Company Achievements in 2013

- Traded 3.2 billion contracts worth approximately $1 quadrillion in notional value.

- Generated $1.3 billion in cash from operations.

- Declared $1.48 billion of dividends to shareholders.

- Enhanced over-the-counter clearing offering, attracting new participants while providing additional choices.

- Grew electronic trading volumes 14 percent outside United States.

- Delivered record options volume, with growth of 20 percent.

- Prepared to launch London-based derivatives exchange, CME Europe.

- Launched regionally specific products in Europe, Asia and Latin America.

Interest Rates

Interest Rates Equities

Equities Energy

Energy Foreign Exchange

Foreign Exchange Agricultural Commodities

Agricultural Commodities Metals

Metals

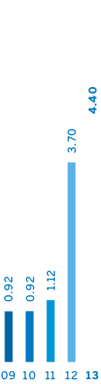

Product Line Revenues

(as a percentage of total clearing and transaction fees)