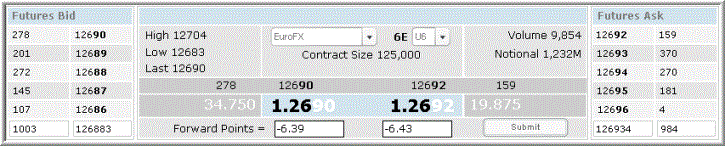

E-quivalents is a CME Group application that utilizes real-time updates of CME Group FX Futures prices and quantities, along with user defined forward points, to calculate spot FX equivalent prices and quantities for each currency pair.

E-quivalents was designed to help market participants who are accustomed to viewing, analyzing and trading FX in spot market convention. The application displays the top five bids and offers in the book and allows market participants to see the best bid and offer in spot equivalent rates. Additionally, the application displays corresponding sizes and market depth, as well as high, low and last trade.

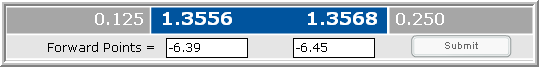

IMM Bid - Contract quantity of the top five bids in the book. Please note that for Japanese Yen, Swiss Franc, Canadian Dollar and Mexican Peso, the offer side of the market will appear on the left side of the screen due to the indirect pricing convention.

IMM Ask - Contract quantity of the top five asks in the book. Please note that for Japanese Yen, Swiss Franc, Canadian Dollar and Mexican Peso, the offer side of the market will appear on the left side of the screen due to the indirect pricing convention.

Bid forward points - User defined field. Please note that if (26.2) was entered as the desired forward point, the application would display this as (.00262) for all currencies except for the Japanese Yen, which would be displayed as (.262).

Offer Side Forward Points - User defined field. Please note that if (26.2) was entered as the desired forward point, the application would display this as (.00262) for all currencies except for the Japanese Yen, which would be displayed as (.262).

Volume - The number of contracts traded for the current day. The trading day starts at 4:30 pm Central Time and ends at 4:00pm Central Time on the next day.

Notional - Notional volume of the underlying currency traded. Total contract volume for Euro FX, British Pound, Australian Dollar, New Zealand Dollar, Euro/Japanese Yen, Euro/British Pound and Euro/Swiss Franc, is calculated as the number of contracts traded, multiplied by the contract size, divided by one million. Total contract volume for Japanese Yen, Swiss Franc, Canadian Dollar, Mexican Peso and Russian Ruble, is calculated as the number of contracts traded, multiplied by the contract size, divided by one million over the spot equivalent offer rate. Total contract volume for CME$INDEX is calculated as the number of contracts traded, multiplied by the contract price, multiplied by Index Price of 1000.

High - High trade for the day. The trading day starts at 4:30 pm Central Time and ends at 4:00pm Central Time on the next day.

Low - Low trade for the day. The trading day starts at 4:30 pm Central Time and ends at 4:00pm Central Time on the next day.

Last - Last traded contract price.

Best Spot Equivalent Bid Rate

- Direct - Euro FX, British Pound, Australian Dollar, New Zealand Dollar, Euro/Japanese Yen, Euro/British Pound, Euro/Swiss Franc

Best Futures Bid Price + Bid Side Forward Points - Indirect - - Japanese Yen, Swiss Franc, Canadian Dollar, Mexican Peso, Russian Ruble

1 / Best Futures Offer (IMM Ask) Price + Bid Size Forward Points - CME$INDEX

Best Futures Bid Price (Forward Points do not apply)

Best Spot Equivalent Bid Quantity

- Direct - Euro FX, British Pound, Australian Dollar, New Zealand Dollar, Euro/Japanese Yen, Euro/British Pound, Euro/Swiss Franc

Best Futures Bid Quantity x Contract Size / 1,000,000 - Indirect - Japanese Yen, Swiss Franc, Canadian Dollar, Mexican Peso, Russian Ruble

Best Futures Offer (IMM Ask) Quantity x Contract Size / 1,000,000 / Best Spot Equivalent Bid Rate - CME$INDEX

Best Futures Bid Quantity x Index Price of 1,000

Best Spot Equivalent Offer Rate

- Direct - Euro FX, British Pound, Australian Dollar, New Zealand Dollar, Euro/Japanese Yen, Euro/British Pound, Euro/Swiss Franc

Best Futures Offer Price + Offer Side Forward Points - Indirect - Japanese Yen, Swiss Franc, Canadian Dollar, Mexican Peso, Russian Ruble

