User Help System

Calculating ICC Limits

Inline Credit Controls (ICC) support account-based, in-line, position limit controls for Globex orders, which are set by Clearing Member Firm (CMF), Legal Clearing Entity (LCE) and/or Execution Firm (EF) account administrators.

- LCE Account admins associate a clearing account established in Account Manager to an Execution Firm ID and identify a trading firm owner for the account.

- Accounts are created by Clearing Member Firm, LCE or EF . Separate limits may be managed by both LCE and EF admins, with the most restrictive limits prevailing.

- Only product-level position limits may be set on accounts.

- Separate limits may be set for futures and options. Option limits are delta-based values.

- E-mail notifications will be sent out for breaches of percentage threshold levels set by account administrators.

- An upload of ICC accounts from an Excel spreadsheet will be supported for limits management within CME Account Manager.

- Calculations are done at the product level (see below calculations and examples)

- All incoming orders treated on a delta basis per product (1.0 or -1.0 delta = 1 contract)

- Delta values for option instruments are fixed at the start of each trading day (no intraday changes)

- The minimum delta value imposed on calls is 0.1 and on puts is -0.1

Note: For futures and options, spread orders with “balanced” intra-commodity spread quantity result in working long and short quantity equal to 15% of balanced quantity.

Example: An intra-commodity spread order to buy 100 CLZ18 – CLZ19 results in working long of 15 in CLZ18 and working short of 15 in CLZ19

Position Limit Calculations

Position limit calculations are described below:

- Every ICC Account starts the new trading day with a flat position.

- Positions are reset at 4:07 PM CT daily, including holidays (when trading is suspended).

- Accounts position limits are reset to zero, at 4:07 PM CT daily, including holidays and regular market closure.

Futures Max Long and Short Position Usage Calculations

Long Usage = Working Long + Traded Long – Traded Short

AND

Short Usage = Working Short + Traded Short – Traded Long

WHERE

- Working Long = Long quantity of open orders (in cleared contracts) + (Calendar Spread Order Quantities * 15%)

- Working Short = Short quantity of open orders (in cleared contracts) + (Calendar Spread Order Quantities * 15%)

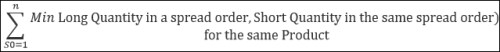

- Calendar Spread Order Quantities = for each working spread order:

Note:

• Long and Short Quantities in spread are after application of the leg ratios and applicable contract multipliers.

• In the spread order, any residual leg quantity above the min quantity on the long or short side of a spread order is considered an outright long / short quantity and is added separately to the working long / short side.

• Only orders for futures contracts (i.e., futures or spreads) are considered for Working and Traded Quantities when testing against Futures Max Long or Max Short Position Limits.

• If Long Usage < 0, then Long Usage is displayed in CME Account Manager as 0. (Negative quantities are not displayed for Net Long Positions).

• If Short Usage <0, then Short Usage is displayed as 0. (Negative quantities are not displayed for Net Short Positions).

Options Max Long and Short Position Usage Calculations

Long Usage = Working Long + Traded Long – Traded Short

AND

Short Usage = Working Short + Traded Short – Traded Long

WHERE

- Working Long = Futures Equivalence of (buy call/sell put) open orders (in cleared contracts) + (Futures Equivalence of Option Calendar Spread Order Quantities * 15%)

- Working Short = Futures Equivalence of (sell call/buy put) open orders (in cleared contracts) + (Futures Equivalence of Option Calendar Spread Order Quantities * 15%)

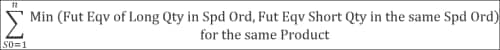

- Option Cal Spread Order Quantities = for each working option spread order:

Note:

• Long and Short Quantity in spread are after application of the leg ratios and applicable contact multipliers.

• In the option cal spread order, any residual quantity (measured in Futures Equivalence) above the min quantity on the long or short side of a spread order is considered outright long / short quantity and is added separately to the working long / short side.

• Only orders for option contracts are considered for Working and Traded Quantities.

• If Long Usage < 0, then Long Usage is displayed as 0 in CME Account Manager. (Negative quantities are not displayed for Net Long Positions).

• If Short Usage <0, then Short Usage is displayed as 0. (Negative quantities are not displayed for Net Short Positions).

