User Help System

Additional Functions

The following sections describe additional BrokerTec Risk Management functions:

About

Opens a landing page with application and contact information; link to instructional webhelp, and CME Group support contacts.

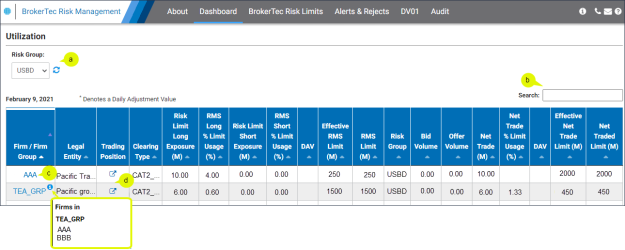

Dashboard

The Dashboard displays a daily summary of Firm and Firm Group risk exposure and utilization of risk limits.

- Risk Group: The Dashboard default display is utilization for USBD; additional Risk Groups, or All, may be selected.

Column headings can be sorted by selecting the arrows to sort by ascending or descending order. By default data is sorted by the Firm / Firm Group column.

- Search: Searches for any text on the dashboard.

- To access Firm / Firm Group Details, select the linked Firm / Firm Group ID.

- To view Firms within a Firm Group, move the mouse pointer over the information (

) icon in the Firm/Firm Group column.

) icon in the Firm/Firm Group column.

- To view a breakdown of the products traded for the Risk Group and aggregate exposure, select the icon (

) under the Trading Positions.

) under the Trading Positions.

Color coding – usage above a certain percentage will be highlighted

- 50%+ is highlighted in yellow

- 75%+ is highlighted in orange

- 100% is highlighted in pink

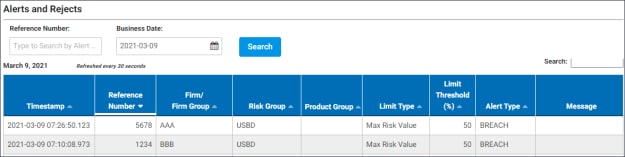

Alerts & Rejects

Use the Alerts & Rejects function to view breach alerts and rejected orders.

Users may search for specific alerts by:

- Reference Number: Alert emails will include Reference numbers; users may look up details of any alert using a reference number.

- Business Date: View all alerts for the selected date.

- Search: Text search for finding an alert within the search results.

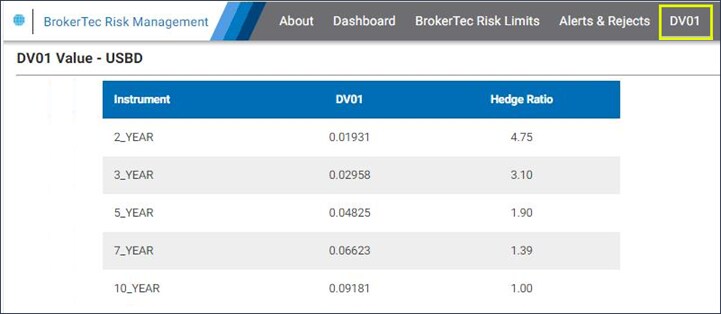

DV01 Values

Instrument DV01 values are used to calculate hedge ratios for converting utilization of USBD Group “Actives” limits into 10 Yr Equivalent Notional Terms.

Hedge Ratio calculation: 10 Yr DV01 / Instrument DV01 = Instrument Hedge Ratio (rounded to 2 decimal places)

Example: 2 Yr Hedge Ratio

0.09004 / 0.01897 = 4.75

Credit Utilization calculation: Notional Amount Instrument * (1 / Hedge Ratio Instrument) = 10 Yr Equivalent Notional Amount

Example: Credit Utilization 2 Yr

$1,000,000 2 Yr * (1 / 4.75) = $210,526.31 10 Yr

*DV01 values are determined at the end of New York trading (rounded to 5 decimal places)

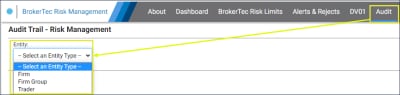

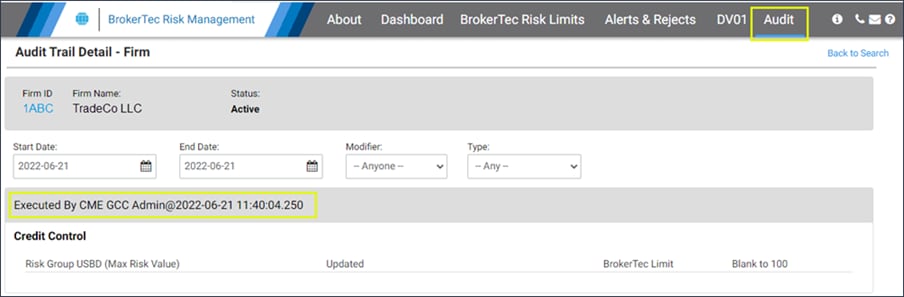

Audit

All entries and updates to BrokerTec Risk Management risk settings are recorded in an audit trail.

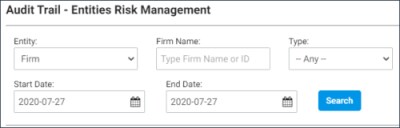

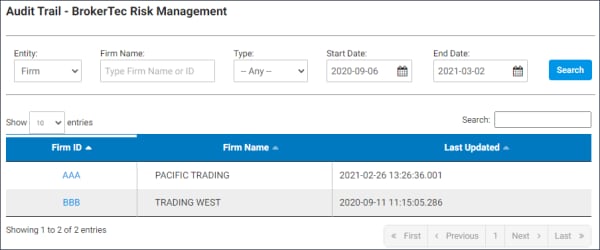

- To access the Audit Trail:

- From the application menu, go to Audit, then select BrokerTec Risk Management / Global Alerts Management Audit Trail.

- From the menu that appears, select the Entity:

- Specify filter options:

- Entity: Select Firm / Firm Group

- Firm / Group Name / Trader

- Type

- Firm: Updates to firm risk settings

- Start / End Dates

- To view matching results, select Search.

Note: Audit Trail results that include updates made by CME Group, are identified as "Executed by CME GCC admin" with the date (YYYY-MM-DD) and time.

Revision History

The below list illustrates the updates made to the BrokerTec Risk Management help system.

|

Date |

Author |

Topic |

Description |

|---|---|---|---|

|

October 25, 2022 |

mr |

Getting Started |

added brief summary list of functions |

|

June 23, 2022 |

mr |

Additional Functions |

Audit trail includes updates made by CME Group |

|

January 25, 2021 |

mr |

All |

initial release |