User Help System

Craft Unique Views from the Start

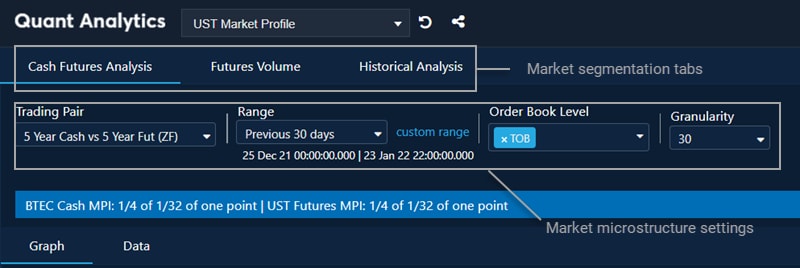

The UST Market Profile starts up with standard settings that are highly customizable through quick dropdown menus and tabs. “Cash Futures Analysis” is selected as the initial market segmentation type. Other types include Futures Volume and Historical Analysis.

The top section of the UST Market Profile provides significant customization

The market microstructures settings seek to dial into the insights that the UST Market Profile can provide. Establish similar tenor derivative and cash products by selecting “Trading Pair.” The UST Market Profile starts with the 5-year point. The other pairs available include 2-, 3-, 5-, 7-, 10-, 20- and 30-year points. At present, the 20-year only has BrokerTec levels, but with the announcement of the 20-Year Bond future, the data will be available soon after the future’s planned launch on March 7, 2022.*

*Pending regulatory review.

Date Range

Choose the date range to view. Standardized time periods include the previous 30 days, each of the prior two months and month-to-date. In addition, custom time periods are simple to create by clicking on the “custom range” link to the right of the dropdown box. Once a time period has been selected, white text below the dropdown box clearly reports what is the beginning and end of the time period.

By default, the tool displays data between 00:00 – 22:00 GMT.

Order Book Level

Analyze up to 10 orderbook levels with the next dropdown box. The UST Market Profile tool is set to initially displace Top-of-Book (TOB), but other individual levels or all levels can be displayed. This brings the power of pricing transparency of a Central Limit Order Book with the significant depth of CME Group’s interest rate markets.

Granularity

Determine the discrete time periods to view as a final setting for market microstructures. Units are in minutes and you can select 5, 10-, 15-, 30- or 60-minute intervals on the Cash Futures Analysis tab.

MPI

For clarity and consistency across markets, the blue bar with white text clearly states what each market’s minimum price increment (MPI) is. For the 5-year, the UST Market Profile displays

“BTEC Cash MPI: 1/4 of 1/32 of one point | UST Futures MPI: 1/4 of 1/32 of one point.”

For each market tenor point, the correct MPIs are displayed.

Update Frequency

Providing backward looking data for analysis, the data is updated on a T+1 day basis – the tool does not provide real time / trade date data.