Calculation Examples

Available examples:

Futures Outright with Default Contact Multiplier

Futures Outright with Contract Multiplier not Equal to 1

Risk Control Algorithm

The risk control algorithm tracks the order size for each account at the product code level based on:

- Long Usage = Working Long + Traded Long - Traded Short

- Short Usage = Working Short + Traded Short - Traded Long

The available order size will be determined as follows:

- Long Order Size = Max Long Limit - Long Usage

- Short Order Size = Max Short Limit - Short Usage

The traded long and traded short positions are reset back to zero at the end of each day upon market close.

If the running long or short usage values for a product are such that it becomes less than zero, then the negative position will be used in the calculation and stored by Account Manager, but Account Manager will display a zero for Long or Short negative usage value.

The risk control algorithm always breaks spreads down into legs and acts upon the legs of a spread, not the spread instrument itself.

The security type and spread type figure prominently in how the risk control algorithm tabulates usage values:

*Delta is an option related statistic which is based on the price movements of the underlying future contract and plays an important part in determining the working position for options. Delta is used as a “hedge ratio” to determine the futures equivalence of the option order. It is the futures equivalence of the option order that the Option Position Limits will apply to.

The value of the option delta is considered to one decimal place, such that the minimum delta applicable will be 0.1 and the maximum will be 1. For example, a delta value such as 0.4985 is rounded up to 0.5.

Note: Delta values are determined at the start of each trading session and are not updated subsequent to the initial determination.

Crude Oil (CL) Futures Example

|

Action |

Long Usage |

Short Usage |

Working Long |

Working Short |

Trade Long |

Trade Short |

|

Buy Order 15 CLF18 |

15 (15+0–0) |

0 (0+0–0) |

15 |

0 |

0 |

0 |

|

Buy Order Trades 5 CLF18 |

15 (10+5–0) |

-5 (0+0–5) |

10 |

0 |

5 |

0 |

|

Sell Order 100 CLZ19 |

15 (10+5–0) |

95 (100+0–5) |

10 |

100 |

5 |

0 |

|

Buy Order 50 CLH18 – CLM18 (calendar spread) |

22.5 (17.5+5+0) |

102.5 (107.5+0-5) |

17.5 (10+(50*.15)) |

107.5 (100+(50*.15)) |

5 |

0 |

|

Buy spread order trades 20 CLH18-CLM18 |

19.5 (14.5+25-20) |

102.5 (104.5+20-25) |

14.5 (10+(30*.15)) |

104.5 (100+(30*.15)) |

25 |

20 |

Crude Oil (LO) Options Example

|

Action |

Long Usage |

Short Usage |

Working Long |

Working Short |

Trade Long |

Trade Short |

|

Buy Order 30 LOF18 49C (0.50 delta) |

15 = ((30*.50)*0-0) |

0 = (0+0–0) |

15 = (30*.50) |

0 |

0 |

0 |

|

Buy Order Trades 10 LOF18 49C |

15 = ((20*.5)+(10*5)–0) |

-5 = (0+0–(10*5)) |

10 = (20*.5) |

0 |

5 = (10*.5) |

0 |

|

Buy Order 500 LOZ19 45P (-0.20 delta) |

15 = (10+5–0) |

95 = (100+0–5) |

10 |

100 = (500*.20) |

5 |

0 |

|

UDS Order B 200 LOG18 55C (0.25 delta) S 50 LOG18 30C (1.0 delta) |

22.5 = (17.5+5+0) |

102.5 = (107.5+0-5) |

17.5 = (10+(200*0.25)*.15) |

107.5 (100+(50*.15)) |

5 |

0 |

|

Buy spread order trades 80 LOG18 55C (0.25 delta) S 20 LOG18 30C (1.0 delta) |

19.5 = (14.5+25-20) |

99.5 = (104.5+20-25) |

14.5 = (10+(120*.25)*.15) |

104.5 (100+(30*.15)) |

25 = (5+(80*.25)) |

20 = (20*1.0) |

Futures Outright with Default Contact Multiplier

The futures outright calculation is based on order quantity and contract multiplier (Tag 231 in the 35=d security definition). Where available the contract multiplier will be used otherwise it will just default to 1.

