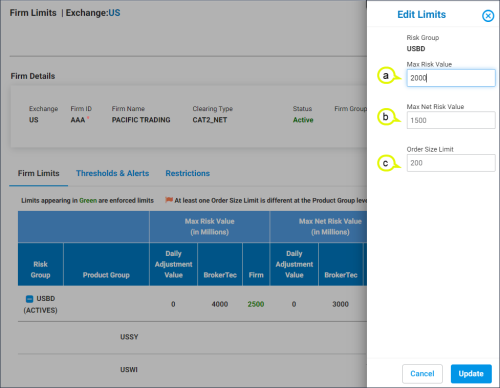

On the side panel that appears, users can enter limits for Max Risk Value, Max Net Risk Value and Order Size (limit).

Firm limits are optional and not required for trading. The more restrictive limit between the BrokerTec limit and optional Firm limits, for each limit type, will be enforced.

- Max Risk Value: This value is also known as potential exposure.

Risk Value Calculation:

- Working long notional quantity + net traded notional quantity = maximum long

- Working short notional quantity + net traded notional quantity = maximum short

- Max Net Risk Value: Also known as Net Traded limit.

Example: Post-trade Max Net Risk Value calculation compares net-traded position against the Max net-traded long / short risk limit.

- Maximum Short = Aggressing order to Sell 10M + Existing Net-traded Short 15M = Short 25M

- Maximum Long = Aggressing order to Buy 20M + Existing Net-traded Short 15M = Long 5M

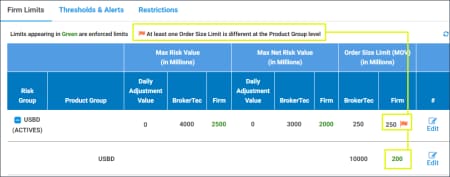

The Order Size limit is set on the Product Group level but a value can be set on the Risk Group level to propagate the limit to all of the Product Groups within the Risk Group.

Note: Order size limits on Product Groups can be set independently from the limit set on the Risk Group level.

If a Product Group - Order Size Limit is different than the overall Risk Group - Order Size Limit, a flag ( ) appears with a message "At least one Order Side Limit has changed at the Product Group level".

) appears with a message "At least one Order Side Limit has changed at the Product Group level".

- Daily Adjustment Value: A Daily Adjustment value may be set by the BrokerTec Admin at the request of the Firm.

The adjusted value will be added to the existing risk limit for the remainder of the trading day and increase the existing risk limits by the daily adjusted value. At the end of the trading day the Adjustment value will reset to 0 and the Max Risk Value / Max Net Risk Value is updated to reflect the configured risk value limit.

Example: If the Max Risk Value limit is 50M and the risk manager enters 10M in the Daily Adjustment Value, the current daily RMS limit will total 60M.

At the end of the trading day, the RMS limit will revert to 50M and the Daily Adjustment Value will reset to zero.

Note: Limits for USBD Group US Treasury Actives limits are set in 10 year equivalent notional terms.

For additional details on Hedge Ratios and Credit Utilization Calculation, refer to DV01 Values.

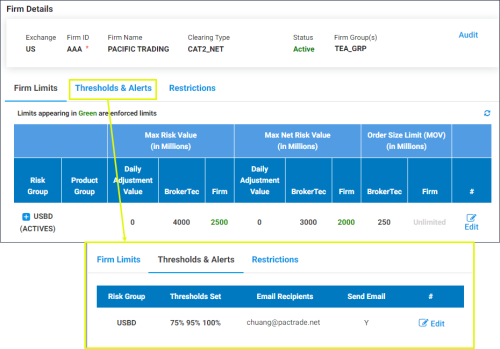

Thresholds & Alerts

On the Thresholds and Alerts screen, users can set up thresholds and email recipients for alert notifications when trading activity exceeds a given percentage of the risk limit.

The following instructions illustrate the process to access Thresholds & Alerts to set up alerts.

- To view and manage Thresholds & Alerts:

- From the Firm Details page, select the Thresholds & Alerts tab.

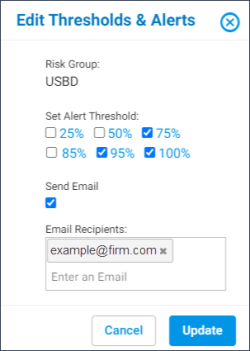

- On the Edit Threshold & Alerts pane, specify the following:

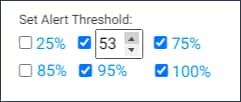

- Set Alert Threshold: Select notification thresholds.

Note: To set alert thresholds, select the checkbox for the alert value to update, then use the up/down arrow or enter a value.

- Send Email: Selected by default to indicate emails will be sent.

Clearing the checkbox will stop email from being sent until it is selected again.

The default selection will be set for each trading session.

- Email Recipients: Specify up to 20 email recipients to receive alert emails for the selected threshold alerts.

- To confirm alert settings, select Update.

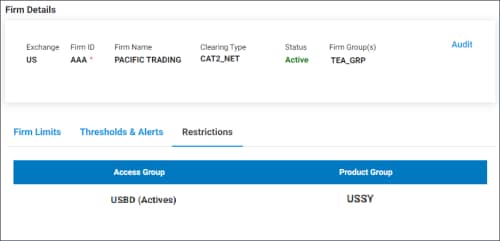

Restrictions

Firm users can view Product Group Restrictions, which are set by the BrokerTec Admin.

- To view restrictions:

From the Firm Details page, select a Firm (to view details), then select the Restrictions tab.

Note: On the Firm Limits search results page, restricted firms / firm groups are indicated with an asterisk (*).