1 / Best Futures Bid (IMM Bid) Price + Offer Size Forward Points - CME$INDEX

Best Futures Offer Price (Forward Points do not apply)

Best Spot Equivalent Offer Quantity

- Direct - Euro FX, British Pound, Australian Dollar, New Zealand Dollar, Euro/Japanese Yen, Euro/British Pound, Euro/Swiss Franc

Best Futures Offer Quantity x Contract Size / 1,000,000 - Indirect - Japanese Yen, Swiss Franc, Canadian Dollar, Mexican Peso, Russian Ruble

Best Futures Bid (IMM Bid) Quantity x Contract Size / 1,000,000 / Best Spot Equivalent Offer Rate - CME$INDEX

Best Futures Offer Quantity x Index Price of 1,000

Best Futures Bid Price - Bid price at the top of the book. Please note that for Japanese Yen, Swiss Franc, Canadian Dollar, Mexican Peso and Russian Ruble, the offer side of the futures market will appear in the bid quantity window, due to the indirect pricing convention.

Best Futures Bid Quantity - Bid quantity at the top of the book. Please note that for Japanese Yen, Swiss Franc, Canadian Dollar, Mexican Peso and Russian Ruble the offer side of the futures market will appear in the bid quantity window, due to the indirect pricing convention.

Best Futures Offer Price - Offer price at the top of the book. Please note that for Japanese Yen, Swiss Franc, Canadian Dollar and Mexican Peso, the bid side of the futures market will appear in the offer price window, due to the indirect pricing convention.

Best Futures Offer Quantity - Offer quantity at the top of the book. Please note that for Japanese Yen, Swiss Franc, Canadian Dollar, Mexican Peso and Russian Ruble the offer side of the futures market will appear in the bid quantity window, due to the indirect pricing convention.

Futures Contract Code

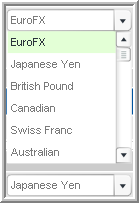

Drop-down list of currencies - Allows for FX product selection within a drop down menu.

Contract Size - The amount of the foreign currency deliverable into one contract.

There are two conventions used in quoting foreign currency prices, which are direct terms and indirect terms. A direct currency pair price is quoted as the number of US Dollars it would take to buy one unit of foreign currency. Indirect quotation prices contracts in terms of the foreign currency; the price is quoted as the amount of foreign currency which equals one US Dollar.

All CME® dollar-based FX futures prices are quoted in direct terms against the U.S. dollar (Dollars per Yen), while the spot market quotes certain currency pairs in direct terms and other pairs in indirect terms (Yen per Dollar).

The OTC market uses indirect quotation (foreign currency per U.S. dollar) for all major currencies excluding the euro, the British pound, the Australian dollar and the New Zealand dollar, which are listed using direct quotation.

E-quivalents effectively converts currency futures prices to OTC market equivalent prices, providing a valuable tool for currency traders accustomed to dealing in OTC market convention. The following products are listed on E-quivalents and are grouped according to pricing convention:

- Direct: Euro FX, British Pound, Australian Dollar, New Zealand Dollar, Euro/Japanese Yen, Euro/British Pound, Euro/Swiss Franc

- Indirect: Japanese Yen, Swiss Franc, Canadian Dollar, Mexican Peso, Russian Ruble

- Not Applicable: CME$INDEX

The E-quivalents converter will provide the trader with Price and Quantity information that is consistent with spot market convention, in order to allow competitive market participants to quickly and easily compare prices and liquidity. To produce spot equivalent prices for direct currency pairs, E-quivalents adds the user entered forward points (positive or negative points) to the futures price. To produce spot equivalent prices for Indirect currency pairs, E-quivalents inverts the futures price (1/Futures Price) and adds the user defined positive or negative forward points.

To produce spot equivalent quantity for direct currency pairs, E-quivalents multiplies the number of contracts at the best bid or offer by the contract size and divides that by one million. This produces the number of millions of foreign currency available at the best price. To produce spot equivalent quantity for indirect currency pairs, E-quivalents multiplies the number of contracts at the best bid or offer by the contract size, divides that by one million and then divides by the spot equivalent bid or offer. This produces the number of millions of US Dollars available at the best price. CME$INDEX is also listed on E-quivalents for the convenience of the trader; as an index, the price is not manipulated by the application.

To view the order book and statistics for a contract in spot equivalent rates:

1. Select a contract to view.

2. Enter forward points and click submit.

The contract is displayed in spot equivalent rates.