Note: The contract multiplier is used to converted traded quantity to cleared quantity.

|

Instrument |

GEZ1 |

|

Contract Multiplier |

1 |

|

Max Long Limit (GE-FUT) |

100 |

|

Max Short Limit (GE-FUT) |

100 |

Example

|

Message Flow |

Working Long |

Working Short |

Traded Long |

Traded Short |

Net Long Usage |

Net Short Usage |

Avail Max Long Limit |

Avail Max Short Limit |

Comments |

|

Buy New Order With Quantity of 10 |

10 |

- |

- |

- |

10 |

- |

90 |

100 |

WL = 10 X 1 = 10 NL = 10 + 0 – 0 = 10 Avail Max Long Limit = Limit - (Working Long + Traded Long - Traded Short) 100 – (10 + 0 - 0) = 90 Avail Max Short Limit = Limit - (Working Short + Traded Short - Traded Long) 100 - (0 + 0 - 0) = 100 |

|

Cancel Replace to Quantity of 20 |

20 |

- |

- |

- |

20 |

- |

80 |

100 |

WL = 20 X 1 = 20 NL = 20 + 0 – 0 = 20 Avail Max Long Limit = Limit - (Working Long + Traded Long - Traded Short) 100 – (20 + 0 - 0) = 80 Avail Max Short Limit = Limit - (Working Short + Traded Short - Traded Long) 100 - (0 + 0 - 0) = 100 |

|

Complete Fill for Quantity of 20 |

0 |

- |

20 |

- |

20 |

(-20) |

80 |

120 |

NL = 0 + 20 – 0 = 20 NS = 0 + 0 – 20 = -20 Avail Max Long Limit = Limit - (Working Long + Traded Long - Traded Short) 100 – (0 + 20 - 0) = 80 Avail Max Short Limit = Limit - (Working Short + Traded Short - Traded Long) 100 - (0 + 0 - 20) = 120 |

|

Sell New Order With Quantity of 10 |

0 |

10 |

20 |

- |

20 |

(-10) |

80 |

110 |

WS = 10 x 1 = 10 NS = 10 + 0 – 20 = -10 Avail Max Long Limit = Limit - (Working Long + Traded Long - Traded Short) 100 – (0 + 20 - 0) = 80 Avail Max Short Limit = Limit - (Working Short + Traded Short - Traded Long) 100 - (10 + 0 - 20) = 110 |

|

Cancel Replace to Quantity of 20 |

0 |

20 |

20 |

- |

20 |

0 |

80 |

100 |

WS = 20 x 1 = 20 NS = 20 + 0 – 20 = 0 Avail Max Long Limit = Limit - (Working Long + Traded Long - Traded Short) 100 – (0 + 20 - 0) = 80 Avail Max Short Limit = Limit - (Working Short + Traded Short - Traded Long) 100 - (20 + 0 - 20) = 100 |

|

Complete Fill for Quantity of 20 |

0 |

0 |

20 |

20 |

0 |

0 |

100 |

100 |

NL = 0 + 20 – 20 = 0 NS = 0 + 20 – 20 = 0 Avail Max Long Limit = Limit - (Working Long + Traded Long - Traded Short) 100 – (0 + 20 - 20) = 100 Avail Max Short Limit = Limit - (Working Short + Traded Short - Traded Long) 100 - (0 + 20 - 20) = 100 Traded short increases acceptable long order size |

Futures Outright with Contract Multiplier not Equal to 1(CMED 50MW Power)

Futures outright calculations are based on order quantity and contract multiplier (Number of deliverable units per instrument, for example, number of peak days or calendar days in maturity month). Where available the contract multiplier will be used; otherwise will default to 1.

|

Instrument |

J4LZ8 |

|

Contract Multiplier |

200 |

|

Max Long Limit (J4L-FUT) |

20,000 |

|

Max Short Limit (J4L-FUT) |

20,000 |

Example

|

Message Flow |

Working Long |

Working Short |

Traded Long |

Traded Short |

Net Long Usage |

Net Short Usage |

Avail Max Long Limit |

Avail Max Short Limit |

Comments |

|

Buy New Order With Quantity of 10 |

2000 |

- |

- |

- |

2000 |

- |

18000 |

20000 |

WL = 10 X 200 = 2,000 NL = Working Long + Traded Long - Traded Short = 2,000 + 0 – 0 = 2,000 Avail Max Long Limit = 20,000 – 2,000 = 18,000 |

|

Cancel Replace to Quantity of 20 |

4000 |

- |

- |

- |

4000 |

- |

16000 |

20000 |

WL = 20 X 200 = 4000 NL = 4,000 + 0 – 0 = 4,000 Avail Max Long Limit = 20,000 – 4,000 = 16,000 |

|

Complete Fill for Quantity of 20 |

0 |

- |

4000 |

- |

4000 |

(-4000) |

16000 |

24000 |

NL = 0 + 4,000 – 0 = 4,000 NS = 0 + 0 – 4,000 = -4,000 Avail Max Long Limit = 20,000 – 4,000 = 16,000 Avail Max Short Limit = 20,000-(-4,000) = 24,000 |

|

Sell New Order With Quantity of 10 |

0 |

2000 |

4000 |

- |

4000 |

(-2000) |

16000 |

22000 |

WS = 10 x 200 = 2,000 NS = 2,000 + 0 – 4,000 = -2,000 Avail Max Short Limit = 20,000 - (-2,000) = 22,000 |

|

Cancel Replace to Quantity of 20 |

0 |

4000 |

4000 |

- |

4000 |

0 |

16000 |

20000 |

WS = 20 x 200 = 4,000 NS = 4,000 + 0 – 4,000 = 0 Avail Max Short Limit = 20,000 - 0 = 20,000 |

|

Complete Fill for Quantity of 20 |

0 |

0 |

4000 |

4000 |

0 |

0 |

20000 |

20000 |

NL = 0 + 4,000 – 4,000 = 0 NS = 0 + 4,000 – 4,000 = 0 Avail Max Long Limit = 20,000 – 0 = 20,000 Avail Max Short Limit = 20,000 – 0 = 20,000 Traded short increases available long order size |

Futures Spread

Futures spread calculations are based on the trade legs only such that:

- The effective side of each leg is derived based on spread side x leg side.

- Buy and sell legs belonging to the same product code could offset each other to the extent possible after taking into account their respective leg ratios.

- The working quantity only (not traded) are further offset by a spread contribution factor such that a configurable value such as 15% will be multiplied with the leg ratio which could be offset between both sides.

- If spread legs belong to a single side or if spread legs belong to different product codes, then no spread contribution factor will be applicable.

- The buy side working quantity for all spread legs belonging to the same product code = total buy leg ratio – total sell leg ratio (if negative then zero) + spread contribution factor (15% of leg ratio common to both buy & sell sides) x spread quantity.

- The sell side working position for all spread legs belonging to the same product code = total sell leg ratio – total buy leg ratio (if negative then zero) + spread contribution factor (15% of leg ratio common to both buy & sell sides) x spread quantity.

- The buy side traded position for all spread legs belonging to the same product group = total buy leg ratio x traded quantity.

- The sell side traded position for all spread legs belonging to the same product group = total sell leg ratio x traded quantity.

- Product code is uniquely qualified with a combination of product code + security type + exchange.

|

Instrument |

GE:BF M8-U8-Z8 |

|

Max Long Limit (GE - FUT |

100 |

|

Max Short Limit (GE-FUT) |

100 |

|

Spread Contribution Factor |

15% |

|

Leg Instrument |

Leg Side |

Leg Ratio |

Product Code |

|

GEM8 |

Buy |

1 |

GE |

|

GEU8 |

Sell |

2 |

GE |

|

GEZ8 |

Buy |

1 |

GE |

Example: Spread contribution factor: 15% of 2 = 0.3 since buy leg ratio (2) and sell leg ratio (2) are the same and offset each other.

|

Message Flow |

Working Long |

Working Short |

Traded Long |

Traded Short |

Net Long Usage |

Net Short Usage |

Avail Max Long Limit |

Avail Max Short Limit |

Comments |

|

Buy New Order With Quantity of 10 |

3 |

3 |

- |

- |

3 |

3 |

97 |

97 |

Working Long = 2 – 2 + 0.3 x 10 = 3 Working Short = 2 – 2 + 0.3 x 10 = 3 |

|

Cancel Replace to Quantity of 20 |

6 |

6 |

- |

- |

6 |

6 |

94 |

94 |

Working Long = 2 – 2 + 0.3 x 20 = 6 Working Short = 2 – 2 + 0.3 x 20 = 6 |

|

Complete Fill for Quantity of 20 |

0 |

0 |

40 |

40 |

0 |

0 |

100 |

100 |

NL = WL (0) + TL (40) – TS (40) = 0 NS = WS (0) + TS (40) – TL (40) = 0 |

|

Sell New Order With Quantity of 10 |

3 |

3 |

40 |

40 |

3 |

3 |

97 |

97 |

Working Long = 2 – 2 + 0.3 x 10 = 3 Working Short = 2 – 2 + 0.3 x 10 = 3 NL = WL (3) + TL (40) – TS (40) = 3 NS = WS (3) + TS (40) – TL (40) = 3 |

|

Cancel Replace to Quantity of 20 |

6 |

6 |

40 |

40 |

6 |

6 |

94 |

94 |

Working Long = 2 – 2 + 0.3 x 20 = 6 Working Short = 2 – 2 + 0.3 x 20 = 6 NL = WL (6) + TL (40) – TS (40) = 6 NS = WS (6) + TS (40) – TL (40) = 6 |

|

Complete Fill for Quantity of 20 |

0 |

0 |

80 |

80 |

0 |

0 |

100 |

100 |

NL = WL (0) + TL (80) – TS (80) = 0 NS = WS (0) + TS (80) – TL (80) = 0 |

Option Outright

Option outright calculation is based on order quantity and delta:

- The delta value for an option is determined at the beginning of the trading session and it will remain constant for the entire trading session. Orders entered during that session will utilize this “daily” delta value and will not change during the session.

- At the beginning of the next trading session, delta values will be refreshed and any new order and old “Good Till” orders still active, will utilize the new delta value.

- Position limits on options on combination (OOC) underliers are treated independently from option on futures involving the same product. For example:

- LO position limits control the delta equivalence of the WTI outright underlier

- WAY position limits control the delta equivalence of the WTI one-month calendar spread

- If there is no delta available for an option, a default value of 1 will be used.

Effective side is based on the order size as well as if the option instrument is a call or put since a put option results in the side being flipped.

|

Instrument |

GEU0 C9950 |

|

Delta |

0.5 |

|

Max Long Limit (GE – OPT) |

100 |

|

Max Short Limit (GE – OPT) |

100 |

Example

|

Message Flow |

Working Long |

Working Short |

Traded Long |

Traded Short |

Net Long Usage |

Net Short Usage |

Avail Max Long Limit |

Avail Max Short Limit |

Comments |

|

Buy New Order With Quantity of 10 |

5 |

- |

- |

- |

5 |

- |

95 |

100 |

Working Long = 10 x 0.5 = 5 |

|

Cancel Replace to Quantity of 20 |

10 |

- |

- |

- |

10 |

- |

90 |

100 |

Working Long = 20 x 0.5 = 10 |

|

Complete Fill for Quantity of 20 |

0 |

- |

10 |

- |

10 |

(-10) |

90 |

110 |

Traded Long = 20 x 0.5 = 10 |

|

Sell New Order With Quantity of 10 |

0 |

5 |

10 |

- |

10 |

(-5) |

90 |

105 |

Working Short = 10 x 0.5 = 5 Avail Max Short Limit = 100 - (5 + 0 - 10) = 105 |

|

Cancel Replace to Quantity of 20 |

0 |

10 |

10 |

- |

10 |

0 |

90 |

100 |

Working Short = 20 x 0.5 = 10 Avail Max Short Limit = 100 - (10 + 0 - 10) = 100 |

|

Complete Fill for Quantity of 20 |

0 |

0 |

10 |

10 |

0 |

0 |

100 |

100 |

Traded short increases available long order size |

Options Spread

Options spread calculation is based on its legs only such that:

- The effective side of each leg is derived based on spread side x leg side, depending on whether the option leg is a put or call.

- The effective leg ratio of each leg needs to be determined by multiplying its leg ratio with its corresponding delta. If the delta is not available then the effective leg ratio will default to 1.

- Buy and sell legs belonging to the same product code may offset each other after taking into account their respective leg ratios.

- The working quantity only (not traded) are further offset by a spread contribution factor such that a configurable value such as 15% will be multiplied with the leg ratio which could be offset between both sides.

- If spread legs belong to a single side or if spread legs belong to different product codes then no spread contribution factor will be applicable between them.

- The buy side working quantity for all spread legs belonging to the same product code = total buy effective leg ratio – total sell effective leg ratio (if negative then zero) + spread contribution factor (15% of effective leg ratio common to both buy & sell sides) x spread quantity

- The sell side working quantity for all spread legs belonging to the same product code = total sell effective leg ratio – total buy effective leg ratio (if negative then zero) + spread contribution factor (15% of effective leg ratio common to both buy & sell sides) x spread quantity

- The buy side traded position for all spread legs belonging to the same product group = total buy effective leg ratio x traded quantity

- The sell side traded position for all spread legs belonging to the same product group = total sell effective leg ratio x traded quantity

- Product code is uniquely qualified with a combination of product code + security type + exchange

|

Instrument |

UD:U$:ST 0104931538 |

|

Max Long Size (GE-OPT) |

100 |

|

Max Short Size (GE-OPT) |

100 |

|

Spread Contribution Factor |

15% |

|

Leg Instrument |

Leg Side |

Leg Ratio |

Product Code |

Delta |

|

GEU0 C9950 |

Buy |

2 |

GE |

0.5 |

|

GEU0 P9962 |

Buy |

3 |

GE |

0.25 |

Example: Spread contribution factor -- 15% of 0.75 = 0.1125 since buy effective leg ratio (2 x 0.5 = 1) and sell (buy put leg) effective leg ratio (3 x 0.25 = 0.75) can offset each other by up to 0.75 since this is the effective leg ratio common to both sides.

|

Message Flow |

Working Long |

Working Short |

Traded Long |

Traded Short |

Net Long Usage |

Net Short Usage |

Avail Max Long Limit |

Avail Max Short Limit |

Comments |

|

Buy New Order With Quantity of 10 |

3.625 |

1.125 |

- |

- |

3.625 |

1.125 |

96.375 |

98.875 |

Working Long = (1 – 0.75 + 0.1125) x 10 = 3.625 Working Short = (0.75 – 1 (0) + 0.1125 ) x 10 = 1.125 |

|

Cancel Replace to Quantity of 20 |

7.25 |

2.25 |

- |

- |

7.25 |

2.25 |

92.75 |

97.75 |

Working Long = (1 – 0.75 + 0.1125) x 20 = 7.25 Working Short = (0.75 – 1 (0) + 0.1125) x 20 = 2.25 |

|

Complete Fill for Quantity of 20 |

0 |

0 |

20 |

15 |

5 |

(-5) |

95 |

105 |

Traded Long = 20 x 1 Traded Short = 20 x 0.75 Avail Max Short Limit = 100 - (0 + 15 - 20) = 105 |

|

Sell New Order With Quantity of 10 |

1.125 |

3.625 |

20 |

15 |

6.125 |

(-1.375) |

93.875 |

101.375 |

Working Long = (0.75 – 1 (0) + 0.1125) x 10 = 1.125 (sell put leg becomes buy) Working Short = (1 – 0.75 + 0.1125) x 10 = 3.625 Avail Max Long Limit = 100 - (1.125 + 20 - 15) = 93.875 Avail Max Short Limit = 100 - (3.625 + 15 - 20) = 101.375 |

|

Cancel Replace to Quantity of 20 |

2.25 |

7.25 |

20 |

15 |

7.25 |

2.25 |

92.75 |

97.75 |

Working Long = (0.75 – 1 (0) + 0.1125) x 20 = 2.25 (sell put leg becomes buy) Working Short = (1 – 0.75 + 0.1125) x 20 = 7.25 |

|

Complete Fill for Quantity of 20 |

0 |

0 |

35 |

35 |

0 |

0 |

100 |

100 |

Traded Long = 20 x 0.75 Traded Short = 20 x 1 Traded short increases available long order size. Traded long increases available short order size. |